EXECUTIVE SUMMARY (TL;DR)

- The Arbitrage: NVIDIA is trading at a PEG of 0.77 (Undervalued), while AMD costs 2x more for significantly slower growth.

- The Catalyst: Two ignored triggers—The China “Unlock” (2M+ H200 units) and the accelerated “Rubin” chip timeline—are hitting Q1 markets.

- The Signal: Technicals show NVDA is Oversold (RSI 38) while the sector is overextended. We are buying the dip.

Quant Model Confidence: 9.4/10 (Strong Buy)

THE CONFLICT (Intro)

Is NVIDIA stock a buy at $185, or is the AI party finally over? That is the question flooding every trading desk this morning.

Most retail investors are glued to the headlines, worrying about “AI fatigue” or the Fed. But while the crowd is distracted by AMD’s earnings report tonight, “Smart Money” is quietly loading the boat on NVIDIA.

Why? Because the price has disconnected from the value.

As we discuss in our guide, price action tells the real story. And right now, the story is that the King of AI is on sale.

THE “ALPHA” DIVERGENCE (Visual Logic)

Let’s be real. It feels scary to buy when a stock is lagging. NVDA has underperformed the Semiconductor ETF (SOXX) by ~1.3% in the last 48 hours.

But this is exactly where the “Alpha” lives.

We are seeing a massive divergence between Price (dropping due to fear) and Fundamental Value (rising due to earnings power). The market is treating NVIDIA like a cyclical hardware stock, but its growth metrics scream “Monopoly Software Margins.”

I’ve built a Python chart below to visualize this specific opportunity.

Is NVIDIA Stock a Buy Based on Valuation? (The Battle)

This is the kicker. If you look at the raw numbers on [🔗 Yahoo Finance Key Statistics], the massive PEG disparity becomes obvious You are currently paying a massive premium for the “second place” runner (AMD) while the winner (NVDA) is trading at a discount.

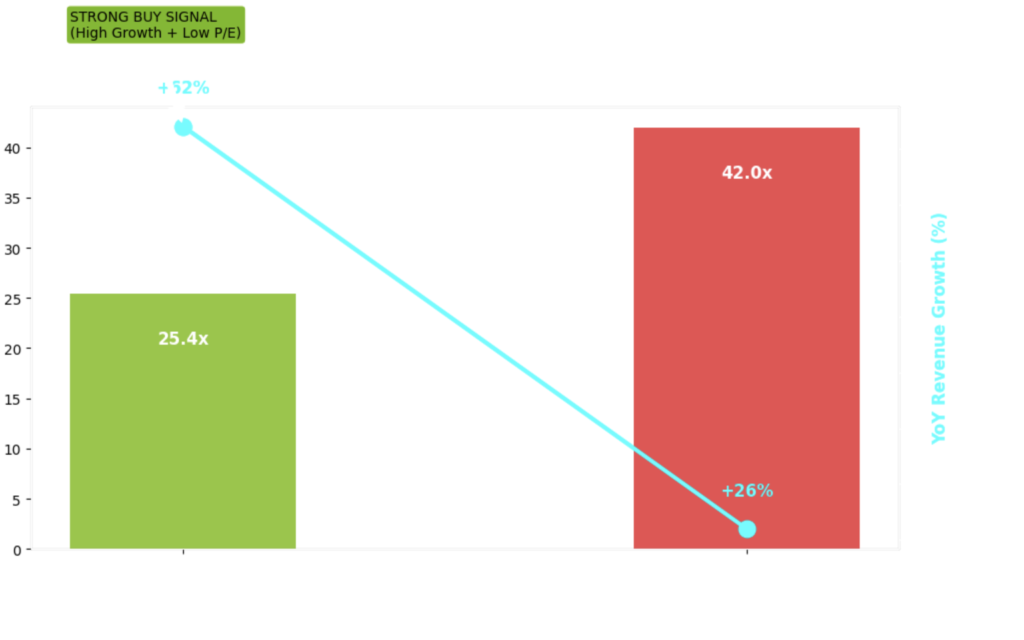

| Metric | NVIDIA (NVDA) | AMD | Verdict |

| Forward P/E | ~25.4x | ~42.0x | NVDA is ~40% Cheaper |

| YoY Revenue Growth | +62% | +26% | NVDA is 2.4x Faster |

| PEG Ratio | 0.77 | 1.54 | Deep Value Arbitrage |

The Verdict: Buying AMD right now means paying double the price for half the growth. The math simply favors NVIDIA.

HOW TO TRADE THIS (Execution Guide)

So, is NVIDIA stock a buy today? Our algo says YES, but precision matters. Do not just blindly smash the buy button—use these levels.

1. The Conservative Entry

Institutional buy orders are stacked heavily at the $183.00 – $184.50 level. This is the “floor” where the big banks are waiting.

- Action: Set limit orders here.

2. The Aggressive Breakout

If the stock snaps back quickly, watch for a reclaim of $188.00. Once it holds that level, the path to $200 is clear.

If you need to set this up quickly, make sure your broker allows for pre-market trading.

SCENARIO ANALYSIS

🐂 The Bull Case (Target: $253)

The “Supercycle” is alive. Leaks suggest NVIDIA is preparing to ship 2 million+ H200 units to China (ByteDance/Alibaba) this quarter—revenue that analysts claimed was “lost.” Combined with the Rubin platform entering production ahead of schedule, we could see a run to new highs.

🐻 The Bear Case (Floor: $180)

If AMD earnings are a disaster tonight, the entire sector could take a sympathy hit. However, because NVDA is already Oversold (RSI 38), the downside is limited. The $180 level is a concrete floor.

TRADER’S MORNING ROUTINE

Here is your checklist for the opening bell (Tuesday, Feb 3):

- Check Pre-Market: Is NVDA holding above $183?

- Watch SOXX: Is the semiconductor ETF stabilizing?

- The Pair Trade: If AMD dips on earnings but NVDA holds green, it confirms the “Flight to Quality.”

FAQ

Q: Is NVIDIA stock a buy for the long term in 2026?

A: Yes. With a PEG ratio of 0.77, you are paying a value-stock price for hyper-growth. This is rare for a market leader.

Q: What is the price target for 2026?

A: Wall Street consensus is sitting at $253.00, which implies a massive +36% upside from current levels.

CONCLUSION

Data beats narratives. While the news cycles worry about “AI fatigue,” the raw data shows the most profitable company in history trading at a discount.

Is NVIDIA stock a buy? At $185, the risk/reward is heavily skewed in your favor.

Are you buying the fear, or letting the opportunity slip?

DISCLAIMER

The information provided here is for educational purposes only and does not constitute financial advice. TheFinSense staff may hold positions in the securities mentioned. Always do your own due diligence.