The Ultimate Showdown: My Personal Journey into the Stocks vs. Real Estate Debate

Introduction: The Choice That Paralyzes Every New Investor

Hello again! It’s your Investi-Buddy. Even before I started my blog, I was stuck on one of the questions: when it comes to growing my money, what’s better — stocks vs. real estate?

Just like you, I was paralyzed by the choice. One path seemed smart and modern, the other felt tangible and traditional. The sheer volume of conflicting opinions can be overwhelming. But after dozens of hours of research, I realized the entire debate is usually skewed by one incredible, and dangerous, real estate “superpower” that most beginners don’t understand.

In this guide, I’m going to share my personal research notes with you. We’ll break down that superpower, expose the hidden headaches of each path, and reveal a secret ‘third option’ that might just be the best starting point for us all.

Part 1: The “Fair Fight” That Isn’t Fair at All

My Notes on Stocks vs. Real Estate

If you just want the cheat sheet, here it is.

- Stocks seem best for: A hands-off approach, starting with less cash, and being able to get your money out fast.

- Real estate seems best for: Using loans to control a big asset (this is the ‘superpower’), but you need a lot of cash and patience.

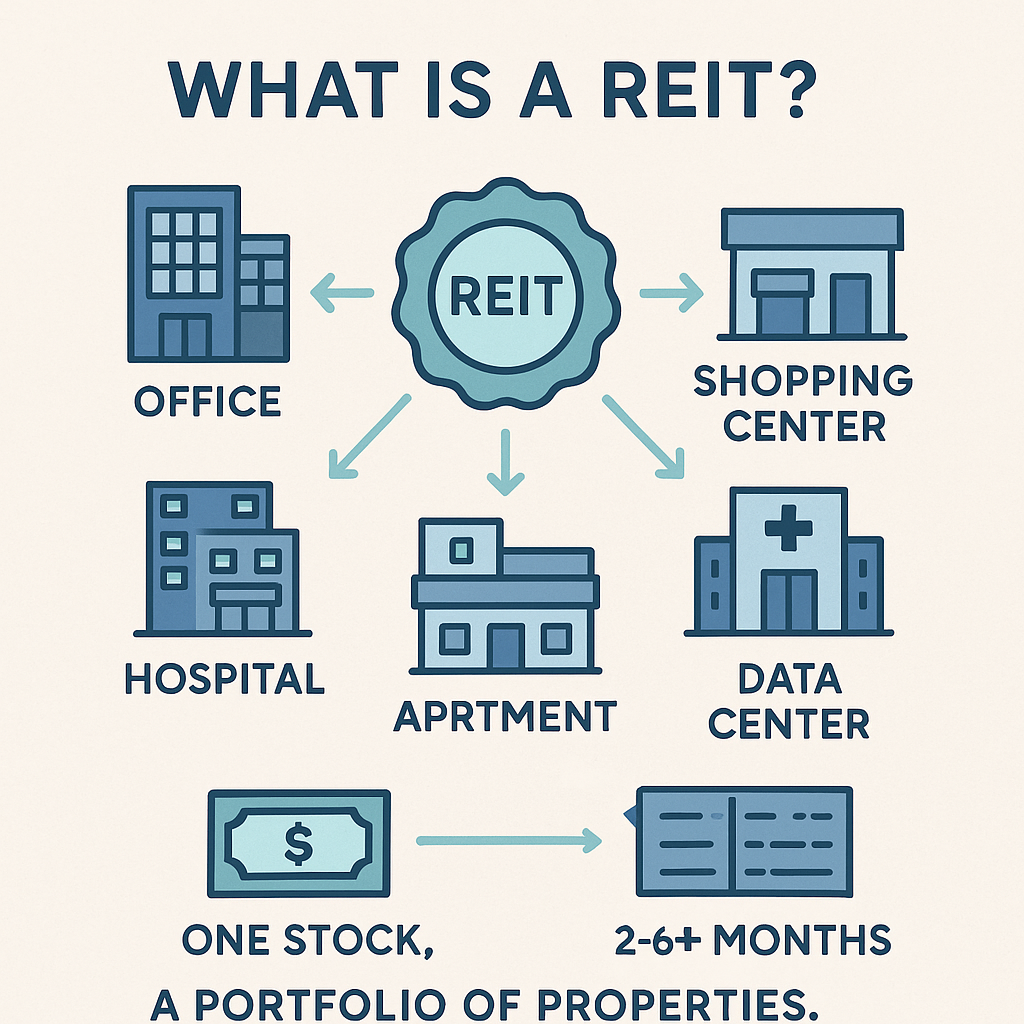

- REITs (a weird stock/real estate hybrid): These are my surprise discovery. They seem to offer a bit of both worlds and are super easy to get into.

First Things First: What Are We Even Comparing?

Before we can judge the fight, we need to know the fighters. What is a stock, really? And what does “investing in real estate” actually mean?

Debunking the Myths: What Your Uncle Gets Wrong

Before we dive deep, let’s clear the air and debunk some common myths you’ve probably heard.

- Myth #1: “The stock market is just gambling.” Reality: Gambling is a random, zero-sum game. Investing in the stock market is owning a piece of productive businesses that generate real value, profits, and innovation over time.

- Myth #2: “Real estate is a guaranteed safe investment that never goes down.” Reality: Housing prices can and do fall, as the world saw in 2008. As we’ll see in Part 2, the “superpower” of leverage can make even small losses devastating.

- Myth #3: “You have to be rich to invest in either.” Reality: This might have been true for our parents, but it’s not anymore. With modern tools like fractional shares and REITs, you can now start with as little as $5.

What Is a Stock? The Neighborhood Pizza Place Analogy

Buying a “stock” just means you’re buying a tiny piece of a company. As we saw in our guide to compound interest, this is how you grow the growth of the best businesses in the world. The best analogy I found is the neighborhood pizza place.

If you buy a “stock” in it, you’re not buying a pizza. You’re buying a piece of the business itself—the ovens, the brand, the secret sauce recipe. If the place becomes a huge hit, your little piece becomes way more valuable.

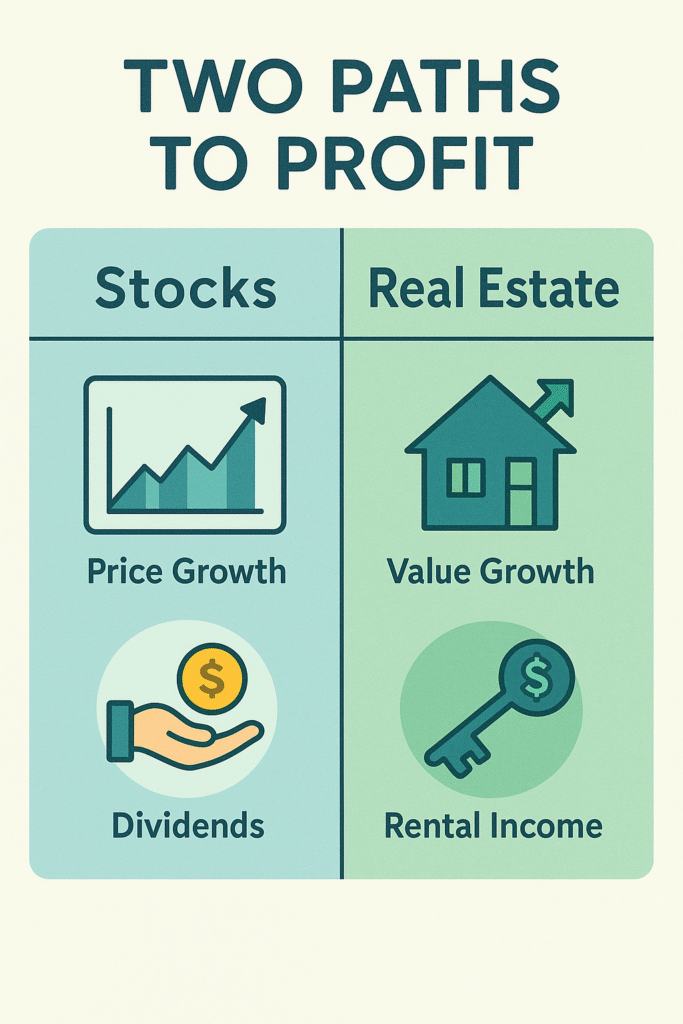

There are two primary ways you get paid from this:

- The Price Goes Up (Capital Appreciation): The company does well, demand for its stock increases, and the price goes up. You sell for more than you paid.

- They Give You Cash (Dividends): The company is so profitable it hands some of that cash back to its owners (you!) as a bonus.

And What About Real Estate? This one feels more obvious because you can literally touch it. You’re buying a physical property, and the ways you profit are a near-perfect mirror of stocks.

- The Value Goes Up (Appreciation): You buy a house, the neighborhood improves, and years later you sell it for a profit.

- Someone Pays You to Use It (Rental Income): This is the classic landlord plan. The cash left over after you pay the mortgage and expenses is your profit. It’s the real estate version of a dividend.

Historical Performance at a Glance

To put some real numbers on it, let’s look at the long-term averages. According to historical data from sources like Macrotrends and the S&P Case-Shiller Index, the S&P 500 (a good benchmark for the stock market) has historically returned about 10% per year on average. By comparison, U.S. home prices have appreciated around 4-5% per year on average. Now, this initial comparison doesn’t account for dividends, rental income, or the real estate “superpower” of leverage, but it gives us a crucial baseline for how the value of these assets has grown over time.

So on the surface, they look almost identical. But what if I told you there’s a ‘legal cheat code’ in real estate that can let a 10% gain turn into a 50% profit on your own cash? In the next part, we’re breaking down this incredible—and frankly, terrifying—superpower.

Part 2: The Real Estate “Superpower” (and Its Hidden Costs)

Leverage: The Rocket Fuel of Real Estate

The one concept that completely changes the stocks vs. real estate debate is leverage. In simple terms, leverage means using borrowed money to invest. With real estate, you’re expected to borrow from a bank; with stocks, it’s rare and risky for a beginner.

Here’s a story to show you the mind-blowing difference.

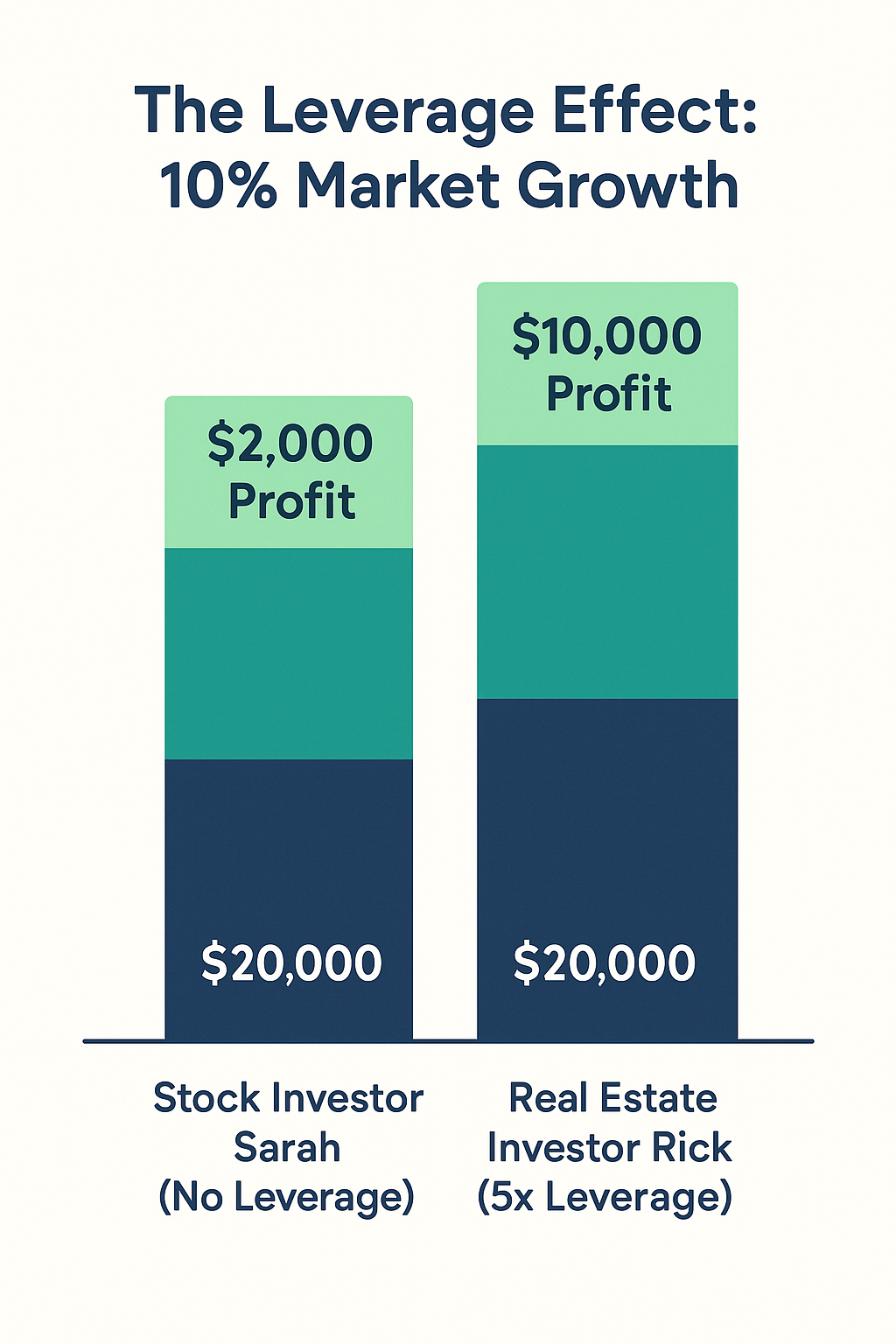

Analogy #2: Sarah and Rick’s $20,000 Let’s say you have $20,000 to invest.

- Stock Market Sarah: Sarah puts her $20,000 into a stock market fund. The market goes up 10%. She makes $2,000, a solid 10% return. Awesome.

- Real Estate Rick: Rick uses his $20,000 as a down payment on a $100,000 house, getting a loan for the other $80,000. The housing market also goes up 10%. The house is now worth $110,000. He made $10,000.

Did you catch that? Both markets grew 10%, but Rick made five times more money. This is because he controlled a $100,000 asset with only $20,000 of his own cash, his return on the money he actually put in was a whopping 50%. That’s leverage.

Don’t Just Take My Word For It—Prove It to Yourself.

I was skeptical of how powerful leverage was until I ran the numbers. Use this calculator to see how a small change in house price can dramatically change your actual cash return.

Now, here’s the scary part. If the house lost 10% in value, Rick would be on the hook for a $10,000 loss, wiping out half his savings. This superpower is a terrifyingly sharp double-edged sword; leverage magnifies losses just as powerfully as it magnifies gains.

The Hidden Costs & Headaches of Real Estate

Leverage is tempting, but it comes with major strings attached.

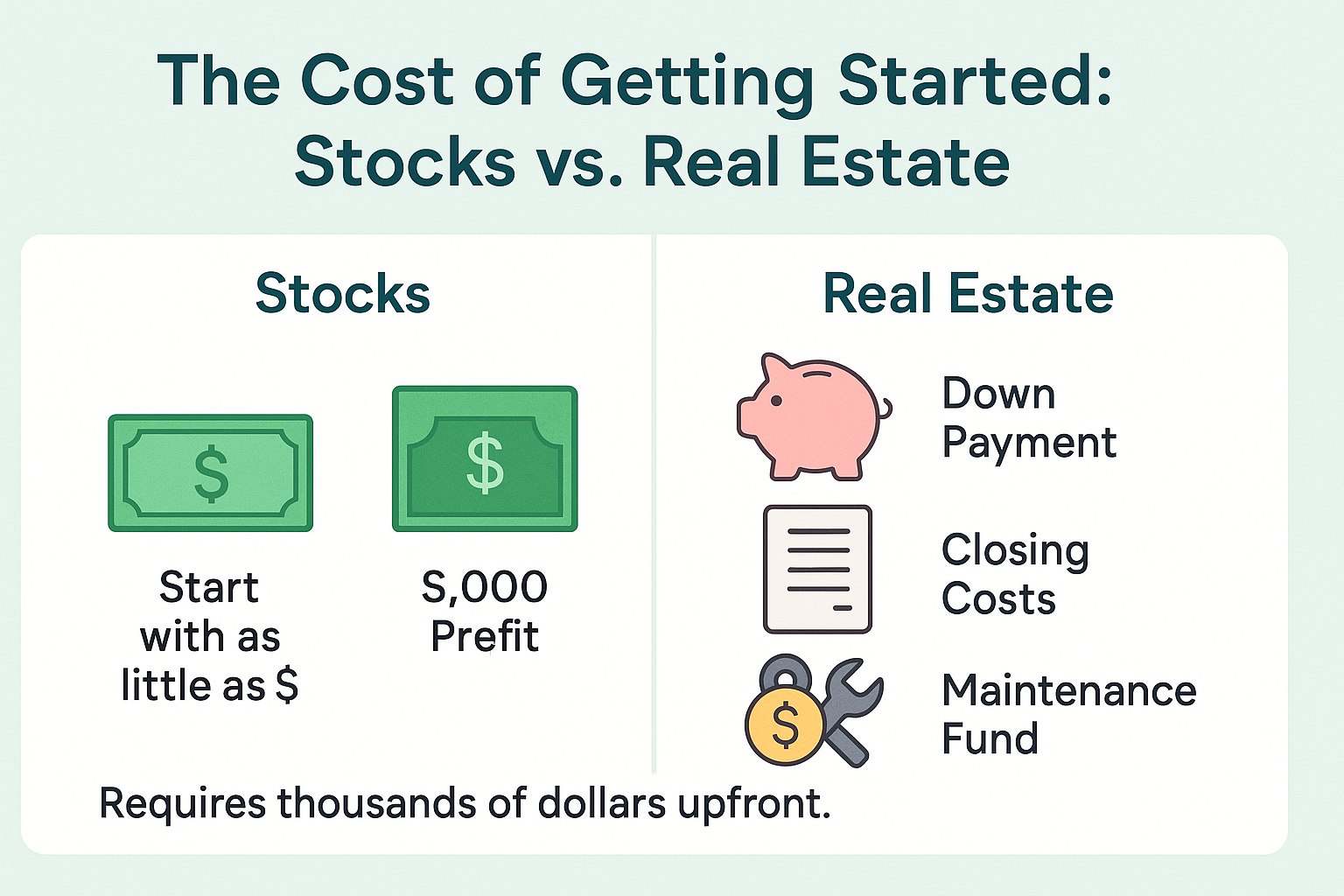

- Initial Cost: With stocks, you can start with a few dollars. Real estate is a capital-intensive game. You need thousands for a down payment, closing costs, and a cash reserve for repairs.

- Effort Required: Owning a rental property is a part-time job. You’re responsible for tenants, rent collection, and the proverbial 2 a.m. phone call about a broken toilet. A stock index fund is completely passive.

- Liquidity: Stocks are highly liquid; you can sell and get cash in a few days. Real estate is highly illiquid; selling a house can easily take several months. There is no quick escape hatch.

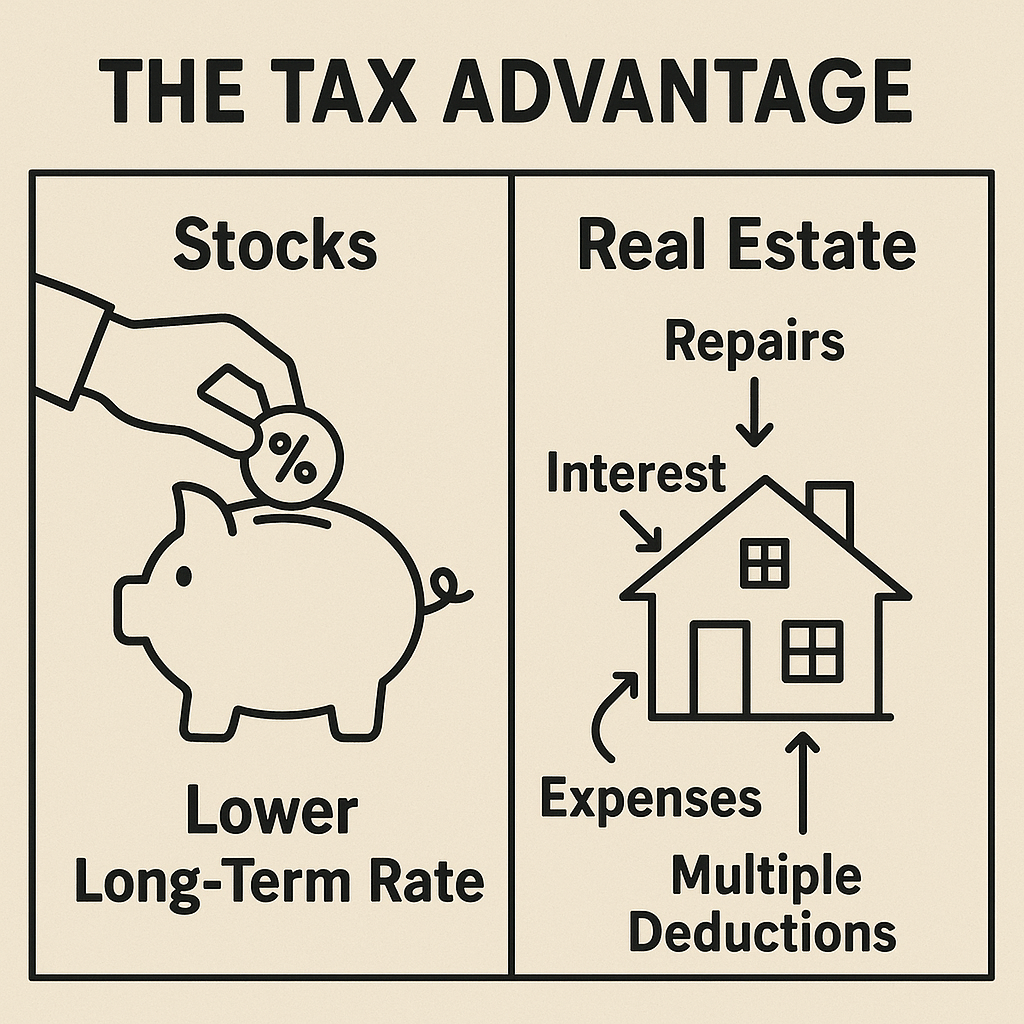

A Quick Note on Taxes: The Unseen Partner

This is a hugely complex topic, but here’s the simple breakdown every beginner should know.

- With stocks, if you hold your investment for more than a year, your profits are typically taxed at a lower “long-term capital gains” rate, which is a big advantage.

- With real estate, you can get some amazing tax breaks, like deducting expenses (repairs, insurance, property taxes) and mortgage interest from your rental income. However, selling a property can involve its own complex taxes. The key takeaway is that both paths have unique tax rules that can significantly impact your real, take-home profit.

So we have a dilemma. Real estate has this incredible leverage, but it’s expensive and a ton of work. Stocks are easy and hands-off, but you’re just using your own cash. This is where I almost gave up—until I found the secret ‘third option’ that bridges the gap.

Part 3: The “Third Option” and My Final Decision

REITs: A Third Option in the Stocks vs. Real Estate Debate?

While digging through all this stuff, I kept seeing a weird acronym: REIT. It stands for Real Estate Investment Trust, and it’s basically a company that does nothing but own a bunch of properties—like apartment buildings, shopping malls, or data centers. Here’s the cool part: you can buy shares of these REIT companies on the stock market, just like you’d buy a share of Coca-Cola.

This seemed to solve a bunch of problems in the stocks vs. real estate dilemma. You get real estate exposure and income, but with the simplicity and low cost of stocks.

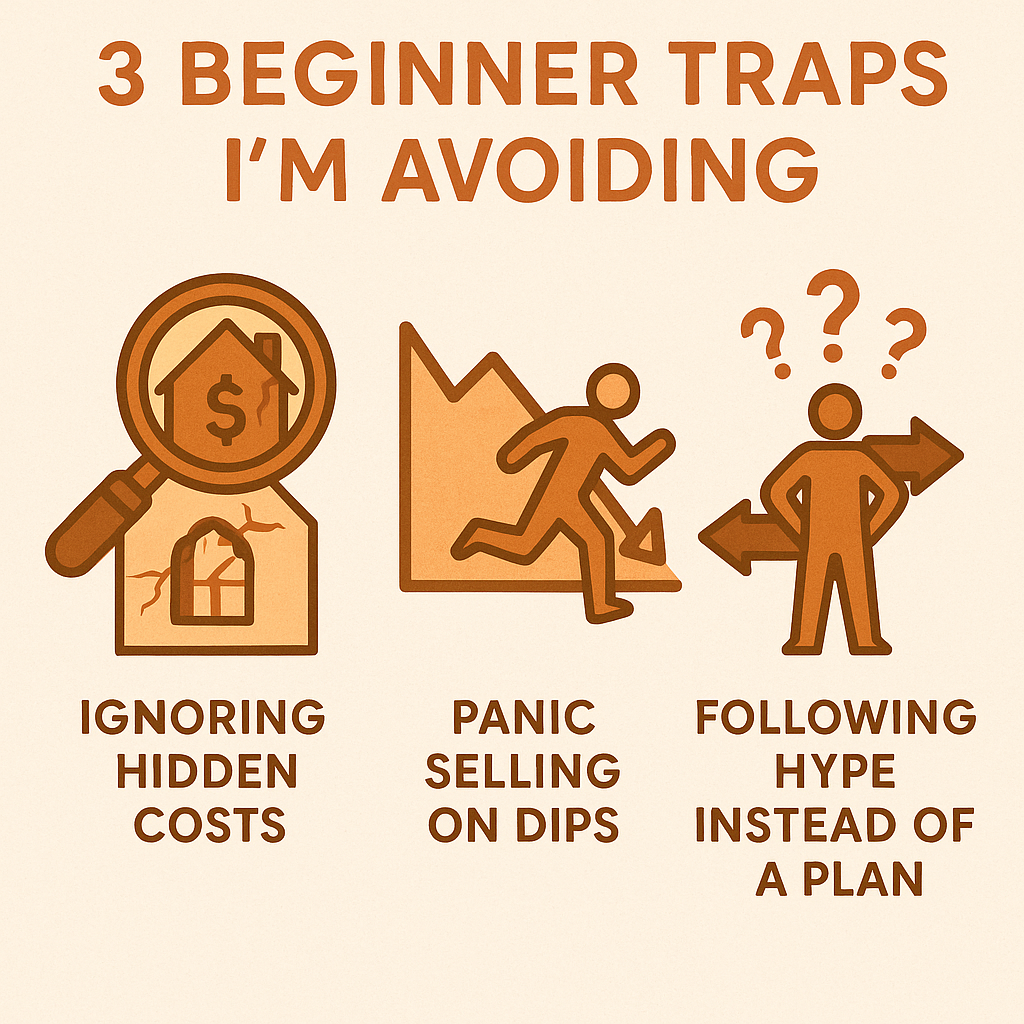

Common Mistakes in the Stocks vs. Real Estate Journey

This research process made me realize there are soooo many traps that are waiting for beginners. Here are my rules to avoid a dumb mistake.

- Forgetting Hidden Costs. I will never consider a property without first plugging every single hidden cost (maintenance, vacancy, insurance, etc.) into a spreadsheet.

- Panic Selling My Stocks. The market is a rollercoaster. I’m telling myself now: when it tanks, I will not sell. I might not even look. I’ll trust the long-term plan.

- Doing What Everyone Else Says Is “Best”. This is the big one. The only “best” investment is the one that fits my life, my budget, and my sleep schedule.

My Personal Scorecard: Stocks vs. Real Estate vs. REITs

After all my research, I decided to grade each option on the factors that matter most to a beginner. Here’s how I scored them on a scale of 1 to 5 stars (⭐️).

| Factor | Stocks (Index Funds) | Physical Real Estate | REITs |

| Ease of Getting Started | ⭐️⭐️⭐️⭐️⭐️ | ⭐️ | ⭐️⭐️⭐️⭐️⭐️ |

| Potential for Leverage | ⭐️ | ⭐️⭐️⭐️⭐️⭐️ | ⭐️⭐️ |

| Passiveness (Low Effort) | ⭐️⭐️⭐️⭐️⭐️ | ⭐️ | ⭐️⭐️⭐️⭐️ |

| Liquidity (Easy to Get Cash) | ⭐️⭐️⭐️⭐️⭐️ | ⭐️ | ⭐️⭐️⭐️⭐️⭐️ |

| My “Sleep Well at Night” Score | ⭐️⭐️⭐️⭐️ | ⭐️⭐️ | ⭐️⭐️⭐️⭐️⭐️ |

My Simple Breakdown of Stocks vs. Real Estate

After all that, here’s the super-simple cheat sheet I made for myself.

- You should probably lean toward STOCKS if: You want to set it and forget it, you’re starting with a smaller amount of money, and you want to be able to get your cash out if you need it.

- You should probably lean toward REAL ESTATE if: You’re excited by the idea of using leverage, you want an asset you can physically improve, and you’re fully prepared for the work that comes with it.

- You should probably look into REITs if: You’re like me and want a little of both. You get the real estate profits without the landlord headaches.

Your Pre-Flight Checklist: Are You Truly Ready to Invest?

Before you take any of the exciting steps below, it’s crucial to be honest with yourself. This is the foundation we built in our previous guides. Ask yourself these three questions:

✅ Is my high-interest debt paid off? (If not, paying down credit cards with 20%+ interest is your best possible “return”).

✅ Do I have a 3-6 month emergency fund? (Your safety net, saved in a High-Yield Savings Account, must come first).

✅ Have I created a simple budget I can stick to? (You can’t invest money you don’t have).

If you can check all three boxes, you are ready to proceed. If not, your mission is to focus on these foundational steps first.

Your First Steps: How to Actually Start

Feeling ready to take action? Here’s what the first step looks like for each path:

If you’re leaning toward Stocks & REITs:

- Choose a beginner-friendly brokerage account (we have a guide for that!).

- Open the account online (this usually takes about 15 minutes).

- Set up a recurring deposit and make your first purchase of a low-cost, diversified index fund or REIT ETF.

If you’re leaning toward Physical Real Estate:

- Start saving aggressively for a down payment in a High-Yield Savings Account.

- Use an online calculator to determine how much house you can realistically afford.

- Begin researching your local market and connect with a real estate agent and mortgage lender to get pre-approved.

Conclusion: My Final Decision (For Now)

At the end of the research, I learned there’s no master key. The real goal ,from the start, wasn’t to find the “best” investment on paper, but the one that’s best for my life. For now, that looks like a simple mix of low-cost stock market funds and some REITs. It feels like the right first step.

I really hope walking through my research helps you out. The most important thing is that we’re asking these questions and learning before we jump in. Good luck out there.

SEE ALSO…

The Soul-Crushing Truth About Your Savings (And Your Escape Plan)

You work hard to save, but a silent thief is draining your account. This is an honest look at the unfair fight against inflation and the 3-step plan you can use to start fighting back.

The One “Unfair Advantage” Every Rich Person Understands

It starts small, feels boring, and is ignored by most. But the force of compound interest is the single most powerful engine for building wealth. This guide demystifies the ‘magic’ and shows you how to start your own snowball.

Your Brain is a Terrible Investor. Here’s the Fix.

The biggest threat to your wealth isn’t a market crash—it’s the 7 hidden biases in your own mind. This is a brutally honest look at the enemy in the mirror and the proven playbook you need to win.

See also…

The Soul-Crushing Truth About Your Savings (And Your Escape Plan) You work hard to save, but a silent thief is draining your account. This is an honest look at the unfair fight against inflation and the 3-step plan you can use to start fighting back.

The One “Unfair Advantage” Every Rich Person Understands It starts small, feels boring, and is ignored by most. But the force of compound interest is the single most powerful engine for building wealth. This guide demystifies the ‘magic’ and shows you how to start your own snowball.

I Obsessed Over Stocks vs. Real Estate So You Don’t Have To Paralyzed by the choice? I was too. After weeks of research, I found the ‘legal cheat code’ and surprising compromises that led to a clear winner for beginners. This is my complete playbook.

Your Brain is a Terrible Investor. Here’s the Fix. The biggest threat to your wealth isn’t a market crash—it’s the 7 hidden biases in your own mind. This is a brutally honest look at the enemy in the mirror and the proven playbook you need to win.

Full Reference List

S&P Dow Jones Indices. (2025). S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index [Data set].

Factual Data, FRED. (2025). NASDAQ Composite Index [Data set]. Federal Reserve Bank of St. Louis.

HAR.com. (2025). Why 2025 might be the year to choose stocks over real estate.

Kiesnoski, K. (2025). Real estate vs. stocks: Which is the better investment?. Investopedia.

Macrotrends. (2025). S&P 500 Historical Annual Returns [Data set].

Nareit. (2025). Quarterly REIT Performance Data [Data set].

Disclaimer

This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.