📋 TL;DR (Too Long; Didn’t Read)

- The Problem: Fundamental Analysis tells you what to buy; Technical Analysis tells you when to buy.

- The Solution: Charts are the “User Interface” of market psychology.

- The Strategy: The C.S.I. Method.

- Context: Is the trend your friend? (The River).

- Structure: Where are the Floors? (Support).

- Ignition: What is the signal? (The Green Hammer).

- The Goal: We don’t predict the future; we forecast the weather to manage risk.

The Truth About Technical Analysis for Beginners

Welcome to the ultimate guide on Technical Analysis for Beginners. You might wonder: Why does a company report ‘record-breaking earnings’ and then watch its stock price crash 15% the next day? Conversely, why does a “dying” company sometimes rally 50% in a month?

If you rely on the news, this looks like chaos. It feels rigged.

But to a “Chart Detective,” it makes perfect sense.

Here is the hard truth: The market is not a calculator. It is a voting machine.

Every price tick on a screen isn’t just a number. It represents the aggregate fear, greed, hope, and panic of millions of humans (and algorithms) voting with their wallets.

Meet “Visual Vinny”

Let’s introduce our guide for this journey. Vinny is a 34-year-old UX Designer. He hates spreadsheets. Show him a P/E ratio or a Balance Sheet, and his eyes glaze over. But Vinny is a genius at spotting patterns in user interfaces. He knows that if a “Buy” button is red, people click it less.

Vinny is about to learn the core secret of Technical Analysis for Beginners: a stock chart is simply a User Interface. Fundamental Analysis checks the engine, but Technical Analysis for Beginners checks the road. He doesn’t need to be a mathematician to trade. He just needs to learn to read the “body language” of the market.

🚀 Micro-Action:

Open [🔗 TradingView ] right now. Don’t sign up or pay. Just look at the front page. That squiggly line? That is the heartbeat of human emotion. You are already qualified to read it.

Technical vs. Fundamental: The “Car vs. Road” Analogy

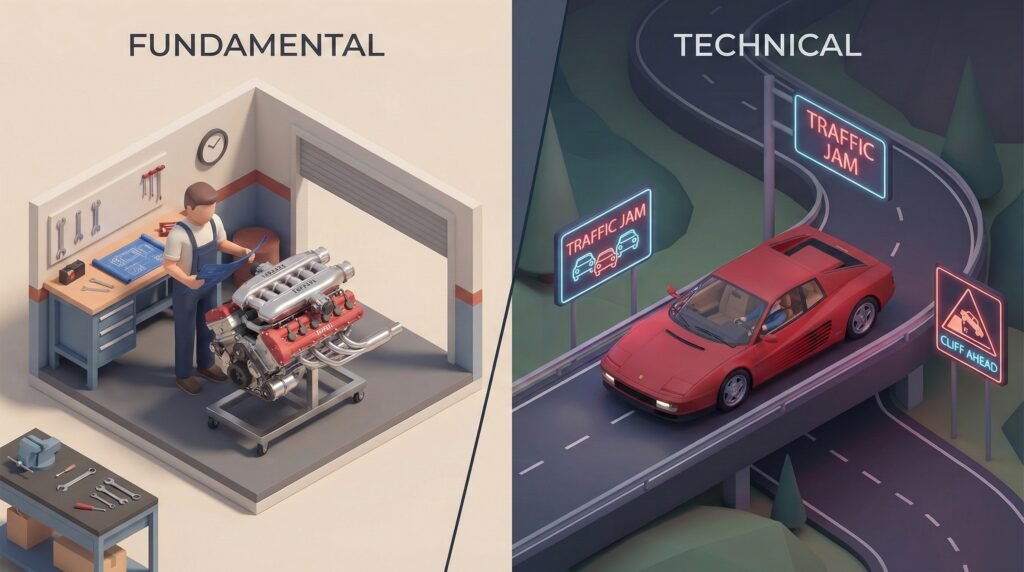

There is an endless war in finance between “Fundamental Analysts” (The Accountants) and “Technical Analysts” (The Chartists). You might think you have to pick a side.

You don’t. In fact, picking one side is dangerous.

Think of your investment journey as a Formula 1 race.

- Layer A (The Logic): Fundamental Analysis is the CAR. Is the engine powerful? Are the tires good? Is the driver (CEO) competent? This tells you what to buy. (For example, choosing the right S&P 500 ETF for the long term.)

- Layer B (The Persona): Technical Analysis is the ROAD. Is there a massive pothole ahead? Is there a traffic jam? Is the bridge out? This tells you when to buy.

The Catch: You can drive a Ferrari (a great company) straight off a cliff (a bad trend). Fundamental analysis tells Vinny that Apple is a great company. Technical analysis tells him that buying it at $250 is a bad idea because everyone else is selling.

The Table of Truth: Logic vs. Emotion

| Feature | Fundamental Analysis (The Mechanic) | Technical Analysis (The Detective) |

| Core Question | What is this company worth? | What are people paying for it? |

| Data Source | Financial Statements (Past) | Price & Volume (Present) |

| Best For | Selecting what to buy (Long Term). | Deciding when to buy (Timing). |

| The Risk | “Value Traps” (Cheap for a reason). | “False Signals” (Market noise). |

| Vinny’s Take | “Boring. Too much math.” | “Visual. I can see the story.” |

🚀 Micro-Action:

Adopt this mantra: Fundamentals tell me WHAT to buy. Technicals tell me WHEN to buy. Do not mix them up.

Step 1 of Technical Analysis for Beginners: Candlesticks

Most beginners look at a “Line Chart.” It connects the closing prices. It’s clean, simple, and useless. It hides the battle that happened during the day.

To be a “Chart Detective,” you need to read Japanese Candlesticks.

The Anatomy of a Candle

A candle gives you four pieces of data in one glance: Open, High, Low, Close (OHLC).

- The Body (The Block): This shows the movement from the Open to the Close.

- 🟢 Green: Buyers won. Price closed higher than it opened.

- 🔴 Red: Sellers won. Price closed lower than it opened.

- The Wick (The Thin Line): This shows the extreme High and Low of the session.

The “Long Wick” Clue

This is the most critical concept in this section. The Wick is the Lie Detector.

Imagine a stock opens at $10. During the day, sellers panic and push it down to $5. It looks like a disaster. But then, buyers rush in (“Buy the dip!”) and push the price all the way back up to close at $9.

The candle will have a small body at the top and a huge lower wick.

- The Logic: The market tried to go lower and was rejected. The floor is solid.

- Vinny’s Take: “Oh, it’s like a user trying to scroll down, but the page bounces back up. The content ends here.”

🚀 Micro-Action:

Go to your chart settings. Switch “Chart Style” to Candles. Find a candle with a very long “tail” (lower wick) at the bottom of a drop. Look at what happened the next day. (Spoiler: It usually reverses upward).

The Strategy: The C.S.I. Method

Now that we know the alphabet, let’s write a sentence. You don’t need 50 indicators cluttering your screen like a pilot’s cockpit. You need three steps to filter a trade.

The C.S.I. Checklist:

- Context (The Trend)

- Structure (The Zones)

- Ignition (The Trigger)

If you don’t have all three, you don’t have a trade.

C is for Context (The River)

The Rule: Never swim upstream.

If the “River” (Trend) is flowing South, you do not buy. You wait. The biggest mistake beginners make is trying to catch the bottom of a crashing stock.

The 50-Day Moving Average (The Health Check)

There is one tool that acts as a binary filter for Vinny. The 50-Day Moving Average (MA). This line represents the average price over the last 10 weeks.

- Price > 50-Day MA: The patient is healthy. The trend is UP. We look for reasons to BUY.

- Price < 50-Day MA: The patient is sick. The trend is DOWN. We sit on our hands.

Devil’s Advocate:

Reader: “But Vinny, the stock dropped 20% and is way below the 50-Day MA. It’s so cheap! Shouldn’t I buy now?”

Expert: No. Something cheap can always get cheaper. We buy strength, not weakness. We wait for the price to reclaim the line.

🚀 Micro-Action:

In TradingView, click “Indicators” -> search “Moving Average” -> click “Settings” -> change Length to 50.

- Is your stock above or below the line? If it’s below, close the tab. You’re done.

S is for Structure (Floors & Ceilings)

Price has memory. If a stock fell to $100 last month and bounced, investors remember that $100 is a “deal.” If it falls to $100 again, those buyers will likely step in again.

- Support (The Floor): A price zone where buyers step in to stop a drop. Think of this as a Trampoline.

- Resistance (The Ceiling): A price zone where sellers step in to stop a rise. Think of this as a Glass Ceiling.

How to Draw Zones (Not Lines)

Vinny likes precision, but the market is messy. Don’t draw a thin pencil line at exactly $100.00. Draw a rectangle zone between $99 and $101.

The Strategy: We want to buy when the price falls into a Support Zone (The Floor). This gives us a high probability of a bounce.

🚀 Micro-Action:

Zoom out on your chart (last 6 months). Look for the lowest points the stock hit and bounced. Do they line up? Use the “Rectangle” tool to draw a box across those low points. That is your “Buy Zone.”

I is for Ignition (The Trigger)

Here is where most people fail. They identify the Trend (Context), they find the Floor (Structure), and then they place a “Limit Buy” order and go to sleep.

The Catch: Sometimes the Trampoline breaks.

If you stand on a trampoline, it holds you. If you jump off a 10-story building onto a trampoline, you might rip right through it. We need to confirm the trampoline is holding before we jump.

The Signal: The “Green Hammer”

We need an Ignition signal. The most reliable signal for beginners is the Hammer Candle.

- Appearance: Small body at the top, very long lower wick.

- The Story: Sellers pushed the price way down (the long wick), but buyers stormed in and pushed it all the way back up to close near the high.

- The Translation: “We tried to go down, but the Floor held. The Bulls are here.”

Volume: The Gas Pedal

A Green Hammer is good. A Green Hammer with High Volume is gold.

Look at the bars at the very bottom of the chart. If the volume bar on your Hammer day is taller than the previous days, it means Institutions (Big Money) are buying.

🚀 Micro-Action:

You cannot enter the trade until you see a Green Candle closing higher than the previous candle’s low, right on your Support line. No Hammer? No Trade.

Case Study: The “Trampoline” Trade

Let’s walk through a hypothetical trade with Vinny using the C.S.I. checklist. We are tracking a Tech Stock dropping from $120.

1. The Guesser (Old Way)

Vinny’s friend, “Gambling Gary,” sees the stock at $100. He says, “It used to be $120! It’s a deal!” He buys. The price drops to $80. Gary panics and sells. **Loss: -$1,000.**

2. The Detective (C.S.I. Way)

Vinny watches the same drop.

- Context: He checks the trend. The stock is above the 200-day line, so the long-term trend is up.

- Structure: He looks left. He sees that the stock bounced at $95 three months ago. He draws a “Floor” at $95. He does nothing at $100.

- Ignition: The price hits $94.50. Vinny waits. At 3:50 PM, the price rallies and closes at $96, forming a Green Hammer. The volume bar is tall.

- The Trade: Vinny enters at $96. He sets a Stop Loss at $93 (just below the wick).

- The Result: The floor holds. The stock rallies back to $110.

The Payoff:

By waiting for the Structure ($95) and Ignition ($96), Vinny risked $3.00 to make $14.00. That is a 1:4 Risk/Reward ratio.

🚀 Micro-Action:

Review your last losing trade. Did you buy a falling knife? Or did you wait for the bounce (Ignition)? Be honest.

The Contrarian Reality: Charts Don’t Predict, They Protect

This is the pill most gurus won’t swallow. Technical Analysis does not predict the future.

If anyone tells you “The chart says this stock will go to $150,” run away.

TA is a Weather Forecast. It tells you: “There is an 80% chance of rain (downtrend), so bring an umbrella.” It does not guarantee rain.

The Seatbelt: The Stop Loss

Since charts are about probability, not certainty, you must accept that you will be wrong 40-50% of the time.

How do you make money if you are wrong half the time?

- When you are wrong, you lose $1. (Stop Loss hits).

- When you are right, you make $3. (Stock rallies).

Vinny knows that before he enters the trade, he must know where he exits if he’s wrong. That is his “Stop Loss.”

🚀 Micro-Action:

Never place a trade without deciding your “Uncle Point.” If the stock drops below the Support Zone ($93 in our example), admit you are wrong and sell immediately.

Discipline is key because scientifically, your brain is hardwired to lose money when trading. The Stop Loss protects you from yourself.

Conclusion: Your First Detective Assignment

The charts are not random squiggly lines. They are the footprints of millions of investors fighting over price.

Your Action Plan for Tomorrow Morning:

- Open [🔗 TradingView | Recommended Source: tradingview.com].

- Pick your favorite company (e.g., TSLA, NVDA, AAPL).

- C: Check the 50-Day Moving Average. Above or Below?

- S: Draw one horizontal box where price bounced previously (The Floor).

- I: Wait. Do not buy until you see a Green Hammer or a strong green candle bounce off that floor.

The chart is always speaking. Are you listening?

FAQ: Common Questions about Technical Analysis

1. Can I use Technical Analysis for Crypto and Forex?

Yes, absolutely. Technical Analysis (TA) works on any asset that has price and volume data with high liquidity. In fact, TA often works better on Crypto than stocks because Crypto is driven almost entirely by sentiment and psychology rather than earnings reports. The patterns (Flags, Support, Resistance) are identical across asset classes.

2. What is the best timeframe to look at?

It depends on your goal. For “Visual Vinny” (a beginner swing trader who has a day job), the Daily Chart is king. Each candle represents one day. This filters out the “noise” of minute-by-minute fluctuations. If you look at a 5-minute chart, you will get false signals and anxiety. Stick to the Daily chart to see the true trend.

3. Isn’t this just a self-fulfilling prophecy?

To an extent, yes. Because millions of traders, algorithms, and banks are watching the same 50-Day Moving Average and the same Support lines, they tend to react at those spots simultaneously. If everyone thinks a stock will bounce at $100, they all place buy orders at $100, which causes the stock to bounce. As a trader, you want to be on the side of that self-fulfilling prophecy.

4. Do I need to ignore Fundamental Analysis completely?

No, they work best together. Use Fundamentals to pick what to buy (e.g., “Nvidia is a game-changing company”). Use Technicals to pick when to buy (e.g., “Nvidia is currently at Support”). The “Techno-Fundamental” approach is the most powerful strategy for long-term wealth building.

5. How much money do I need to start trading this way?

You can start with $0 using “Paper Trading.” Most platforms allow you to trade with fake money to practice the C.S.I. method. Once you are ready for real money, the amount doesn’t matter as much as the process. However, ensure you can afford to lose what you invest. We recommend starting small to test your emotional discipline before scaling up.

⚠️ CRITICAL DISCLAIMER

The content provided in this article is for educational and informational purposes only and does not constitute financial, investment, legal, or tax advice. The “C.S.I. Method” and the “Visual Vinny” persona are theoretical frameworks used to simplify complex market concepts. Trading stocks, options, and cryptocurrencies involves a significant risk of loss and is not suitable for every investor. Past performance is not indicative of future results. Please consult with a licensed financial advisor before making any investment decisions.

📚 References (APA 7th Edition)

- Fidelity Learning Center. (n.d.). Technical Analysis: Support and Resistance. Fidelity Investments. [https://www.fidelity.com/learning-center/trading-investing/technical-analysis/support-resistance]

- Malkiel, B. G. (2020). A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing (12th ed.). W. W. Norton & Company.

- Murphy, J. J. (1999). Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications. New York Institute of Finance.

- Nison, S. (2001). Japanese Candlestick Charting Techniques: A Contemporary Guide to the Ancient Investment Techniques of the Far East (2nd ed.). Penguin Books.

- Schwab Network. (2024). Technical Analysis: The Basics. Charles Schwab. [https://www.schwab.com/learn/story/technical-analysis-basics]