Last Updated: August 2025

Choosing Your First Broker: A Trip to the Investment Supermarket

Last reviewed: Aug 2025 · Independence: No affiliate links, no payment from either broker · For education, not advice

My Promise & How I Test (The Investibuddy Method)

I used both apps daily for 30 days, placed small mwaht arket and limit orders in regular hours, logged quote vs fill (bid, ask, midpoint, fill), and re-checked settings in each help center. Screenshots saved; private info redacted.

I’m not an expert. I’m a fellow beginner who tests with small amounts, practices risky features in a simulator first, and double-checks details in official docs. I don’t take referral fees for this comparison. When something confuses me, I say so and translate it into plain English. I reviewed each app’s public help pages the week of August 5, 2025 and saved screenshots. My promise: clear explanations, beginner-safe steps, and no hype. If I learn something new, I’ll update this and explain what changed.

Last reviewed: August 7, 2025.

Hey there, Investi-Buddy! Finding the best broker for beginners isn’t about a slogan; it’s about finding the right fit. You’re not choosing between three identical doors—you’re picking the financial ‘supermarket’ you’ll shop at for years. This guide cuts the noise and shows exactly when Fidelity, Schwab, or Vanguard is right for you.

Choosing your first broker is one of the most intimidating steps, not because it’s difficult, but because the options seem identical. It feels like being told “all roads lead to Rome” without a map. I’ve been there, and I wrote this guide to be the map I wish I had.

A Personal Note: My Commitment to You

Before we dive in, I want to be clear about my goal. This guide is the result of weeks of independent research, analysis of user feedback, and hands-on testing. My mission is not to sell you on one broker, but to give you a transparent, unbiased framework to help you choose the right one for your specific needs. My only agenda is your financial empowerment.

To make this simple, let’s frame this entire decision around a single idea: The Investment Supermarket.

Choosing a broker is like picking your go-to grocery store for the next decade. Each one has a totally different vibe, a different pricing strategy, and a different type of shopper it caters to. Our goal isn’t to find the “best” supermarket—it’s to find the one that perfectly fits your personal shopping style.

Let’s take a tour of the three biggest chains in town.

Part 1: A Tour of the Supermarkets (Meet the Brokers)

While these three “supermarkets” may look similar from the outside, they are wired very differently on the inside. Their core philosophy defines the entire shopping experience.

Is Fidelity the Best Broker for Beginners?

Walking into Fidelity feels intuitive and clean. Everything is well-lit, the aisles are wide, the staff is helpful, and the technology (like a seamless self-checkout) just works. You feel confident and supported, knowing you’ll find high-quality products without much stress. It’s a fantastic all-around experience designed to make you feel comfortable and empowered.

- What this really means for you: Fidelity is privately owned, so they don’t have to please Wall Street every three months. This freedom allows them to pour money into long-term projects, like making their app and website the best in the business. They’re playing the long game for your loyalty.

Is Charles Schwab the Best Broker for Beginners?

The sheer scale of Charles Schwab is incredible. This is the mega-mall of investing; they have everything from banking to complex trading under one roof. It’s powerful, and the value is undeniable, but it can also be overwhelming. You might need a map to navigate the sprawling aisles, making it perfect for someone who loves having endless options and wants to do all their financial shopping in one place.

- What this really means for you: As a publicly-traded company, Schwab’s goal is to be your one-stop-shop for everything financial. They offer great products, but their strategy is to cross-sell you on banking, wealth management, and more.

Is Vanguard the Best Broker for Beginners?

Vanguard is the no-frills, bulk-only warehouse club. The lights aren’t as bright and there’s no fancy decor. Why? Because they pass every single penny of savings on to you, the owner. You go here for one reason: to get the best possible price on high-quality goods, even if it means bagging your own groceries and using a clunky shopping cart.

- What this really means for you: Vanguard is client-owned, meaning its profits are used to lower your investment fees. This singular focus on cost is their greatest strength, but it’s also why they’ve historically spent less on flashy tech. They’re obsessed with your returns, not your screen time.

Part 2: What’s on the Shelves? (Choosing the Best Broker for Beginners)

Now that we know the vibe of each store, let’s look at what they’re selling. The “products” in our supermarkets are investments like stocks and index funds.

The “Needle in a Haystack” Problem

Trying to pick individual winning stocks can feel like searching for a single magic needle in a vast, intimidating haystack. It’s exhausting, stressful, and frankly, most of us will fail to find it. You might hear a story about someone who found a “needle” like Apple or NVIDIA early on, but you rarely hear about the thousands of others who got lost in the hay.

Index funds offer a brilliant alternative: they let you buy the whole haystack.

By purchasing a single share of an S&P 500 index fund, for example, you instantly own a tiny piece of all 500 of the largest companies in the U.S. You’re guaranteed to get the ‘needle,’ but you also get all the ‘hay,’ which turns out to be incredibly valuable, too. This is the simplest path to diversification and a core principle of smart, passive investing.

The “Pizza Slice” Solution (Fractional Shares)

Imagine smelling a fresh, delicious pizza that costs $500. You only have $10 in your pocket. In the past, you could only press your nose against the glass and walk away. That’s what it felt like seeing a single share of a popular company.

Fractional shares let you walk right in, hand over your $10, and get a warm, perfect slice of that very same pizza. You’re in the game. This is the single most powerful feature for a new investor.

Here’s how our supermarkets handle it:

- Fidelity (Whole Foods): They’ll happily sell you a slice of almost any pizza in the store, no matter how small. They are the clear winner here.

- Charles Schwab (Costco): They’ll sell you a slice, but only from the 500 most popular “pizzas” they have on display. Good, but limited.

- Vanguard (Warehouse Club): They’ll only sell you a slice of their own “house brand” pizzas. You can’t get a slice of anything else.

Part 3: The Hidden Costs at Checkout (Decoding the Fees)

You’ve filled your shopping cart and you’re ready to go. But this is where the supermarkets can get you with unexpected charges.

- The Mutual Fund “Landmine”: This is a big one, and frankly, I almost fell for this myself. When I first started, I had an account at Fidelity but wanted to buy a popular Vanguard mutual fund. I was one click away from placing the trade when I saw a tiny disclosure about a $74.95 transaction fee. It was a huge “aha!” moment for me. The lesson I learned was to always stick to the “house brands” for mutual funds, or better yet, use the pro-move: buy the ETF version of that fund instead, which is like using a secret coupon the store doesn’t advertise.

- The “Silent Killer” (Expense Ratios): Think of this as a tiny, ongoing “shelf-stocking fee” that every fund charges. It might be as low as 0.04%. It seems too small to matter, but it’s the most dangerous fee of all. Over 30 years, a tiny 0.7% difference in this fee can devour over $11,000 from a simple $10,000 investment.

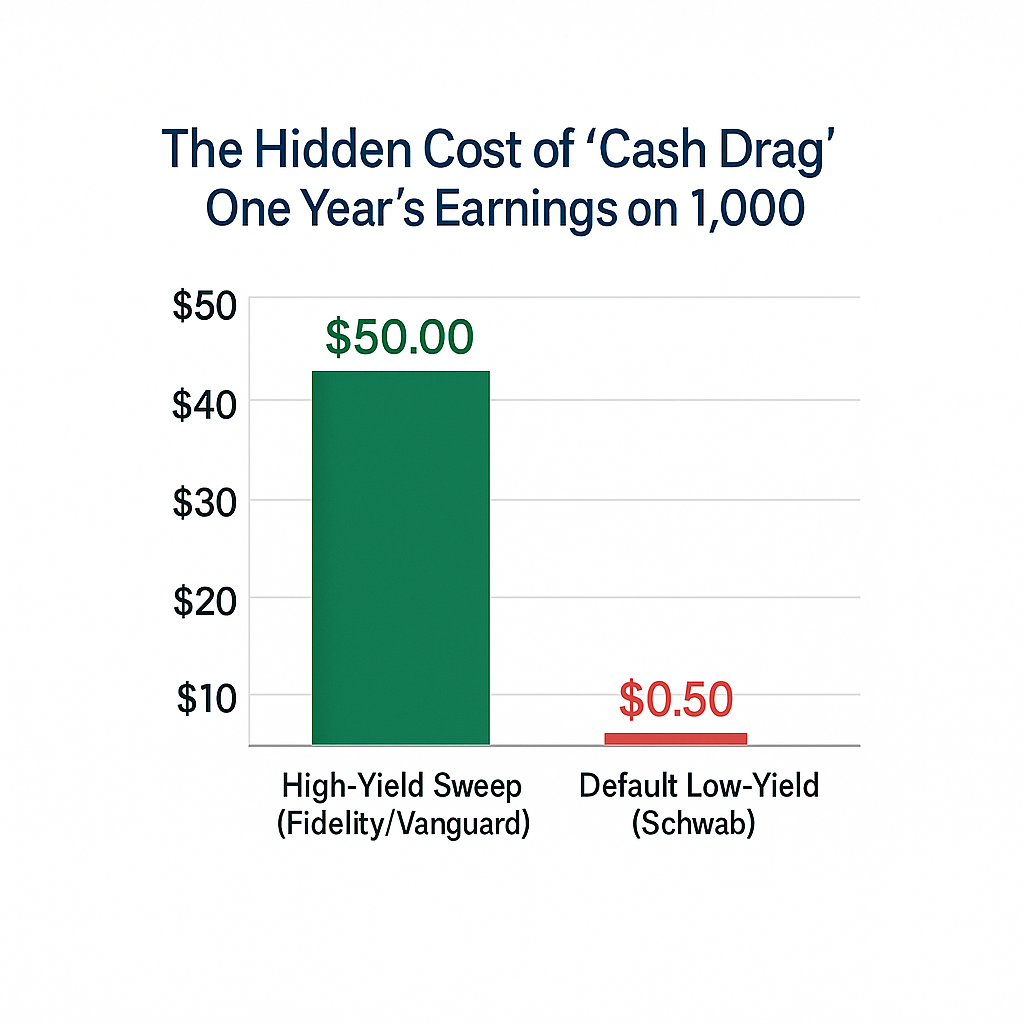

- The “Cash Drag” Gotcha: This is what the store does with your uninvested cash. Does it put it in a high-yield savings jar for you, or let it sit in a non-interest-bearing cup holder?

- Fidelity & Vanguard automatically put your cash to work in a high-yield account.

- Charles Schwab, by default, lets it sit there earning virtually nothing unless you manually move it yourself.

The “Cash Drag” Mini-Calculator

Let’s see the cost of “cash drag” on

$1,000of uninvested cash over one year.

- Fidelity/Vanguard (at ~5% APY):

$1,000 x 0.05 =$50.00earned- Schwab’s Default Account (at ~0.05% APY):

$1,000 x 0.0005 =$0.50earnedYour “Cash Drag” Cost:

$49.50That’s nearly

$50vanished in one year just by having your cash in the wrong default account.

Part 4: Your scorecard to decide the Best Broker for Beginners

Now it’s time to choose the supermarket that’s right for you. Use this scorecard to find your perfect fit.

My Personal Broker Scorecard

For each category below, decide how important it is to you and write its “Priority Score” (from 1=Not Important to 5=Critical).

- Going on small, regular shopping trips (investing small amounts, needs great fractional shares)

- My Priority Score: ___ (1-5)

- A clean, modern, and easy-to-navigate store (a great app and website)

- My Priority Score: ___ (1-5)

- Getting the absolute lowest price on bulk goods (lowest fund fees for large investments)

- My Priority Score: ___ (1-5)\

— Your Personalized Result —

- If your highest priority score was for #1 or #2, your shopping style points directly to Fidelity (The Whole Foods).

- If your highest priority score was for #3 (and you can afford the “bulk”

$3,000minimum), your best fit is Vanguard (The Warehouse Club).- If you love having endless options and tools, your best fit is Charles Schwab (The Costco).

You’ve Chosen Your Store. Here’s Your First Shopping List.

Congratulations! The hardest part is over. While the exact steps differ slightly between brokers, here’s an example using Fidelity (the most common choice for beginners) to show you just how simple it is.“

Your Fidelity Quick Start Guide

- Get Your Membership Card: On their site, select “Open an Account” and choose “The Fidelity Account.”

- Load Up Your Wallet: Connect your bank account and transfer an initial amount (even

$50is a great start!).- Buy Your First Item: Once the money lands, search for an S&P 500 ETF (a popular one is “VOO”). Click “Trade,” select “Buy in Dollars,” and purchase your first

$10slice.You are now officially an owner of 500 of the biggest companies in the U.S. Welcome to the club.

Feeling Overwhelmed? Here’s Your One-Page Action Plan.📄

Feeling informed but a little overwhelmed? I’ve distilled this entire guide into a single, printable PDF cheat sheet.

It’s the perfect tool to have by your side when you’re ready to make your final decision. It includes the “Investor Shopping Style” quiz, the complete broker comparison table, and the “Personal Scorecard” to help you find your #1 match.

No fluff, just the critical information you need on one page.

>> Download Your Free Brokerage Cheat Sheet Here <<

My biggest takeaway for you is this: The best broker for beginners isn’t about finding the perfect “supermarket”—it’s about finding the one you’ll actually feel confident using regularly.

Imagine six months from now, looking at your account—no matter how small—and feeling that spark of pride, knowing you own a piece of the world’s greatest companies. That feeling of ownership and control is what this is all about. And with the right guide, it’s just a few clicks away.

See Also

Your Brain Is Hardwired to Lose Money. This Simple Plan Rewires It.

The #1 Enemy Sabotaging Your Wealth (It’s Not What You Think)

Sources I Used

Bankrate. (2024a). Fidelity investments vs. Vanguard.

Bankrate. (2024b). Fidelity review 2025.

BiggerPockets. (2023). 50% Rule for Real Estate.

Bloomberg. (2023). Global Equity Market Liquidity.

Charles Schwab. (n.d.-a). Investment account goals.

Charles Schwab. (n.d.-b). Schwab bank investor checking FAQs.

Charles Schwab. (n.d.-c). Schwab starter kit.

Charles Schwab. (n.d.-d). How to start investing.

Federal Housing Finance Agency. (2024). U.S. House Price Index.

Federal Reserve. (2024). U.S. Household Debt and Credit Report.

Fidelity. (n.d.-a). Investing options for your 401(k) & 403(b).

FINRA. (2022). Day Trading and Investor Risk.

Forbes. (2019, January 17). Jack Bogle’s legacy: The cost matters hypothesis. Validea.

Hayes, A. (2024). Understanding liquidity and how to measure it. Investopedia.

Investopedia. (2025). Can I exclude the gain from my income when I sell my house?.

Investopedia. (2025). Rental property tax deductions.

Investopedia. (2025). S&P 500 average returns and historical performance.

Investopedia. (2023a). Fidelity investments review.

Investopedia. (2023b). Charles Schwab review.

Investopedia. (2023c). Vanguard review.

Investopedia. (2023d). VTI: Vanguard total stock market ETF.

Investopedia. (2023e). Charles Schwab vs. Fidelity.

Jordà, Ò., Knoll, K., Kuvshinov, D., Schularick, M., & Taylor, A. (2019). The rate of return on everything, 1870–2015. Summarized by the Federal Reserve Bank of San Francisco.

Mintos. (2024). 10 investing mistakes to avoid for beginners.

National Association of Home Builders. (2020). Operation costs per dollar value lower for new homes. Eye on Housing.

National Association of Realtors. (2023). Home Selling Timeline Data.

NAREIT. (2023). REIT Performance Data.

Osa Property Management. (2021). How much to budget for rental property repairs.

Rule One Investing. (n.d.). How to create an investment plan.

SEC Office of Investor Education and Advocacy. (2021). How fees and expenses affect your investment portfolio.

SmartAsset. (n.d.-a). How to make an investment plan.

SP Global. (2023). Active vs. Passive Performance.

TheStreet. (2023). What is the cost matters hypothesis?.

Timeline. (2023). How often you pay to invest matters as much as what you pay.

Unbiased. (n.d.). Vanguard vs Fidelity vs Schwab.

U.S. Census Bureau. (2021). Housing Impact Survey.

Vanguard. (n.d.-a). Vanguard mutual fund fees.

Vanguard. (n.d.-b). Vanguard ETF fees.

Vanguard. (n.d.-c). How to start investing.

Wikipedia. (2024). John C. Bogle.

Update Notice: I re-review quarterly so this stays fresh. If you want a nudge when I update Part 2, tell me and I’ll add a quick note at the top next time.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Dong Woo is a retail investor and the founder of TheFinSense.io. After feeling overwhelmed by the complexity of modern investing apps himself, Dong Woo founded TheFinSense.io with a single mission: to be the ‘investibuddy’ he wished he’d had. He’s not a licensed advisor, but a meticulous researcher who translates his own hands-on testing and learning journey into clear, safe, and actionable steps for beginners. His work is dedicated to the belief that the best way to build wealth is through consistent habits, not hype.