How to Invest in the S&P 500: The Definitive Guide to VOO, IVV & Global Alternatives

Last Updated: December 21, 2025

Author: Dong Woo Hwang

Executive Summary:

Putting your money into the stock market is the moment you switch from being a “saver” (who loses money to inflation) to an “investor” (who owns the economy). For most people—whether you are in New York, London, or Seoul—this journey starts with the Standard & Poor’s 500 (S&P 500). This guide isn’t just a list of tickers; it’s a deep dive into why this index works, how to buy it without getting hit by hidden fees, and what it actually feels like to hold it for decades.

📌 Key Takeaways

- Owning the Machine: When you buy the S&P 500, you aren’t just buying stocks. You are buying a stake in the combined success of the U.S. economy, covering about 80% of the market.

- The “Must Buy” Verdict:

- 🇺🇸 USA: VOO (Vanguard) and IVV (iShares) are the winners. They are cheaper and better structured than the older SPY.

- 🌍 International: You likely need Ireland-based ETFs (like CSPX) to avoid losing 30% of your dividends to U.S. taxes.

- The “Active” Trap: History proves that simply holding the market beats 92% of professional money managers over a 15-year period.

- Execution Rule: To avoid the “fear of missing out,” use Market Orders (buy now) instead of Limit Orders (buy later).

Part I: What Exactly Am I Buying?

When you buy an S&P 500 ETF, you are betting on American Capitalism. However, to trust this with your life savings, you need to understand the engine under the hood.

It’s Not Just a List of “Big Companies”

A common myth is that the S&P 500 is just a robotic list of the 500 largest companies. If that were true, it would be full of over-hyped, money-losing startups.

In reality, the index is managed by a committee that acts like a strict “Nightclub Bouncer.” To get past the velvet rope and into your portfolio, a company must meet tough standards:

- Size: It must be worth at least $8.2 billion.

- Liquidity: The stock must be traded frequently enough that buying it doesn’t break the market.

- The “Profitability” Shield: This is the secret sauce. A company must have positive earnings for the sum of its last four quarters.

Why this matters: This rule is your safety net. It blocks speculative companies from entering your portfolio until they prove they can actually make money.

The “Self-Cleaning Garden” (Market-Cap Weighting)

The index uses something called “market-cap weighting”. That sounds technical, but the concept is beautiful.

Imagine a garden that weeds itself.

- The Winners: When a company like Apple or Nvidia invents something amazing and their stock price doubles, they automatically become a bigger part of your portfolio.

- The Losers: When a company starts to fail (think of Kodak or Blockbuster), it shrinks. Eventually, it gets too small and is kicked out of the index entirely.

and weeds out the losers (like Blockbuster).

The Insight: Consequently, you are always owning more of the winners and less of the losers. You never have to make the hard decision to sell a failing stock—the math does it for you.

Part II: The Vehicle (Why Choose an ETF?)

The S&P 500 is just a list on paper. To own it, you need a vehicle. For decades, the Mutual Fund was the only option. Then came the Exchange-Traded Fund (ETF), and it changed the game.

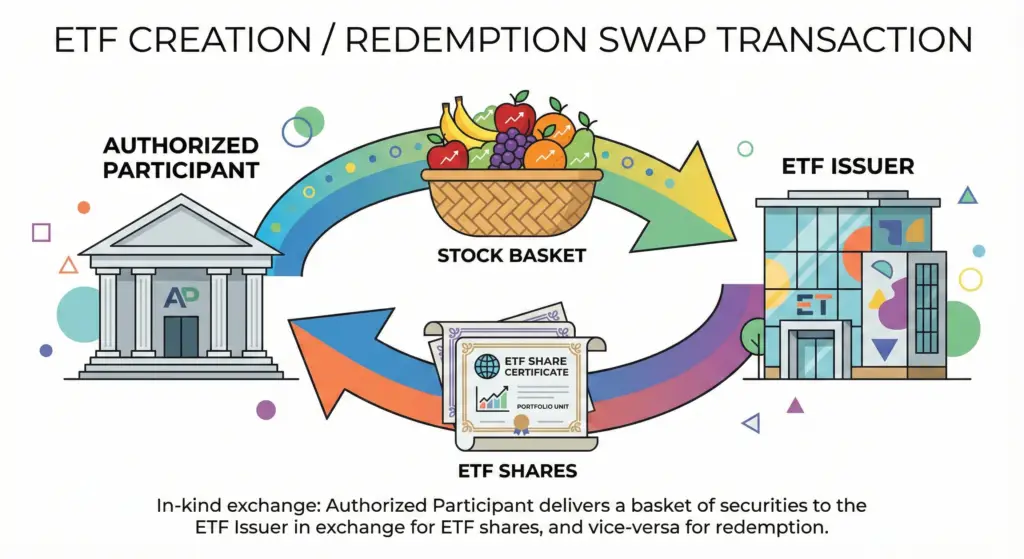

The “Warehouse Swap” (How ETFs Save You Taxes)

The biggest advantage of the ETF is how it handles taxes. To understand why, let’s look at an analogy.

The Mutual Fund Problem (The Store):

Imagine a Mutual Fund is like a retail store. If a customer (another investor) wants to return a shirt (sell shares) and the store has no cash, the manager has to sell a display mannequin (stock) to pay them. That sale creates a tax bill for the store owner—you. In short, you pay taxes because someone else panicked.

The ETF Solution (The Warehouse):

An ETF works differently. When big banks want to cash out, they don’t ask for money. They use a “barter” system. They swap a box of ETF shares for a box of the actual stocks.

- Bank says: “Here are 50,000 shares of the ETF.”

- Vanguard says: “Here is a basket of Apple and Microsoft stocks.”

Because they are swapping items instead of selling for cash, the IRS doesn’t treat it as a sale. Therefore, no tax bill is generated. This allows you to delay paying taxes for decades until you decide to sell.

Part III: The Investment Thesis (Data vs. Ego)

Choosing the S&P 500 is an act of humility. It is admitting that you probably can’t predict the future better than the entire market combined. And the data says you are right.

The 92% Failure Rate

We all like to think we are above average. But in investing, even the “experts” fail. S&P Global publishes a scorecard called SPIVA (S&P Indices Versus Active), and the results are brutal.

- The Short Term: In 2024, 65% of active fund managers lost to the S&P 500.

- The Long Term: Over a 15-year period, 92.2% of active funds failed to beat the index.

Think about that. These are professionals with supercomputers and insider connections. Yet, 9 out of 10 can’t beat a simple, boring index fund.

The Million Dollar Bet

Warren Buffett, the world’s most famous investor, proved this in 2007. He bet $1 million that a simple S&P 500 fund would beat a group of elite, high-fee hedge funds over a decade.

- Hedge Funds: Returned 2.2% per year (after fees).

- S&P 500: Returned 7.1% per year.

The Key Takeaway: Fees are like termites. They eat your wealth from the inside out. By choosing a low-cost ETF (0.03% fee) instead of an active fund (2% fee), you keep the money that would otherwise pay for a manager’s yacht.

Part IV: Selecting the Ticker (The Global Guide)

This is the most critical section. The “best” ticker depends entirely on the passport in your pocket.

For U.S. Residents

If you pay taxes in the USA, you have a choice between three giants.

| Ticker | Fund Name | Fee | Verdict |

| SPY | SPDR S&P 500 | 0.095% | Avoid. It is an old structure (UIT) that can’t reinvest cash instantly, leading to a “Waiting Room Penalty” (cash drag). |

| IVV | iShares Core | 0.03% | Buy. Modern structure, ultra-low fee. Mathematically superior to SPY. |

| VOO | Vanguard S&P 500 | 0.03% | Buy. Functionally identical to IVV. A perfect choice. |

❓ Deep Dive: Should I Buy VOO or VTI?

One of the most common questions new investors ask is: “Why should I limit myself to just 500 companies? Shouldn’t I buy the entire U.S. stock market (VTI)?”

This is a classic debate.

- VOO holds roughly 500 of the largest profitable companies.

- VTI (Total Stock Market) holds over 3,700 companies, including tiny businesses.

The Reality:

Surprisingly, they perform almost exactly the same. Because the U.S. market is “weighted” by size, the giant companies in VOO make up about 80% of VTI’s value anyway.

Think of it like a cup of coffee:

- VOO is a standard black coffee.

- VTI is that same black coffee, but with a tiny splash of milk (the small companies).

Conclusion: Don’t stress. Pick one and stick to it. If you want pure simplicity, VOO is perfect.

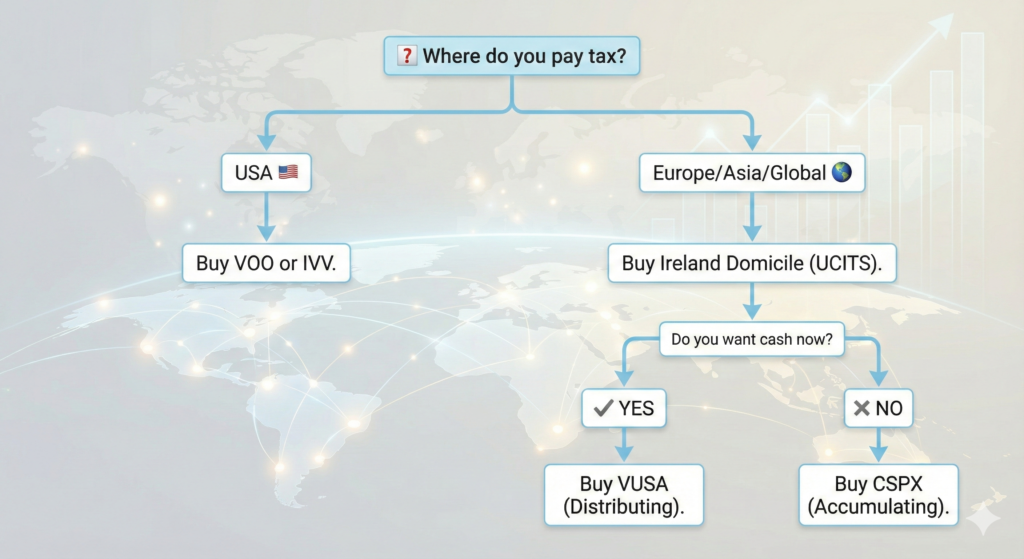

🌍 For International Investors (Europe, Asia, LatAm)

Warning: If you are not a U.S. resident, buying VOO or IVV can be a costly mistake.

The Two Traps:

- The 30% Tax Cut: If you buy a U.S. ETF (like VOO), the U.S. government takes 30% of every dividend before you even see it.

- The Inheritance Risk: If you pass away holding more than $60,000 in U.S. assets, the IRS can take up to 40% of your portfolio in Estate Tax.

The Solution: The “Ireland” Shield (UCITS)

You should buy ETFs that are legally based in Ireland (labeled “UCITS”). Ireland has a treaty with the U.S. that lowers the tax to 15%, and crucially, there is no U.S. Estate Tax for foreign holders.

Which Ticker Should I Buy?

In many countries, you can choose between “Distributing” (pays cash) and “Accumulating” (reinvests automatically).

- CSPX (iShares – Accumulating): The gold standard. It doesn’t pay you cash; it uses the dividends to buy more stock inside the fund. This often allows you to delay paying tax in your home country for years.

- VUSA (Vanguard – Distributing): Good if you need cash income now.

Part V: Currency Risk (The “Hidden” Variable)

Common Question: “I live in Korea/Europe. If the U.S. Dollar crashes, do I lose money?”

You will see “Hedged” versions of these ETFs (e.g., “S&P 500 EUR Hedged”). My advice: Generally, avoid hedging.

Why? First, hedging isn’t free. The fund manager has to buy complex contracts, which costs money and drags down your returns.

Second, the U.S. Dollar acts as a “Safe Haven.” Historically, when the global economy crashes, investors rush to the Dollar. If you hold an unhedged S&P 500 ETF, your investment might actually increase in value (in your local currency) during a crisis because the Dollar spiked.

Part VI: My Experience (The Limit Order Mistake)

I want to share a personal story to save you from a common psychological trap. As an analyst, I thought I was smart enough to time my entry.

It was a few years ago. I had a lump sum of cash ready to invest in VOO. The market had been volatile, and VOO was trading at $350.50.

I looked at the chart and saw it had been at $349.00 just an hour ago. I refused to “overpay” by $1.50. So, I set a Limit Order for $350.00. I told my broker: “Do not buy this unless it hits my exact price.”

The Experience:

I sat there refreshing my phone.

- 10:00 AM: $350.20 (So close!)

- 12:00 PM: $350.80 (Drifting away…)

- 2:00 PM: $351.50 (Frustration setting in.)

- Close: $352.00.

I went to bed annoyed. “I’ll get it tomorrow,” I thought.

But I didn’t. The next day, positive inflation news came out. The market jumped to $355.00.

I watched in horror as the price climbed for the next two weeks. I eventually gave up and bought in at $365.00.

The Lesson:

By trying to save $0.50, I ended up paying $15.00 more.

In the grand scheme of a 20-year investment, the entry price on a random Tuesday does not matter. Being out of the market matters.

Now, I always use Market Orders. I click “Buy,” I pay the current price, and I go on with my life, knowing my money is working.

Part VII: Execution (The Step-by-Step)

Ready? Here is how to actually do it.

Step 1: The Brokerage

- USA: Use Fidelity, Schwab, or Vanguard. Make sure they offer Fractional Shares so you can invest $50 even if one share costs $600.

- Global: Interactive Brokers (IBKR) is often the best choice. It gives you access to the London Stock Exchange (where CSPX trades) and has cheap currency conversion.

Step 2: The Trade

- Search Ticker: VOO (US) or CSPX (Global).

- Order Type: Market. (Trust me on this one).

- Quantity: Enter your cash amount.

- Click Buy.

Step 3: Automate It

Buying once is just a transaction. Wealth is built by consistency. Set up Dollar-Cost Averaging (DCA), where you invest a fixed amount every month. Also, turn on Dividend Reinvestment (DRIP) so your profits generate their own profits.

Part VIII: The Endgame (When Can I Retire?)

We have spent a lot of time talking about buying. But you might be wondering, “When do I get to sell? When am I rich enough to quit my job?”

To answer this, financial experts often point to something called the 4% Rule.

How it works:

The goal is to build a “Golden Goose” (your portfolio) that lays enough “Golden Eggs” (profits) for you to live on forever, without ever killing the goose.

The Magic Number: 25x

Mathematically, you are financially independent when your portfolio value is 25 times your annual expenses.

- For example: If you spend $40,000 a year to live.

- You need: $40,000 x 25 = $1,000,000.

Why 25?

Because 4% of $1,000,000 is $40,000.

Historically, the market grows fast enough that if you only withdraw 4% each year, your money should last for 30 years or more. This gives you a concrete finish line to aim for.

Conclusion

Investing in the S&P 500 is a rejection of complexity. It is an admission that “boring is brilliant”.

- If you are American, buy VOO or IVV.

- If you are International, consider CSPX.

Automate your deposits. Ignore the news headlines. And let the 500 most powerful companies in the world go to work for you.

Buying the S&P 500 is a great long-term strategy. But if you want to optimize your entry price and avoid buying at the very top, you need to understand the charts. Check out our guide on [Charts Don’t Lie: Intro to Technical Analysis for Beginners] to time your first trade.

Sources

[1.1] HANetf. (n.d.). Irish Domiciled ETF | Tax Advantages.

[1.4] Dinesh Aarjav And Associates. (2024). Ireland-Domiciled ETFs: Benefits for US & Non-US Investors.

[2.1] StashAway. (2025). Comparing SPY, VOO, IVV, and CSPX.

[2.3] Lightyear. (n.d.). $CSPX vs £VUSA | ETF performance comparison.

[3.2] Skybound Wealth USA. (n.d.). U.S. Estate Tax Rules for Non-Residents.

[4.2] Chartered Accountants Ireland. (2021). Key Irish tax considerations for individual investors in foreign funds.

[4.3] FSMOne Singapore. (2024). Looking to save on withholding taxes? Here’s how you can do it with ETFs.

[5.1] Interactive Brokers. (2025). Commissions & Fees.

[12] The Unified Content Framework. (2025). 1.1 The Standard & Poor’s 500: Proxy for the American Economy.

[26] The Unified Content Framework. (2025). 1.1.2 The Selection Committee and Inclusion Criteria.

[30] The Unified Content Framework. (2025). 1.1.2 The Selection Committee and Inclusion Criteria.

[32] The Unified Content Framework. (2025). 1.1.2 The Selection Committee and Inclusion Criteria.

[36] The Unified Content Framework. (2025). 1.1.3 The Mechanics of Market-Cap Weighting.

[38] The Unified Content Framework. (2025). 1.1.3 The Mechanics of Market-Cap Weighting.

[40] The Unified Content Framework. (2025). 1.1.3 The Mechanics of Market-Cap Weighting.

[51] The Unified Content Framework. (2025). 1.2.1 ETF vs. Mutual Fund: The Structural Advantage.

[57] The Unified Content Framework. (2025). 1.2.1 ETF vs. Mutual Fund: The Structural Advantage.

[68] The Unified Content Framework. (2025). 1.2.2 The Creation/Redemption Mechanism.

[84] The Unified Content Framework. (2025). 2.2.1 The Failure of Active Management.

[86] The Unified Content Framework. (2025). 2.2.1 The Failure of Active Management.

[95] The Unified Content Framework. (2025). 2.3 The Warren Buffett Bet: A Case Study.

[97] The Unified Content Framework. (2025). 2.3 The Warren Buffett Bet: A Case Study.

[100] The Unified Content Framework. (2025). 2.3 The Warren Buffett Bet: A Case Study.

[103] The Unified Content Framework. (2025). Part III: Selecting the Vehicle – VOO vs. SPY vs. IVV.

[113] The Unified Content Framework. (2025). 3.2 Deep Dive: SPY (The Trader’s Tool).

[118] The Unified Content Framework. (2025). 3.2 Deep Dive: SPY (The Trader’s Tool).

[127] The Unified Content Framework. (2025). 3.3 Deep Dive: VOO and IVV (The Wealth Builders).

[130] The Unified Content Framework. (2025). 3.3 Deep Dive: VOO and IVV (The Wealth Builders).

[146] The Unified Content Framework. (2025). 4.1 Step 1: Selecting and Opening a Brokerage Account.

[157] The Unified Content Framework. (2025). 4.3 Step 3: Placing the Trade (Order Types).

[166] The Unified Content Framework. (2025). 4.3 Step 3: Placing the Trade (Order Types).

[169] The Unified Content Framework. (2025). 4.4 Step 4: Strategic Implementation (DCA & DRIP).

[174] The Unified Content Framework. (2025). 4.4 Step 4: Strategic Implementation (DCA & DRIP).

[516] The Unified Content Framework. (2025). Part VII: Conclusion.