TL;DR (Bottom Line Up Front)

- Free Money: Dividends are cash payments companies send you just for owning their stock.

- The Secret: You do not need to sell your shares to get paid.

- The Strategy: Reinvesting these payments (The Golden Goose Protocol™) is the math-backed way to snowball small amounts into a massive portfolio.

Imagine waking up, checking your phone, and seeing a notification: “Deposit Received: $45.00.”

You didn’t work an extra shift. You didn’t sell anything on eBay. You literally got paid for sleeping.

This isn’t magic. This is the power of dividends. While most people obsess over stock prices going up and down, smart investors know that cash flow is king. Today, we are going to walk through Dividends 101 to show you exactly how this works and how you can start “The Golden Goose Protocol™” to build a stream of income that grows every single year.

Dividends 101: What Are They Really?

Dividends are regular cash payments that a company shares with its stockholders from its profits. Think of it as a “loyalty bonus” for owning a piece of the business. You receive this money simply for holding the stock, regardless of whether the stock price goes up or down that day.

🧠 Beginner Note: Not every company pays dividends. Big, established companies (like Coca-Cola or Johnson & Johnson) usually do. New, fast-growing tech startups usually don’t—they prefer to spend that cash on growing the business instead.

Meet Alex (Our Case Study)

To show you how this works in the real world, let’s meet Alex.

Alex is a 30-year-old Barista. He doesn’t have a fortune; he has about $50 left over at the end of every month. He decides to buy 1 share of a fictional company, “SafeSoda Inc.”

- Stock Price: $50 per share.

- Dividend: $2.00 per year.

Because Alex owns that one share, SafeSoda sends him $2.00. It doesn’t sound like much now, but as we will see, this is how the avalanche starts.

🚀 Micro-Action:

Log into your brokerage app (like Robinhood, Fidelity, or Schwab). Search for a company you love. Look for a stat labeled “Div/Yield” or “Dividend Yield.” If you see a number (e.g., 3.5%), that company pays you to own it!

The Dividends 101 Rules: How to Get Paid (The 4 Dates)

New investors often get confused about when the money hits their account. You can’t just buy the stock the morning of the payment and expect a check. You need to know the rules.

Here is the timeline of a Dividend Payment:

The “Party Invitation” Analogy

To make this simple, think of a dividend like a wedding invitation.

- Declaration Date (The Save the Date): The company announces, “Hey, we are paying a dividend of $0.50 on March 1st!”

- Ex-Dividend Date (The RSVP Deadline): This is the most important date. You must own the stock before this date to get the money. If you buy on or after this date, the previous owner gets the money, not you.

- Record Date (The Guest List): The company checks its books to see who is on the list.

- Payment Date (The Wedding): The cash lands in your brokerage account.

⚠️ Reality Check:

If the Ex-Dividend date is Wednesday, and you buy the stock on Wednesday, you will NOT get the dividend. You must buy it by Tuesday (the day before).

🚀 Micro-Action:

Google “[Company Name] Ex-Dividend Date” for a stock you are interested in. If the date is tomorrow, you need to buy today if you want that check.

Dividends 101 Strategy: The “Golden Goose Protocol™”

This is where Alex (our Barista) needs to be careful. In the world of Dividends 101, there are two main numbers to watch: Dividend Yield and Dividend Growth.

1. Dividend Yield (The Size of the Egg)

This tells you how much cash you get relative to the stock price.

- Formula: (Annual Dividend / Stock Price) x 100

- Translation: If you invest $100, what percentage do you get back in cash?

2. Dividend Growth (The Goose Getting Stronger)

This tells you if the company raises the payout every year.

The Trap vs. The Treasure

| Feature | 🔴 The “Yield Trap” | 🟢 The “Golden Goose” |

| Yield % | High (8% – 15%+) | Moderate (2% – 5%) |

| Why? | Stock price likely crashed due to trouble. | Company is stable and profitable. |

| Risk | Dividend might be cut to $0 soon. | Dividend likely to increase next year. |

| Alex’s Move | Avoid. | Buy. |

💡 Pro Tip:

Look for “Dividend Aristocrats.” These are companies that have increased their dividends for 25+ years in a row. They are the ultimate Golden Geese.

🚀 Micro-Action:

Go to a site like [🔗 Link to Authority: Search “Dividend Aristocrats List” on Investopedia] and pick one familiar brand from the list to research.

The Information Gain: The “Reinvestment Miracle”

Here is the secret sauce. What should Alex do with that $2.00 dividend?

Option A: The Consumer. Alex takes the $2.00 and buys a coffee.

Option B: The Compounder. Alex uses a “DRIP” (Dividend Reinvestment Plan). This automatically uses the $2.00 to buy tiny slivers more of SafeSoda stock.

Let’s look at a Dividends 101 simulation to see the math in action.

Scenario: Investing $10,000 into a stock growing at 7% per year with a 3% dividend yield.

Timeframe: 20 Years.

The 20-Year Wealth Gap

| Strategy | Final Value | Annual Income |

| A: Keep the Cash (Spend Dividends) | $38,696 | $1,160 / year |

| B: The Golden Goose (Reinvest/DRIP) | $67,275 | $2,018 / year |

| DIFFERENCE | +$28,579 | +74% More Income |

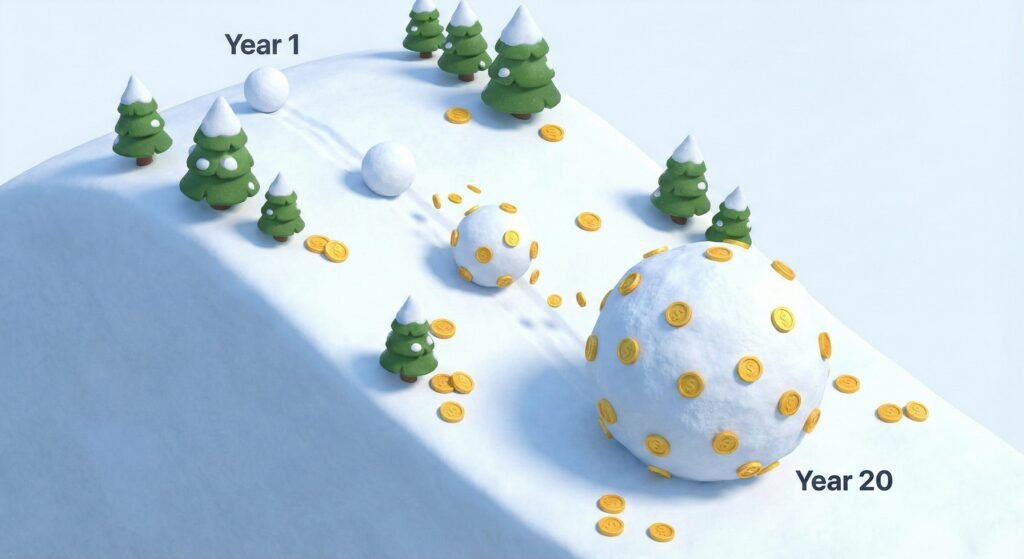

Analysis: By simply clicking “Reinvest,” Alex nearly doubles his money compared to spending the cash. He gets more shares, which pay more dividends, which buy more shares. It is a snowball rolling down a hill.

🧠 Beginner Note:

DRIP stands for Dividend Reinvestment Plan. Most brokers allow you to toggle this on for free. It means your dividends instantly buy more stock without you touching a button.

🚀 Micro-Action:

Log into your brokerage. Find “Account Settings” or “Dividend Settings.” Ensure “Reinvest All Dividends” is checked. Do it now. It costs you nothing and makes you thousands later.

Is It Free Money? (Taxes & Risks)

Before you go all-in, you need to know the rules of the road.

1. The Tax Man Cometh

Even if you reinvest the money (DRIP) and never see the cash in your bank account, the IRS still counts it as income.

- Qualified Dividends: Taxed at a lower rate (usually 15%). Most US stocks fall here.

- Ordinary Dividends: Taxed at your normal income tax rate. (REITs often fall here).

- Plain English: [🔗 Link to Authority: Search “Qualified vs Ordinary Dividends” on IRS.gov]

2. The Cut Risk

Companies are not forced to pay dividends. If the economy tanks, they can cut the payment. This is why we prefer “Dividend Aristocrats”—they hate cutting payments because it looks bad.

🚀 Micro-Action:

Check if your brokerage account is a “Tax-Advantaged” account like a Roth IRA. If you hold dividend stocks in a Roth IRA, you don’t pay taxes on the dividends!

Interactive: The “Golden Goose” Checklist

Before Alex buys a stock, he runs it through this 4-step filter. Can you check these boxes for the stock you are looking at?

- [ ] The Yield Check: Is the yield between 2% and 6%? (Above 8% is suspicious!).

- [ ] The Payout Ratio: Is the “Payout Ratio” under 75%? (This means they aren’t giving away all their cash).

- [ ] History: Have they paid dividends for at least 10 years without stopping?

- [ ] Growth: Is the dividend payment higher today than it was 5 years ago?

FAQ: People Also Ask

Q: Do I need a lot of money to start?

A: No! Alex started with one share. With “Fractional Shares,” you can start with as little as $5. Even $5 of a stock will earn you a few cents of dividends.

Q: How often do I get paid?

A: Most US companies pay quarterly (4 times a year). Some pay monthly, and some European companies pay once a year.

Q: Can I live off dividends?

A: Yes, but it takes time. To earn $40,000/year in dividends with a 4% yield, you would need a $1,000,000 portfolio. It is a marathon, not a sprint.

Q: What happens if I sell the stock?

A: You stop receiving dividends immediately. You only get paid while you hold the golden goose.

Q: Where is the safest place to find these stocks?

A: Look into Dividend ETFs (Exchange Traded Funds). These are baskets of hundreds of dividend stocks. Popular examples include VYM or SCHD. [🔗 Internal Link: Link to related post about “Best ETFs for Beginners”].

Conclusion: Your Tomorrow Morning Action Plan

Understanding Dividends 101 is the closest thing to finding a cheat code for free money.. They reward you for patience.

Alex didn’t get rich overnight. But after 10 years of reinvesting dividends, his $50/month grew into a safety net that pays his electric bill automatically.

Your Action Plan:

- Open your brokerage app.

- Turn on “Dividend Reinvestment” (DRIP).

- Buy 1 share (or fractional share) of a “Dividend Aristocrat” or a Dividend ETF.

- Wait for that first notification: “Deposit Received.”

The best time to plant a tree was 20 years ago. The second best time is today.

TRUST & SAFETY BLOCK

Disclaimer:

This article is for educational purposes only and does not constitute financial advice. The “Alex” persona is a fictional example used for illustration. Past performance of stocks does not guarantee future results. All investments carry risk, including the loss of principal. Please consult with a certified financial planner or tax professional before making investment decisions.

References (APA 7th Edition):

- Internal Revenue Service. (2025). Topic No. 404: Dividends. https://www.irs.gov/taxtopics/tc404

- Investopedia. (2025). Dividend Yield: Definition, Formulas, and Examples. https://www.investopedia.com/terms/d/dividendyield.asp

- U.S. Securities and Exchange Commission (Investor.gov). (2024). Glossary: Dividend. https://www.investor.gov/introduction-investing/investing-basics/glossary/dividend