S&P 500 vs. Nasdaq-100 vs. Dow Jones: Why My Portfolio Didn’t “Moon” When Nvidia Did (2026 Deep Dive)

Executive Summary:

As we close out 2025, the U.S. stock market has ceased to be a single entity. While the Nasdaq-100 sufrged over 22% fueled by the AI boom, the Dow Jones Industrial Average lagged at 14% due to its archaic price-weighted architecture. This guide deconstructs the structural “physics” of these indices, explaining why the “Magnificent Seven” drove a wedge between benchmarks and offering a “Barbell” strategy for 2026 to balance growth with resilience.

Table of Contents

- The 2025 Scorecard: At A Glance

- Confession: Why I Misunderstood “The Market”

- The Mathematical Flaw: Price vs. Cap

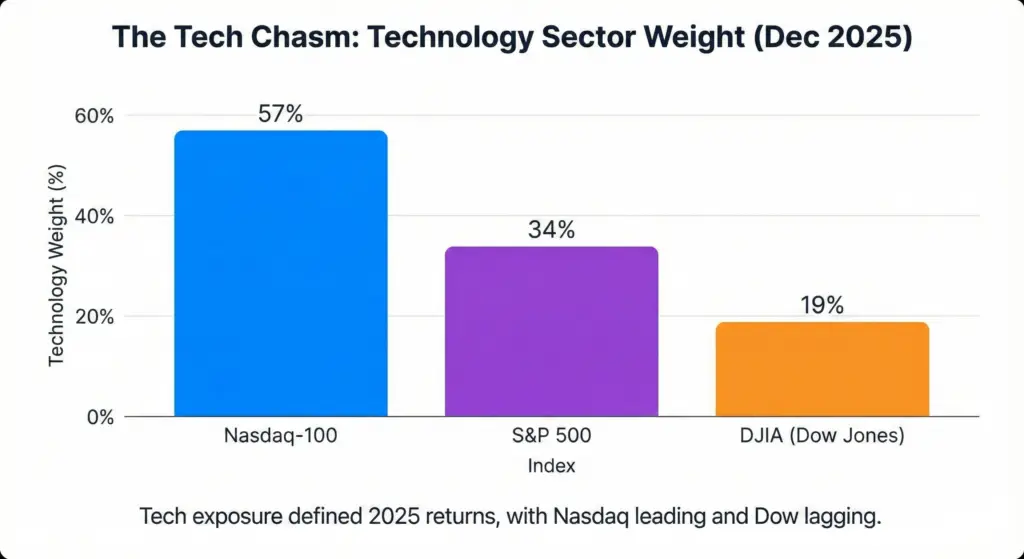

- The Tech Chasm: Sector Wars

- The Concentration Dilemma

- 2026 Strategy: The Barbell Approach

- Recommended Reading

- FAQ: S&P 500 vs Nasdaq vs Dow

⚡ At A Glance: Which Index Won 2025?

If you’re in a rush, here is the cheat sheet. This table breaks down the key differences that defined the market this year.

| Feature | Nasdaq-100 (NDX) | S&P 500 (SPX) | Dow Jones (DJIA) |

| 2025 Return | Highest (~22%) | Strong (~18%) | Lagging (~14%) |

| Primary Driver | AI & Tech (Nvidia, Microsoft) | Broad Market Rally | Financials & Industrials |

| Tech Weight | ~57% (Aggressive) | ~34% (Balanced) | ~19% (Low) |

| Weighting Logic | Market Cap (Modified) | Market Cap (Float) | Price (The Flaw) |

| Best For… | Aggressive Growth | Core Portfolio | Income & Defense |

📌 Key Takeaways (TL;DR)

- The “Tech Chasm” Defined 2025: The Nasdaq-100 is essentially a levered technology bet (57% allocation), capturing the full AI value chain, while the Dow (19% tech) structurally missed the semiconductor rally.

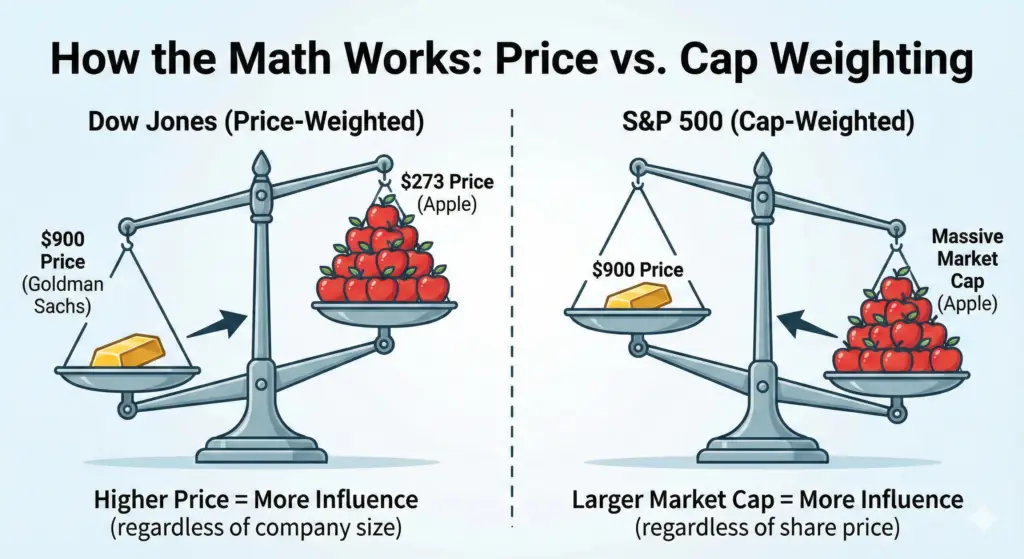

- The Price-Weighting Trap: In the Dow, a $900 stock like Goldman Sachs has nearly 3x the influence of Apple ($273), regardless of Apple’s massive market cap. This math matters.

- Concentration Risk vs. Reward: The “Magnificent Seven” now make up nearly 50% of the Nasdaq-100. While risky, this concentration was the primary driver of the index’s superior returns.

- 2026 Strategy: The “Easy Money” is gone. A “Barbell Strategy”—pairing the Nasdaq (Innovation) with the Dow (Quality/Defense)—is the prudent move for the volatility ahead.

1. Confession Time: I Thought “The Dow” Was The Market

Let’s be real for a second. When I first started investing, I treated the terms “Dow Jones,” “S&P 500,” and “The Stock Market” as synonyms. If the news anchor said, “The Dow is down 200 points,” I assumed my portfolio was bleeding. If they said “The market is rallying,” I assumed everything I owned was going up.

Boy, did 2025 teach me a lesson.

By December 26, 2025, the market had completely bifurcated. The divergence was huge. The Nasdaq-100 was popping champagne with returns over 22%, riding the wave of AI commercialization. Meanwhile, the Dow Jones Industrial Average (DJIA) was sitting at the kids’ table with a 14% gain.

You might be asking, “Why the huge gap?”.

I used to think it was just random noise. But after digging into the methodology—the actual “engine room” of these indices—I realized they weren’t designed to answer the same questions.

- The Dow is a relic of the industrial age (1896), built to track “smokestack” companies like sugar and rail.

- The S&P 500 is the modern standard, designed to represent the corporate aggregate of the U.S. economy.

- The Nasdaq-100 is the “Innovation Engine,” explicitly excluding banks to double down on growth.

Understanding this “personality difference” is the only way to make sense of your returns this year.

2. The Math That Cost Me Money: Price vs. Value

Here is the part that blew my mind (and honestly, kind of annoyed me).

In the modern world, we measure a company’s size by Market Capitalization (Price × Total Shares). It makes sense, right? Apple is a $3+ trillion company, so it should be the most important stock in the index.

The S&P 500 and Nasdaq-100 agree with this logic. They are “Cap-Weighted”.

The Dow Jones, however, is Price-Weighted.

Because it was invented before computers existed, Charles Dow calculated the index by just adding up the stock prices and dividing by a number. This means a stock with a high share price has more power than a huge company with a low share price.

The Goldman Sachs vs. Apple Absurdity

Look at the data from December 2025. It highlights just how distorted this can get:

| Company | Share Price (approx.) | Weight in DJIA | Actual Market Cap |

| Goldman Sachs (GS) | ~$900 | ~11.46% | Medium |

| Apple (AAPL) | ~$273 | ~3.46% | Massive (20x GS) |

[Data Source: Year-End 2025 Report, Table 3]

Do you see the problem? Goldman Sachs is nearly 3.5 times more important to the Dow than Apple, simply because its stock price is higher.

This explains the “Nvidia Anomaly.” In 2025, Nvidia was the engine of the entire stock market. In the S&P 500 and Nasdaq, it was a top-two holding. But in the Dow? It was ranked around 20th, with a measly ~2.4% weight.

The Takeaway: If you held a “Dow” ETF thinking you were investing in the AI boom, the math was literally working against you. The Dow structurally could not capture the Nvidia rally because of its price-weighted constraints.

3. The Sector Battlefield: Where the War Was Won

The divergence in 2025 wasn’t just about math; it was about Technology. I call this the “Technology Chasm”.

If you look under the hood of the Nasdaq-100, it is an unapologetic tech bet. It allocates nearly 57% to Information Technology. It owns the chip designers (Nvidia, AMD), the software platforms (Microsoft), and the hardware makers. It’s a “Risk-On” vehicle.

The Dow Jones, on the other hand, is only 19% tech. Even worse, it has 23% exposure to Financials (banks and credit cards).

- When interest rates spike: The Dow often outperforms because banks make more money on loans.

- When AI takes off (like in Q2-Q3 2025): The Nasdaq leaves the Dow in the dust.

In 2025, the Dow was dragged down by “real economy” struggles in companies like Boeing and Nike, which faced headwinds from trade and manufacturing issues. Meanwhile, the Nasdaq was floating in the cloud (pun intended).

4. The “Magnificent Seven” Dilemma: Too Much of a Good Thing?

We need to talk about concentration. By December 2025, the market had become incredibly top-heavy. The “Magnificent Seven”—Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, Meta—basically dictated where your portfolio went.

- In the S&P 500: These seven stocks make up 34.3% of the index. That’s historic. It’s higher than the Dot-Com bubble peak.

- In the Nasdaq-100: It’s even wilder. They make up nearly 50% of the index.

The “Capping” Safety Mechanism

Here is a nuance I learned this year that saved me some sleep. The Nasdaq-100 isn’t completely lawless. It has a special “Capping Rule”.

If the biggest companies get too dominant (specifically, if companies with >4.5% weight collectively exceed 48% of the index), the index forces a “special rebalance” to trim them down.

In 2025, this happened. The rule forced the index to sell some Nvidia and Microsoft winners and redistribute that money to the other 90+ companies. It acts like an automated “take profit” system. The S&P 500 doesn’t do this as aggressively, which means the Nasdaq actually has a structural guardrail against becoming just an Nvidia fund.

5. 2026 Outlook: The “Barbell” Strategy

So, the easy money of 2025 has been made. Valuations are high (the Nasdaq is trading at over 30x earnings!). So, what is the best ETF strategy for 2026?

✅ Quick Quiz: Which Index Fits Your 2026 Goal?

Still unsure? Check the boxes that sound like you.

Option A: The “Iron Stomach”

- [ ] You can handle a 20% drop without panicking.

- [ ] You believe AI is just getting started.

- [ ] You don’t care about dividends.

- Winner: Stick with the Nasdaq-100 (QQQ).

Option B: The “Sleep Well at Night”

- [ ] You want exposure to US growth but hate volatility.

- [ ] You prefer owning the “whole economy,” not just tech.

- [ ] You check your portfolio once a month, not daily.

- Winner: The S&P 500 (VOO or SPY) is your home base.

Option C: The “Cash Flow King”

- [ ] You are worried about a recession or crash.

- [ ] You like seeing dividend payments hit your account.

- [ ] You trust established giants (like Coca-Cola) over new disruptors.

- Winner: The Dow Jones (DIA) acts as your shield.

Based on the data, I’m adopting a “Barbell Strategy”. Imagine a weight bar with heavy plates on both ends, but nothing in the middle.

- Left Side (Growth): Stick with the Nasdaq-100 (Invesco QQQ or QQQM). AI is a secular trend, not a fad. You need exposure to the “Innovation Engine”.

- Right Side (Defense): Balance that risk with the Dow Jones (DIA) or Dividend Aristocrats. If the economy gets rocky or rates stay “higher for longer,” the Dow’s cash-rich, value companies act as a buffer.

- The Tactical Pivot: I’m also looking at the S&P 500 Equal Weight (RSP). This fund treats the smallest company in the S&P the same as Apple. If the rally “broadens out” to the other 493 stocks that got left behind in 2025, this is where the alpha will be.

📚 Recommended Reading

Ready to dive deeper? Check out our other guides to master your ETF portfolio.

- How to Invest in the S&P 500: The Definitive Guide to VOO, IVV & Global Alternatives

- What Is an ETF? A Simple Beginner’s Guide (2025)

❓ Frequently Asked Questions (FAQ)

Is the Dow Jones better than the S&P 500 for beginners?

No, the S&P 500 is generally better for beginners. It is more diversified (500 companies vs. 30) and uses market-cap weighting, which accurately reflects the economy. The Dow is better suited for conservative investors seeking lower volatility and dividends.

Why is Nvidia not in the Dow Jones top holdings?

This is due to Price-Weighting. Even though Nvidia is a massive company, its share price is lower than companies like Goldman Sachs. In the Dow, a lower share price means less influence, preventing it from driving the index like it does in the Nasdaq-100.

Does the Nasdaq-100 include bank stocks?

No. The Nasdaq-100 explicitly excludes the Financials sector. This means it holds zero exposure to banks like JPMorgan or Visa, making it a pure play on “Risk-On” sectors like Technology and Biotech.

👤 About the Author

The Investi-Buddy is a financial enthusiast and market analyst focused on translating complex index methodologies into actionable strategies for retail investors. With a focus on the 2025 AI-driven market cycle, he specializes in identifying structural anomalies in ETF benchmarks. (Note: This article is backed by data from the Gemini Financial Insights 2025 Year-End Report.)

Sources

Gemini Financial Insights. (2025, December 28). Strategic Benchmarking of U.S. Equity Indices: A Comprehensive Technical and Performance Analysis of the S&P 500, Dow Jones Industrial Average, and Nasdaq-100 (Year-End 2025). [Internal Report].

Nasdaq. (2025, December 28). Nasdaq-100® Performance vs S&P 500 Returns. https://www.nasdaq.com/solutions/global-indexes/nasdaq-100/performance.

S&P Dow Jones Indices. (2025, December). Methodology: Dow Jones Averages. S&P Global. https://www.spglobal.com/spdji/pt/documents/methodologies/methodology-dj-averages.pdf.

Investopedia. (2025, December 26). Markets News: Stock Indexes Log Weekly Gains After Quiet Friday Session. https://www.investopedia.com/dow-jones-today-12262025-11876265.

Slickcharts. (2025, December). Dow Jones Companies by Weight. Retrieved December 28, 2025, from https://www.slickcharts.com/dowjones.

Visual Capitalist. (2025). Charted: Companies in the Nasdaq 100, by Weight. Retrieved December 28, 2025, from https://www.visualcapitalist.com/cp/nasdaq-100-companies-by-weight/.

Disclaimer:

The content provided in this article is for informational purposes only and does not constitute financial advice, investment recommendations, or an endorsement of any specific security or strategy. All investments involve risk, including the loss of principal. Past performance is not indicative of future results. The author is not a registered financial advisor. Please consult with a qualified financial professional before making any investment decisions.