Robo-Advisor vs DIY For Beginners: How To Avoid Costly Mistakes

If this feels like a lot, you are not behind. Most people were never taught this. We will take it one clear step at a time. This guide explains robo-advisor vs DIY for beginners in plain words, and also shows when a small hybrid can help.

Quick Note: This is education, not personal advice. I am not an expert. I read official pages, write in simple words, and add dates when I check things. Rules and prices can change.

How I Verify, In One Line: I read each provider’s fee page, portfolio and cash policy, and tax info, then cross-check with SEC, SIPC, or IRS when needed. I put a “checked on” date near numbers that matter.

At-A-Glance, One Screen

- Who This Helps: New and busy investors who want a clear plan

- Quick Choice: Pick Robo for automation. Pick DIY if you enjoy building. Pick Hybrid if you want both

- Typical Robo Advisory Fees: Often 0% to 0.25% per year at big names. Some charge 4 dollars per month until you deposit enough or reach a balance level, then 0.25%. Some use no advisory fee but keep a cash slice that can be an indirect cost

- What A Robo Does: Short quiz, low-cost funds, auto-deposits, and automatic rebalancing when your mix drifts

- Safety: Assets sit at a brokerage. SIPC covers up to 500,000 dollars, and cash up to 250,000 dollars, if the broker fails. SIPC does not protect against market loss

Checked On: 19 Aug 2025, KST

If you only do one thing after this page, turn on an auto-deposit you can keep.

If you are comparing robo-advisor vs DIY for beginners, start with a small, steady deposit first.

Glossary In Plain Words, With Quick Tips

If any word trips you up, pause here. Clear words make clear choices.

- Robo-Advisor: Software that builds and maintains a portfolio for you. It uses your answers about risk and goals, buys low-cost funds, and keeps your mix on target

- Tip: Compare your all-in cost. That is advisory fee plus fund fees plus any cash policy effect

- Gotcha: “No management fee” can still mean a built-in cash slice that may slow growth over time

- DIY, Do-It-Yourself Investing: You pick funds and write rules you will follow. Costs can be very low, but you do the work

- Tip: Write a one-page plan before you buy anything

- Gotcha: Too many trades and no routine can hurt results

- Advisory Fee: The platform’s yearly fee, for example 0.25 percent per year. This is on top of fund fees

- Tip: Write down your all-in fee on one line so you can compare providers

- Expense Ratio, ER: The fund’s yearly fee inside the fund, for example 0.03 percent per year

- Tip: Broad index funds are often cheapest for core money

- Basis Points, Bps: 100 bps equals 1 percent

- Tip: 25 bps equals 0.25 percent, which is common for robos

- Asset Allocation: Your split, for example 80 percent stocks and 20 percent bonds. This drives risk more than any one fund

- Tip: Pick a split you can live with during a bad year, not just a good year

- Rebalancing: Moving back to your target split when it drifts. You sell a little of what grew and buy what lagged

- Common Rule: Once a year, or when any slice moves more than 5 percentage points

- Drift: How far your actual split moved from your target split

- Tip: Set a calendar reminder so rebalancing actually happens

- Cash Drag: A portfolio choice that keeps extra cash. Helpful for stability, but may lower growth if markets rise

- Tip: Read the cash policy before you choose

- Taxable Account vs Tax-Advantaged Account: Taxable is a normal brokerage account. Tax-advantaged means IRA, Roth IRA, or similar, with special tax rules

- Tip: TLH applies to taxable accounts. IRA limits change, check the IRS page

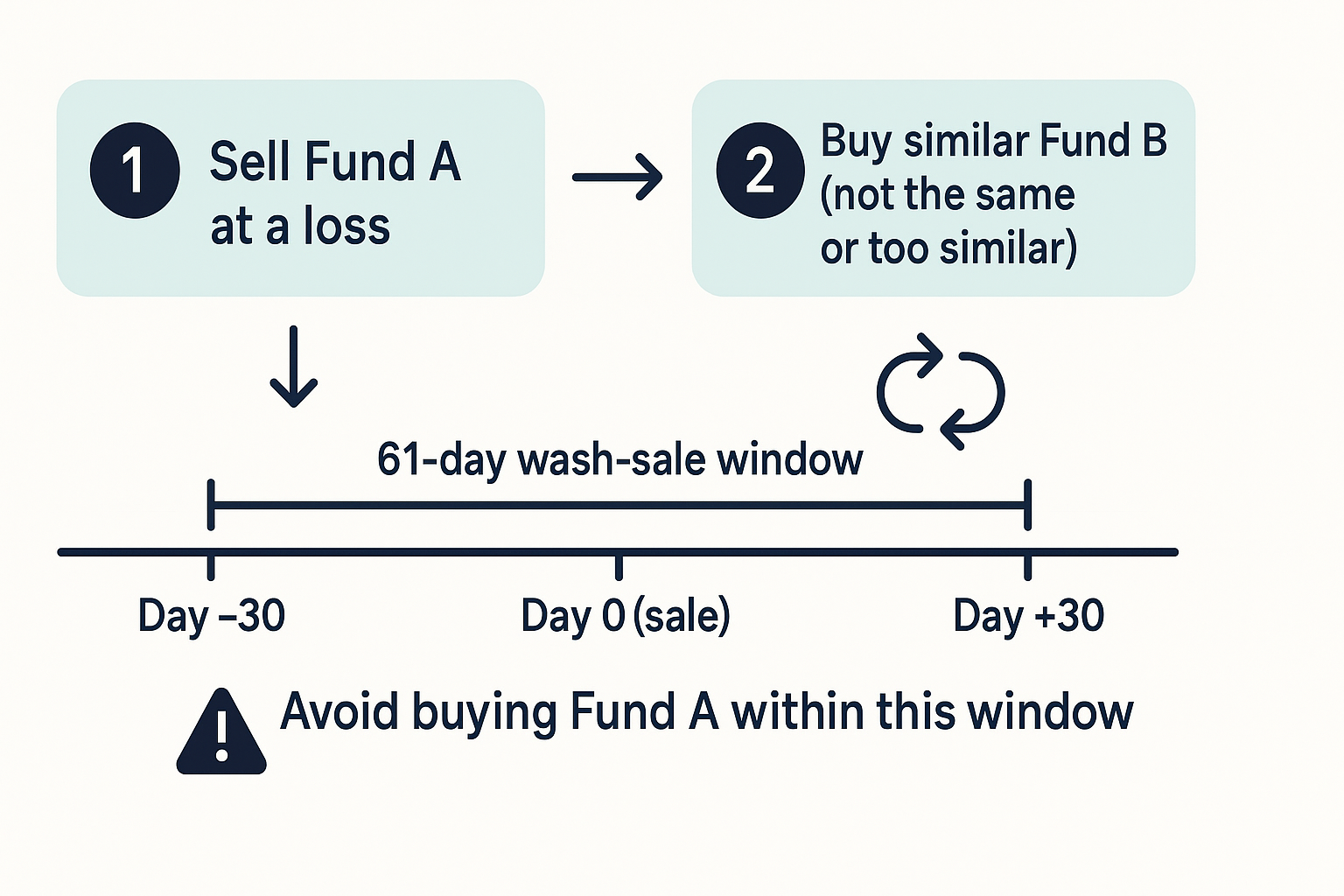

- Tax-Loss Harvesting, TLH: Selling at a loss and buying a similar fund so you may use the loss at tax time, within IRS rules

- Gotcha: The wash-sale rule can block the loss if you rebuy the same or “substantially identical” investment too soon

- Wash-Sale Rule: Buying the same or very similar security within the restricted window, usually 30 days before or after the sale, can disallow the loss

- Tip: Many robo systems pick alternate funds to reduce wash-sale risk. Read the details first

- Custodian: The brokerage that holds your assets and sends statements

- Tip: Check that the broker is a SIPC member

- SIPC: A backstop if a SIPC-member brokerage fails and assets are missing, up to limits. Not market loss insurance

- Tip: Know what is covered and what is not

- ETF vs Mutual Fund: Both are baskets of stocks or bonds. ETFs trade all day. Mutual funds trade once per day at the close

- Tip: Cost, tracking accuracy, and your habits matter more than the label

- IPS, Investment Policy Statement: Your one-page plan that states target mix, deposit rule, and rebalance rule

- Tip: Sign and date it. Follow it when markets get loud

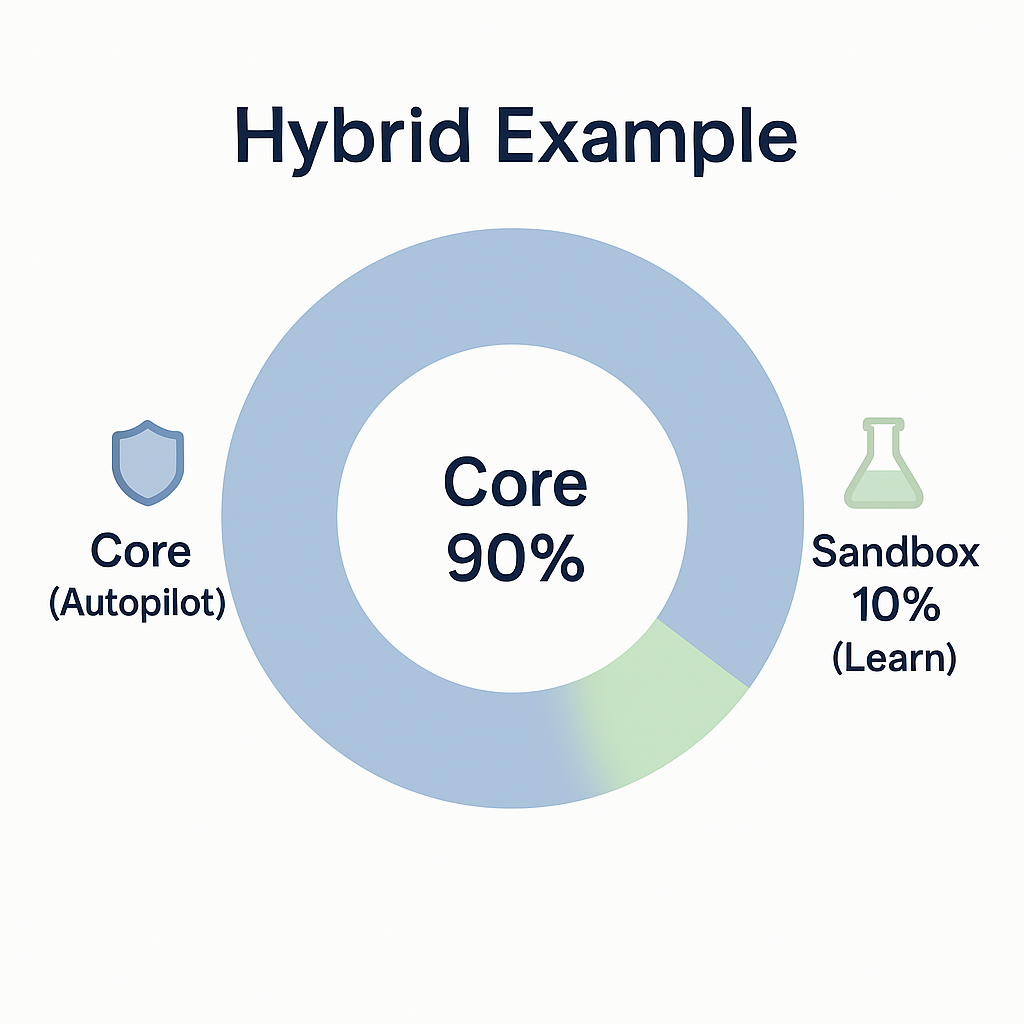

- Core And Satellite, Also Called Sandbox: Core is your main diversified portfolio. The sandbox is a small, capped slice to learn and experiment

- Common Cap: 5 to 10 percent of total invested money so mistakes cannot sink the plan

Reader Checkpoint 1: Can you explain “all-in fee” in one sentence. If not, reread Advisory Fee and Expense Ratio above, then write your one sentence now.

What Is A Robo-Advisor, In Plain Words

If this part feels heavy, that is normal. Here is the 60 second version. A robo asks a few questions, builds a low-cost mix, and keeps it on track for you.

Why People Choose It: Fewer choices, steady habits, and less second-guessing.

Notes From My Research, Short List:

- Rebalancing rules differ by provider. Read the FAQ before you start

- Some programs hold more cash by design. Learn the cash policy first

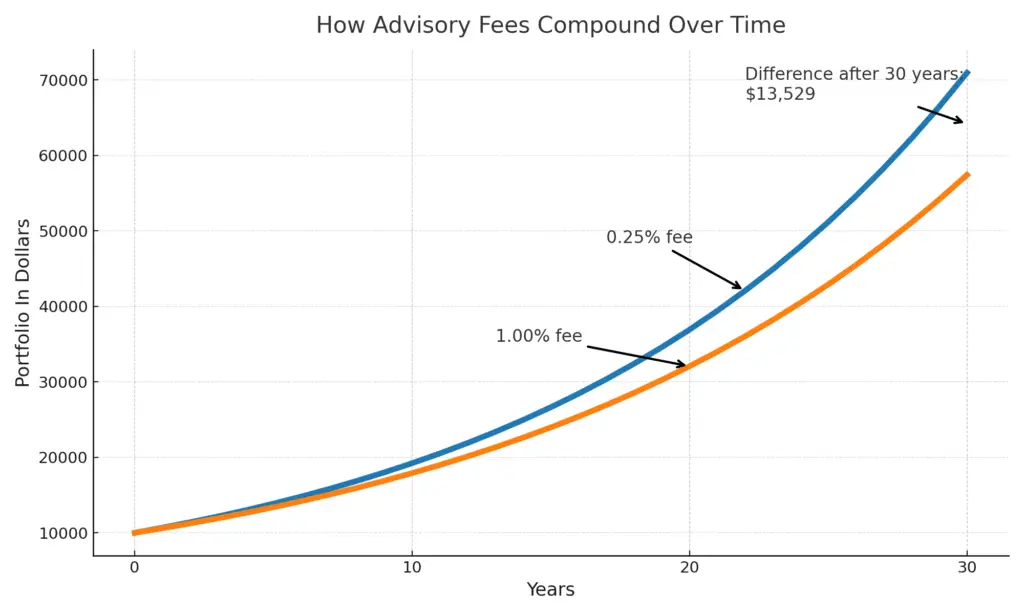

- Fees look small but compound over time. Measure them

Beginner Steps, Opening A Robo Account:

- Create the account and finish identity checks

- Answer the goal and risk questions honestly

- Review the suggested mix. Note the stock, bond, and cash slices

- Turn on auto-deposits with an amount you can keep doing

- Add beneficiaries and turn on two-factor authentication

- Set one yearly review on your calendar

Why This Matters: Automation is great, but only if the settings fit you. A few minutes now can save years of second-guessing later.

Fees In Robo-Advisor vs DIY For Beginners

Money grows over time. Fees do too. Small percentages become big dollars.

Checked On: 19 Aug 2025

- Advisory Fee, The Platform Fee

- Betterment, 4 dollars per month until you set up 250 dollars or more per month in deposits, or reach 20,000 dollars across accounts, then 0.25 percent per year

- Wealthfront, 0.25 percent per year for the Automated Investing account

- Schwab Intelligent Portfolios, no advisory fee. Portfolios include a cash allocation that earns revenue for the bank. That is an indirect cost

- Fund Costs, Expense Ratios

Every ETF or mutual fund has a yearly fee. Both robo and DIY pay these. Check each fund’s expense ratio - Cash Policy, Also Called Cash Drag

If a portfolio parks extra cash by design, long-term growth may be lower than being fully invested. Read the cash policy before you choose

Example, Your All-In Fee In One Minute:

- Advisory fee 0.25 percent on 10,000 dollars is 25 dollars per year

- Average fund ER 0.05 percent is 5 dollars per year

- All-in cost is about 30 dollars per year, roughly 2 dollars and 50 cents per month

Write this number down for each provider so you can compare fairly

Why This Matters: Fees are the one thing you can control today. A lower all-in fee leaves more of the return for you.

For robo-advisor vs DIY for beginners, write your all-in fee on one line so choices stay simple.

Reader Checkpoint 2: Do you know your current all-in fee. If not, write it down for your account before moving on.

How Taxes Affect Robo-Advisor vs DIY For Beginners

Some robos offer tax-loss harvesting in taxable accounts. The software sells a fund at a loss and buys a similar one so you may use the loss at tax time, within IRS rules. Read the TLH page first so there are no surprises.

- Wealthfront, automated investing is 0.25 percent. Docs explain TLH availability

- Betterment, pricing shows the 4 dollars per month to 0.25 percent switch. Help center explains TLH details

- Schwab, TLH is available in taxable accounts with limits and disclosures

Handy Limits For 2025: IRA cap is 7,000 dollars. Catch-up is 1,000 dollars if you are 50 or older.

Beginner Tip, Where TLH Usually Does Not Help: TLH is for taxable accounts. It does not apply inside IRAs because those accounts use different tax rules.

Why This Matters: Taxes reduce real returns. Knowing where TLH fits, and where it does not, keeps you from pushing buttons you do not need.

In robo-advisor vs DIY for beginners, TLH helps only in taxable accounts, so do not expect it inside IRAs.

Is My Money Safe If A Broker Fails

SIPC protects customers of failed brokerage firms up to 500,000 dollars, including 250,000 dollars for cash. This covers custody failures, not market losses. Read “what SIPC protects” so you know the limits.

Security Basics You Can Do Today: Turn on two-factor, use a strong password, avoid unknown links, and keep your contact details current so alerts reach you.

Why This Matters: Safety lets you stay invested. A few quick settings reduce avoidable risks you do not get paid for.

Safety basics matter in robo-advisor vs DIY for beginners because strong logins keep you in the game.

Why Automation Helps In Robo-Advisor vs DIY For Beginners

- Auto-Rebalancing: The system sells a little of what ran up and buys what lagged. This keeps your risk close to target

- Auto-Deposits: Steady beats perfect timing. Even small amounts add up when they are monthly

- Fewer Panic Moves: The rules are set in advance, which helps during rough markets

Why This Matters: Good behavior often beats perfect picks. Automating the boring parts keeps you moving.

Robo-Advisor vs DIY For Beginners, Side By Side

Here is robo-advisor vs DIY for beginners, side by side, plus a small Hybrid option.

| Feature | Robo | DIY | Hybrid |

|---|---|---|---|

| Advisory Fee | Zero To 0.25 Percent At Big Names | Zero Percent | Core In Robo, Small DIY Sandbox |

| Fund Costs (ER) | Yes | Yes | Yes |

| Auto-Rebalancing | Built In At Most Providers | Only If You Do It | Robo Handles The Core |

| Tax-Loss Harvesting | Often Available In Taxable Accounts | Manual Or With Tools | Robo Handles The Core |

| Time Per Week | About 0 To 15 Minutes | About 30 To 120 Minutes | About 10 To 45 Minutes |

| Best For | Set It And Forget It | Tinkerers | Most Busy People |

| Biggest Risk | Over-Trusting Defaults | Over-Trading Or Style Drift | Doing Both Poorly |

| What To Do Next | Pick A Low-Cost Robo And Turn On Auto-Deposit | Write A One-Page Plan And Set Calendar Check-Ins | Set A Core-To-Sandbox Percent And Stick To It |

Robo-Advisor vs DIY For Beginners: What Should I Pick Today

- Want the easiest path and steady habits, pick a Robo

- Love to learn and tweak, pick DIY

- Want automation for the core and a small sandbox for learning, try Hybrid

Reader Checkpoint 3: Write your path in five words. For example, “Robo core, 10 percent sandbox.” If you cannot, pick Robo for now and revisit in three months.

What If I Want To Do DIY But Keep It Simple

DIY Mini-Playbook, Boring And Safe Is Good

- Write one page. “My target is ___ percent stocks and ___ percent bonds. I rebalance once a year or when any slice drifts more than 5 percentage points.”

- Pick two or three broad index funds. Total stock. Total international. Total bond

- Turn on auto-deposit on the same date each month

- Rebalance yearly, or when drift is more than 5 percentage points

- If taxable, read the wash-sale rule before trying TLH

First-Time Fund Setup, Two Paths:

- Two-fund idea. Total stock market and total international stock

- Three-fund idea. Total stock market, total international stock, total bond market

Why This Matters: Simple rules beat complicated plans you cannot keep.

Can I Start This In 30 Days

Day 1 To 5: Pick a path, Robo, DIY, or Hybrid, and write your one-pager

Day 6 To 10: Open the account or accounts. Turn on auto-deposits

Day 11 To 15: Add beneficiaries. Turn on two-factor

Day 16 To 20: Check fees and the cash policy. Write your all-in fee, advisory plus ER plus any cash effect

Day 21 To 25: Set a once-a-year review on your calendar

Day 26 To 30: Read your provider’s FAQ on rebalancing and TLH so there are no surprises

Quick Paths In Robo-Advisor vs DIY For Beginners

Robo

Who This Fits: Busy people who want simple automation and low upkeep.

Setup, Step By Step

- Open the account and finish identity checks

- Pick a risk level you can hold during a bad year. Common starters are 80 percent stocks and 20 percent bonds for long goals, or 60 percent stocks and 40 percent bonds for medium goals

- Turn on auto-deposit on payday. Any steady amount works

- Review the cash policy. Note the cash percent if there is one

- If this is a taxable account, decide on TLH after you read the provider page. If unsure, leave it off for now

- Turn on dividend reinvestment if the platform lets you choose

- Add beneficiaries, turn on two-factor, and store recovery codes safely

Ongoing Routine

- Monthly, 5 minutes. Check deposits, skim holdings, note cash percent

- Quarterly, 10 minutes. Confirm advisory fee and add-ons, scan the activity log for rebalancing

- Yearly, 20 minutes. Review risk level, savings rate, cash policy, and your all-in cost

Numbers To Track

- Savings rate. Deposits this month divided by monthly income

- All-in fee. Advisory fee plus average ER plus any cash effect

- Drift. How far stocks and bonds are from target

When To Switch Paths

- You keep pausing deposits

- You want more control and are willing to do the work

- The cash slice or features no longer match your plan

Success Looks Like

- Automatic deposits are running

- You spend under 30 minutes per month

- You can state your risk level in one clear sentence

DIY

Who This Fits: People who like control and can follow simple rules.

Setup, Step By Step

- Write a one-page plan. Example, “Target is 80 percent stocks and 20 percent bonds. I rebalance once per year or if any slice drifts more than 5 percentage points.”

- Pick two or three broad index funds

- Two-fund idea. Total stock market and total international stock

- Three-fund idea. Total stock market, total international stock, total bond market

- Turn on auto-deposit for the same date each month

- Turn on dividend reinvestment

- Choose a rebalancing rule. Annual on a set date, or threshold at 5 percentage points

- For taxable accounts, read about the wash-sale rule before you try TLH

- Add beneficiaries and turn on two-factor

Ongoing Routine

- Monthly, 10 minutes. Check deposits, holdings, and drift

- Quarterly, 15 minutes. Confirm expense ratios and look for overlap, for example two funds that track the same index

- Yearly, 30 minutes. Rebalance to target and review your plan

Guardrails That Help

- Trade count cap. At most two discretionary trades per month

- Position cap. One fund or stock is at most 20 percent of the sandbox, and at most 5 percent of total money

- Do-not-buy list. No leveraged funds. No single-stock bets in the core

Numbers To Track

- All-in fee target. Keep core cost below 0.15 percent per year if you can

- Drift. If off by more than 5 percentage points, rebalance

- Overlap. Avoid owning two funds that do the same job unless you have a reason

When To Switch Paths

- Rebalancing or record-keeping stresses you

- You skip deposits for months

- You start chasing headlines

Success Looks Like

- You can name your funds and why you hold each one

- You rebalance on schedule, not on mood

- Your all-in fee is written down and updated yearly

Hybrid

Who This Fits: Most people who want automation for the core and a small space to learn.

Setup, Step By Step

- Decide your core-to-sandbox split first. A common choice is 90 percent core and 10 percent sandbox

- Open a Robo for the core. Follow the Robo steps above

- Open a separate DIY account for the sandbox to keep records clean

- Write sandbox rules on one page

- Size cap. 5 to 10 percent of total invested money

- Position cap. One idea cannot be more than 20 percent of the sandbox

- Trade count cap. For example two per month

- One simple exit rule you can follow

- Set auto-deposit. New money goes to the core first. If you fund the sandbox, do it only after the core deposit runs

- Turn on two-factor in both accounts

Ongoing Routine

- Monthly, 10 minutes. Check core deposits, review sandbox positions, confirm sandbox size is within the cap

- Quarterly, 15 minutes. Do a core fee audit and write one short note on what the sandbox taught you

- Yearly, 30 minutes. Rebalance the core if needed, reset the sandbox to the cap, and write a short “lessons learned” paragraph

Numbers To Track

- Sandbox percent. Sandbox value divided by total invested money. Keep it at 5 to 10 percent

- All-in fee for core. Advisory fee plus ERs plus any cash effect

- Hit rate in sandbox. Winners divided by total ideas. This is for learning, not bragging

When To Switch Paths

- Sandbox drifts above the cap more than twice a year

- Core deposits stop for two months

- The sandbox takes more time than you like

Success Looks Like

- Core runs on autopilot

- Sandbox is fun and small

- You write down one lesson each year

For anyone weighing robo-advisor vs DIY for beginners, a 90 percent Robo core with a 10 percent DIY sandbox keeps learning fun and risk small.

Common Pitfalls, With Quick Fixes

Fee Creep

What Goes Wrong: Small add-ons pile up. Advisory tiers change. Fund choices drift toward higher expense ratios.

How To Spot It

- Advisory fee is higher than you remembered

- New features show up on the bill

- Average expense ratio rises above your target

Fix, Simple Audit Plan

- Open the billing and fee pages. Write the advisory fee in percent and dollars

- Export your holdings. Add up each fund’s expense ratio

- Write the all-in fee on one line, advisory plus expense ratios plus cash policy effect

- Set a twice-a-year calendar reminder to repeat these steps

- If costs are high, switch to cheaper share classes or a simpler core

Targets To Use

- Core all-in fee at or below 0.35 percent per year is a helpful aim for many index-based portfolios

Cash Drag

What Goes Wrong: A default cash slice sits in the portfolio, or new deposits wait in cash too long.

How To Spot It

- Cash percent is higher than you expected

- Cash grows during rising markets without a reason

- New deposits sit in cash for weeks

Fix, Two Choices

- Accept the cash level and write down why, for example near-term spending

- If you do not accept it, choose a different setting or a product that keeps less cash

Why This Matters: Cash choices quietly shape long-run results. Thirty seconds on the cash line today can avoid years of slow growth.

Helpful Habits

- Keep an emergency fund outside your investment account

- Review the cash policy once per year and write the number down

Thrill Trades

What Goes Wrong: The sandbox becomes the whole show. Turnover rises. The plan gets lost.

How To Spot It

- You check prices many times a day

- You trade because of a headline

- Sandbox size is above the written cap

Fix, Simple Guardrails

- Sandbox cap. 5 to 10 percent of total invested money, measured monthly

- Position cap. One idea is at most 20 percent of the sandbox

- Cooling-off rule. Wait 24 hours before any new idea

- Trade count cap. Two discretionary trades per month

- Write a note after each trade. Reason, size, and what would make you exit

Reset Button

- If the sandbox broke the cap, sell down to the cap today and write what you learned

Tax Oops

What Goes Wrong: You turn on TLH without reading, create a wash sale, or trigger short-term gains by accident.

How To Spot It

- Disallowed losses on the statement

- Many short-term sales on the 1099

- The same or near-identical fund in two accounts that trade on different schedules

Fix, Simple Flow

- Read the TLH page for your provider

- If you turn TLH on, learn the alternate fund pairs they use

- Avoid buying the same or substantially identical fund within the 30-day windows that create wash sales

- Keep a short tax log. Date, fund sold, fund bought, and purpose

- Skip TLH in IRAs. Those accounts use different tax rules

Why This Matters: A few minutes up front can prevent tax headaches that undo your hard work.

Year-End Habits

- Download tax forms early, check names and numbers, and ask questions before filing

Rebalance Whiplash

What Goes Wrong: You rebalance too often and pay extra costs.

Fix

- Pick one method. Annual on a set date, or threshold at 5 percentage points

- Put it on a calendar. Ignore day-to-day noise

Why This Matters: Rebalancing keeps risk steady, but only when it is done on purpose, not out of worry.

Risk Mismatch

What Goes Wrong: The portfolio is too aggressive for your sleep level, or too conservative for your goal.

Fix

- If big drawdowns make you panic, add more bonds and write the new target into your plan

- If the goal is many years away and you can hold through bad years, a higher stock share can be reasonable for some people

Neglected Security

What Goes Wrong: Accounts are open, but access is weak.

Fix

- Turn on two-factor

- Update email and phone

- Store recovery codes safely

- Review beneficiaries once per year

Fee-Drag Chart, Add This Image Later

Make a simple chart that shows 10,000 to 250,000 dollars over 10, 20, and 30 years at 0.25 percent versus 1.00 percent advisory fees. Label the dollar difference at year 30. A clear picture sticks better than a paragraph.

Image alt text suggestion: “Robo-advisor vs DIY for beginners comparison of fee drag.”

FAQ, More Plain Answers

Robo-Advisor vs DIY For Beginners, Which Should I Choose

If you want the easiest path with steady habits, start with a Robo. If you enjoy learning and can follow a plan, DIY can work. A small Hybrid, for example 90 percent core Robo and 10 percent DIY sandbox, lets you learn without risking the core. This page explains robo-advisor vs DIY for beginners and shows when a small Hybrid is useful.

Can You Lose Money With A Robo-Advisor

Yes. Markets move. SIPC is not insurance against market losses. It only helps if a SIPC-member broker fails and assets are missing, up to limits.

Are Robo-Advisors Worth The Fee

If you need steady habits, rebalancing, and guardrails, and you will not do it yourself, the small fee can be worth it. If you enjoy the work and keep costs low, DIY can be fine too.

How Often Do Robos Rebalance

It varies. Many monitor your mix and rebalance when it drifts outside a set range. Read the provider page or FAQ for the exact rule.

What Is A Reasonable Advisory Fee Today

About 0.25 percent per year is common at large robos. Some charge 4 dollars per month until you pass certain levels. One offers no advisory fee but keeps a cash allocation. Always compare official pages.

How Much Should I Keep In A DIY Sandbox

A common cap is 5 to 10 percent of invested money. Small enough that a bad bet does not break your plan.

What About IRA Limits In 2025

The IRA limit is 7,000 dollars, or 8,000 dollars if you are 50 or older.

About Me

I am not a CFP or a CFA. I am a careful reader who turns fine print into simple steps. I link sources, say when I am unsure, and update when things change. If you spot an error, please tell me and I will fix it.

References

Betterment LLC. (n.d.). Pricing. Betterment. Retrieved August 19, 2025, from https://www.betterment.com/pricing

Betterment LLC. (n.d.). What are Betterment’s fees? Betterment Help. Retrieved August 19, 2025, from https://www.betterment.com/help/fees

Charles Schwab & Co., Inc. (n.d.). Schwab Intelligent Portfolios®: Automated investing overview. Schwab. Retrieved August 19, 2025, from https://www.schwab.com/intelligent-portfolios

Charles Schwab & Co., Inc. (n.d.). Schwab Intelligent Portfolios® sweep program and current interest rates. Schwab. Retrieved August 19, 2025, from https://www.schwab.com/legal/sip-sweep-current-interest-rates

Charles Schwab & Co., Inc. (n.d.). Asset allocation (white paper). Schwab. Retrieved August 19, 2025, from https://www.schwab.com/automated-investing/asset-allocation

Internal Revenue Service. (n.d.). Publication 550: Investment income and expenses. IRS. Retrieved August 19, 2025, from https://www.irs.gov/publications/p550

Internal Revenue Service. (n.d.). Publication 550 [PDF]. IRS. Retrieved August 19, 2025, from https://www.irs.gov/pub/irs-pdf/p550.pdf

Internal Revenue Service. (n.d.). Instructions for Schedule D (Form 1040). IRS. Retrieved August 19, 2025, from https://www.irs.gov/instructions/i1040sd

Internal Revenue Service. (n.d.). IRA contribution limits. IRS. Retrieved August 19, 2025, from https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

Internal Revenue Service. (2024, November 1). 401(k) limit increases to $23,500 for 2025; IRA limit remains $7,000 [News release]. IRS. https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

Securities Investor Protection Corporation. (n.d.). What SIPC protects. SIPC. Retrieved August 19, 2025, from https://www.sipc.org/for-investors/what-sipc-protects

Securities Investor Protection Corporation. (n.d.). Introduction to SIPC. SIPC. Retrieved August 19, 2025, from https://www.sipc.org/for-investors/introduction

Securities Investor Protection Corporation. (n.d.). How SIPC protects you [Brochure PDF]. SIPC. Retrieved August 19, 2025, from https://www.sipc.org/media/brochures/HowSIPCProtectsYou-English-Web.pdf

U.S. Securities and Exchange Commission. (n.d.). Investor bulletin: Robo-advisers. SEC. Retrieved August 19, 2025, from https://www.sec.gov/resources-for-investors/investor-alerts-bulletins/ib_robo-advisers

U.S. Securities and Exchange Commission. (n.d.). Automated investment advice (FinHub). SEC. Retrieved August 19, 2025, from https://www.sec.gov/about/divisions-offices/office-strategic-hub-innovation-financial-technology-finhub/automated-investment-advice

U.S. Securities and Exchange Commission. (n.d.). Wash sales (glossary). Investor.gov. Retrieved August 19, 2025, from https://www.investor.gov/introduction-investing/investing-basics/glossary/wash-sales

Wealthfront Corporation. (n.d.). Pricing. Wealthfront. Retrieved August 19, 2025, from https://www.wealthfront.com/pricing

Wealthfront Corporation. (n.d.). Understanding Wealthfront fees. Wealthfront Help. Retrieved August 19, 2025, from https://support.wealthfront.com/hc/en-us/articles/13992378758676-Understanding-Wealthfront-fees