The 7 Hidden Mind Traps Secretly Sabotaging Your Portfolio

Last reviewed: Aug 2025 · Independence: No affiliate links, no payment from either broker · For education, not advice

Introduction: My First (and Most Expensive) Investing Mistake

When I was young, I used to do investing without any prior knowledge, ignoring any investor psychology that had effects on me. And still, until now, The moment when I sold a stock in a panic still pops out. The market was dropping, red numbers were flashing everywhere, and a little voice in my head screamed, “GET OUT NOW before it goes to zero!”

So, I sold and locked in a painful loss. Of course, the market recovered a week later without me.

The financial cost was bad, but the feeling of being outsmarted by my own brain was worse. That moment sent me on a deep dive to understand investor psychology—the real enemy of every investor.: the one staring back at us in the mirror. It turns out, the biggest risk to our money isn’t a bad stock or a housing bubble; it’s our own mind. This is the core lesson of investor psychology.

In this guide to investor psychology, we’re going to tackle this head-on.

- Part 1: We’ll identify the enemy within by exploring the simple science of why our brains are wired to make bad money decisions.

- Part 2: We’ll examine the “crime scenes” from famous market crashes to see this psychology in action.

- Part 3: We’ll build the mental armor you need to win the inner game, for good.

Let’s get into it.

My Promise (The Investibuddy)

I’m not an expert. I’m a fellow beginner who tests with small amounts, practices risky features in a simulator first, and double-checks details in official docs. I don’t take referral fees for this comparison. When something confuses me, I say so and translate it into plain English. I reviewed each app’s public help pages the week of August 5, 2025 and saved screenshots. My promise: clear explanations, beginner-safe steps, and no hype. If I learn something new, I’ll update this and explain what changed.

Last reviewed: August 4, 2025.

Part 1: The 7 Hidden Mind Traps Secretly Sabotaging Your Portfolio

What’s This ‘Behavior Gap’ Costing You a Fortune?

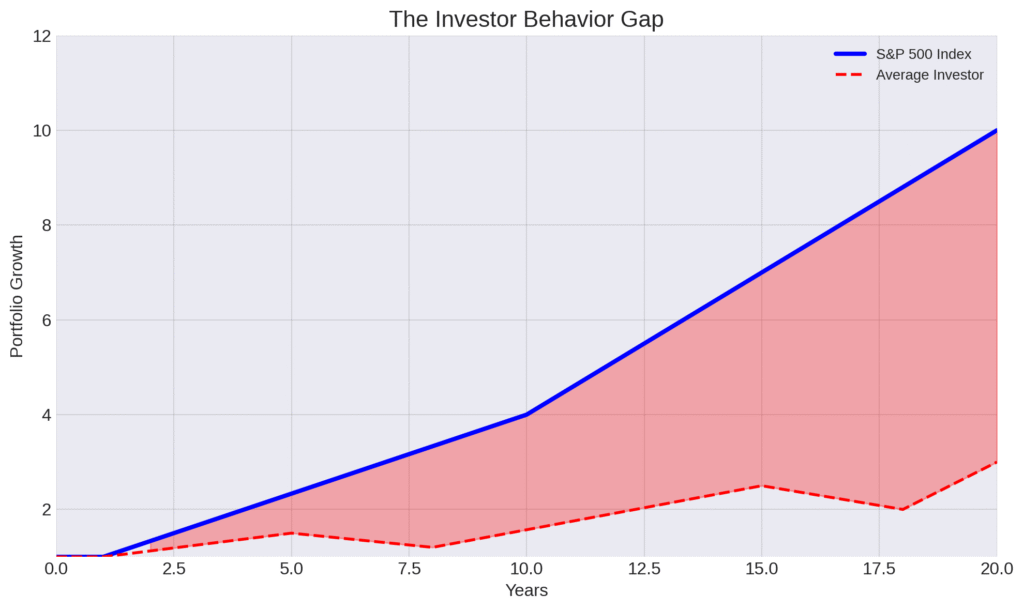

While I was doing my research, I stumbled upon something that honestly blew my mind. I found a study from a company called DALBAR that has been tracking how regular investors actually perform compared to the stock market. The results are pretty brutal.

Over a 20-year period, this “behavior gap” means the average person makes 2.72% less than the market every single year. This is a constant, wealth-destroying pattern caused by our own emotional decisions.

The Science of Investor Psychology: Your Brain on Money

So, why do we keep making these same mistakes? It all comes down to a field called behavioral finance.

Basically, some super-smart guys won a Nobel Prize for proving one simple thing: for most of us, losing $100 feels twice as bad as winning $100 feels good.

That simple fact—that losses hurt more than gains feel good—is the source code for almost every bad decision in investor psychology.

What Are the Most Common Investor Psychology Mistakes?

The most common investor mistakes are not bad stock picks, but psychological traps that lead to emotional decisions. These well-documented biases cause the “behavior gap,” where investors consistently underperform the market.

Some of the most critical traps to understand include:

- Overconfidence Bias: Overestimating your own skill and taking on too much risk.

- Loss Aversion: Fearing the pain of a loss far more than you value an equivalent gain.

- Herd Mentality: Following the crowd due to a fear of missing out (FOMO).

- Confirmation Bias: Seeking out information that confirms your existing beliefs while ignoring contradictory evidence

Know Your Enemy: The 7 Key Traps of Investor Psychology

Now that we understand the basic science, let’s look at the specifics. The field of investor psychology identifies seven key mental traps I’ve learned to spot. Here are the specific mental traps I’ve learned to spot, now with more detail on how they show up in the real world.

🧠 Trap #1: Overconfidence Bias (The “I’m a Genius” Delusion). This is that little voice that pops up after a few wins and whispers, ‘Hey, you’re a genius at this!’ It’s easy to mistake a rising market for our own skill. The real danger is that this bias encourages us to trade too often and take on far too much risk.

The most famous cautionary tale for this is the spectacular collapse of a hedge fund called Long-Term Capital Management (LTCM) in 1998. The firm was run by Wall Street legends and even included two Nobel Prize-winning economists—literal, certified geniuses. They created complex computer models that they believed were foolproof and were so confident in their own brilliance that they borrowed over $100 billion to amplify their bets.

When an unexpected crisis hit (a Russian debt default), their “perfect” models failed, and the firm lost $4.6 billion in a matter of months, forcing the U.S. Federal Reserve to step in to prevent a wider economic collapse. It’s the ultimate proof that no one, not even a team of Nobel laureates, is smarter than the market.

💔 Trap #2: Loss Aversion (The Pain of Seeing Red). Because losing feels so terrible, we do irrational things. Imagine you bought a stock at $50. It drops to $40, and your stomach sinks. The thought of selling and turning that “paper loss” into a real, painful loss is so dreadful that you hold on, hoping it comes back.

Meanwhile, another stock you own goes from $50 to $60. You feel a rush of excitement and immediately sell to “lock in” that good feeling, even though the company might have much more room to grow. Over time, this leads to a portfolio full of your worst ideas (the losers you couldn’t bear to sell) and none of your best ones (the winners you sold too early). You’re left holding the weeds and you’ve sold all your flowers.

🐑 Trap #3: Herd Mentality (Following the Crowd). Think about trying to pick a busy restaurant in a new city. Do you check every menu, or do you just go to the one with the long line out the front? Most of us follow the crowd, assuming the line means the food is good. This is Herd Mentality.

It’s our deep-seated instinct to do what everyone else is doing, powered by a Fear Of Missing Out (FOMO). It’s the voice that says, “Everyone is buying it, so it must be right!” This is how speculative bubbles are born, and it almost guarantees you’ll buy high and sell low.

What it feels like: You see a stock or crypto coin triple in a week. Your group chat is buzzing. You feel a knot in your stomach—a mix of excitement and intense anxiety that you’re being left behind. The thought ‘I just need to get in now, I can figure it out later’ is deafening. That powerful, gut-wrenching feeling is the siren song of Herd Mentality.

🎧 Trap #4: Confirmation Bias (The Echo Chamber). Our brain loves to be right. It’s like when you’re thinking of buying a specific model of car. Suddenly, you start seeing that car everywhere on the road. The cars were always there, but your brain is now actively filtering reality to confirm your interest.

Now, imagine this on steroids. Social media and news algorithms are designed to show you more of what you already like. If you’re excited about a particular investment, your entire digital world can quickly become an echo chamber, feeding you only the good news and hiding the risks, making this bias more dangerous than ever.

⚓ Trap #5: Anchoring Bias (Chained to an Old Price). Our brain tends to get stuck on the first number it sees. If you bought a stock at $100 and it drops to $60, your brain screams, “It’s 40% off! What a bargain!” But that’s a dangerous trap. The market is telling you the company is now worth less for a reason, but your brain is still anchored to the old, irrelevant price you paid.

To break this bias, the only question that matters is: “Based on everything I know today, is this company worth $60 a share?” The price you paid yesterday is irrelevant history.

💸 Trap #6: Sunk Cost Fallacy (Throwing Good Money After Bad). This is the same reason people will sit through a terrible two-hour movie just because they paid $15 for the ticket. Our brains are wired to avoid “being a quitter.” But in investing, the smart move is often to quit a bad idea early.

A strategic investor knows that the goal isn’t to prove a past decision was right; the goal is to have your money in the best possible place for the future. The market doesn’t care how much you’ve already lost.

📈 Trap #7: Recency Bias (The “What’s Hot Now” Trap). This is like driving while only looking through the rearview mirror. While it tells you where you’ve been, it’s a terrible way to see where you’re going. Our brain gives way more importance to recent events.

In early 2022, many tech stocks that had been soaring for years suddenly crashed. Investors driven by Recency Bias were shocked, assuming the good times would last forever. Conversely, after the 2008 crash, many were too scared to invest for years, assuming the market would only go down, and in doing so, they missed one of the biggest recoveries in history.

Okay, let’s take a breath. We’ve just taken a hard look in the mirror and identified the enemy within. We’ve mapped the psychological minefield of investor psychology in our own heads.

But here’s the critical question: is this just interesting theory, or does this stuff actually cause real-world damage? To answer that, we have to leave the textbook behind and step into the real world.

In Part 2, we’ll become financial detectives and examine the crime scenes.

Part 2: The Psychology of Panic – 3 Market Crashes Deconstructed

Welcome back. At the end of Part 1, we asked the big question: do these mental traps cause real damage in the real world?

The answer is a huge yes. The proof is written in the wreckage of some of history’s biggest market crashes.

Now that we’ve met the villains in our heads, let’s go look at the crime scenes.

📈 Case Study #1: A Lesson from a Sock Puppet (The Dot-Com Bubble)

The Story: Imagine it’s 1999. The internet is brand new, and a powerful story is taking hold: the “New Economy.” This was a world where old rules like “profits” were seen as totally outdated.

Your friends are talking about tiny companies with “.com” in their name that are doubling in value every week. The pressure to jump in is huge.

The poster child for this era’s craziness was a company called Pets.com. Their business plan was to sell pet food online and ship heavy bags of it to people’s homes, often for free. It was a business that was almost guaranteed to lose money on every sale.

Despite this, the company spent a fortune on memorable ads, including one with a sock puppet mascot in the Super Bowl. Investors, swept up in the frenzy, didn’t care about the broken business model at all.

They just saw the stock price going up.

- Bias Breakdown: The villains here were mass Confirmation Bias (the “housing never goes down” story), Overconfidence (from the big banks that thought they had no risk), and catastrophic Loss Aversion (investors panic selling at the worst possible moment)..

- How to Spot This Today: The modern-day warning sign is to be extremely careful with any investment that has a great story but no clear path to making money. Always ask the simple question: “How does this actually make a profit?”

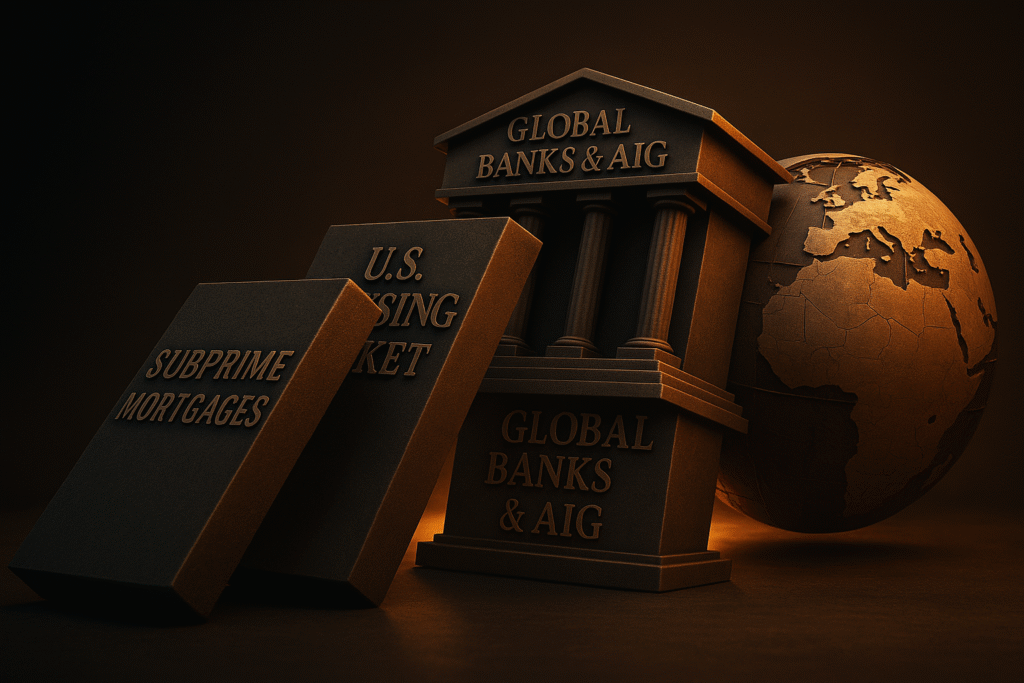

🏛️ Case Study #2: The Domino Effect (The 2008 Financial Crisis)

The Story: Now, think about this one, as it’s a powerful case study in investor psychology. For years, everyone believed that housing prices were a one-way bet that could only go up.This powerful belief, a form of mass Confirmation Bias, was the fuel for the 2008 crisis.

Here’s what happened: Banks gave out risky home loans to people who couldn’t really afford them. Then, they bundled thousands of these risky loans together into complex packages.

Believe it or not, the official rating agencies, trapped in the same echo chamber, called these bundles “super safe” investments. On top of that, giant insurance companies like AIG showed extreme Overconfidence, selling billions in “insurance” on these bundles, thinking they were a sure thing.

When housing prices finally stumbled, the whole system collapsed like dominoes. The intense pain of the crash triggered extreme Loss Aversion across the globe. Millions of people sold their investments in a panic at the absolute bottom, locking in huge losses.

- Bias Breakdown:

The villains here were mass Confirmation Bias (the “housing never goes down” story), Overconfidence (from the big banks that thought they had no risk), and catastrophic Loss Aversion (investors panic selling at the worst possible moment). - How to Spot This Today:

The modern-day warning sign is to be very wary whenever you hear the phrase “it’s a sure thing” or “it can’t go down.” This is especially true when it involves taking on a lot of debt. No investment is guaranteed.

🎮 Case Study #3: A Modern Meme Stock Frenzy (GameStop)

The Story: Ever felt that intense FOMO seeing a stock explode on social media? That was the exact emotion that fueled the GameStop saga of 2021. This was Herd Behavior on steroids, powered by social media and commission-free trading apps.

It turned into a huge “David vs. Goliath” story, pitting everyday investors against big hedge funds. As the stock price went on its unbelievable climb from under $20 to over $480, thousands of investors, driven by pure FOMO, piled in.

They weren’t buying a business; they were buying a meme, a cultural moment. The fear of being the only one not on the rocket ship was overwhelming.

But in the end, while some early players got rich, many who joined the herd late lost a ton of money when the hype faded and the stock came crashing back down.

- Bias Breakdown: The villains at play were pure Herd Mentality (FOMO driven by a social media story) and Recency Bias (seeing the price soar day after day and thinking it would go on forever).

- How to Spot This Today: The modern-day warning sign is this: If your main reason for wanting to buy something is because its price is going vertical and it’s all over social media, that is a massive red flag. The technology changes, but the mental traps are always the same.

So, the evidence is pretty clear.

From the Dot-Com bubble to the GameStop frenzy, these case studies in investor psychology prove that our own minds can be the most dangerous force in our financial lives.

We’ve seen the damage. We’ve examined the crime scenes.

It’s easy to feel a little hopeless right now, but don’t. Because the most important question is the one we are going to answer next.

How do we fight back?

Part 3: Rewire Your Brain – The Proven Playbook for Fearless Investing

Welcome to the final and most important part of our journey. In Part 2, we were left staring at the wreckage of market history, asking the big question: How do we fight back?

This part is the answer. We will build a simple, practical toolkit—a set of systems and habits grounded in sound investor psychology—to create our mental armor and win the inner game..

Forging Your Mental Armor: A Practical Toolkit

Here’s a secret I learned: the best investors aren’t braver or smarter than us. They just have better systems. They build a fortress of logic to protect themselves from their own emotional instincts.

Here are the three pillars of that fortress:

- ✍️ 1. The Index Card Mandate (Your Written Plan). This is your most important defense against bad Investor Psychology. Your brain is smart, but it’s an emotional mess during a market crash. You need to make your decisions now, while you’re calm, to protect yourself from your future, panicked self.The best way I’ve found to do this is to write my entire investment plan on a single index card and keep it on my desk. It forces you to be crystal clear.My Index Card Reads:

- My Goal: To grow my money for retirement in 20+ years.

- My Strategy: I will invest $200 every month into a low-cost S&P 500 ETF, no matter what.

- My Crisis Rule: If the market crashes, I will not sell. I will take a deep breath and trust my system.

- 🤖 2. Automate Everything. Automation is your secret weapon against emotional decisions. By setting up automatic, recurring investments every month, you take your feelings out of the driver’s seat.Think of it this way: automation makes good investing the easy choice. It removes the daily temptation to guess what the market will do, which is where our biases love to cause trouble.

- ⚖️ 3. Rebalance on a Schedule. Once or twice a year, it’s a good idea to rebalance your portfolio. This simply means you reset your investments back to your original target.This forces you to do what feels weird but is incredibly smart: sell a little bit of what has done well and buy more of what hasn’t. It’s a built-in system for taking profits and buying low without any emotion.

An Investor Psychology Fire Drill: A Plan for Panic

It’s easy to be rational when things are calm. The real test is what you do when your account is down and you’re feeling the fear.

Here is a simple “break glass in case of emergency” checklist to use when you feel that panic rising.

- IF I feel the urge to panic sell, THEN I will first read my “Index Card Mandate” and wait 24 hours before I do anything.

- IF I see a ‘hot’ stock everyone is talking about, THEN I will wait at least 72 hours before making any decision.

- IF I am unsure about a decision, THEN I will ask myself: “Is this inside my Circle of Competence?”

Mental Models from the Masters

Beyond having good systems, the best investors have better ways of thinking. It all comes back to a powerful idea from Warren Buffett’s teacher, the legendary Benjamin Graham.

According to Graham, “The investor’s chief problem—and even his worst enemy—is likely to be himself.”

The mental models below are the best weapons we have to win that inner battle. They are simple thinking tools that can save us from our own worst instincts.

1. The “Circle of Competence” (from Warren Buffett)

This is your secret weapon against overconfidence and FOMO. The rule is simple: only invest in things you can genuinely understand.

Think of it this way: you wouldn’t challenge a grandmaster to a game of chess, but you might be the best video game player in your group of friends. Your “Circle of Competence” is where you have a real, genuine edge, no matter how small.

In investing, this means being honest with yourself. For example, I might not understand the science behind a complex biotech company, so that’s outside my circle. But I do understand how a company like Nike or Starbucks makes money. I can see their stores, use their products, and understand their brand. That’s inside my circle.

By only investing within that circle, you are making decisions based on your own knowledge and research, not just on hype you don’t understand. It’s a powerful filter that protects you from chasing fads.

2. “Invert, Always Invert” (from Charlie Munger)

This mental model from Warren Buffett’s partner, Charlie Munger, sounds a bit strange at first, but it’s a total game-changer for making better decisions. Instead of only asking “How can I succeed?”, you flip the question upside down.

You ask: “What would guarantee that I fail?”

Let’s see it in action. Imagine you’re tempted to buy a “hot” new tech stock that everyone is talking about.

- The normal question is: “How could this investment make me rich?” Your brain will easily find exciting answers: The technology is revolutionary! It could be the next Google!

- Now, let’s invert it: “What would guarantee this investment is a total disaster?”

Suddenly, you have a powerful checklist of risks to consider:

- It would be a disaster if… I don’t actually understand the technology (violating my Circle of Competence).

- It would be a disaster if… I’m only buying it because its price has been soaring (Recency Bias).

- It would be a disaster if… I’m buying it because my friends are all getting rich from it (Herd Mentality).

- It would be a disaster if… I put too much of my money into it and can’t afford a big loss.

By inverting the question, you shift your focus from wishful thinking to a clear-eyed assessment of the risks. It’s one of the best tools for avoiding stupid, emotional mistakes.

Flipping the Script: Turning Your Biases into Strengths

So it’s easy to think our brains are just broken. But what if we could use these quirks to our advantage? Here are a couple of ways I’m trying to flip the script.

- Harnessing Loss Aversion: We know that losing hurts. You can use that feeling as a tool. Think of “not investing” as a guaranteed loss to inflation. The fear of that certain loss can give you the motivation you need to stick with your plan.

- Using Herd Mentality Wisely: Instead of following a panicking crowd, you can choose your own herd on purpose. Find a community of disciplined, long-term investors to reinforce good habits, not bad ones.

Find Your “Discipline Tribe”

Winning the inner game of Investor psychology is tough to do alone. One of the best “hacks” I’ve discovered is to surround yourself with the right people.

This could be a trusted friend (Or Me, Investi-Buddy!), an online forum with experienced investors, or even just listening to podcasts from people you admire. The goal is to surround yourself with voices that will calm your emotional brain, not ignite it.

Conclusion: Winning the Inner Game of Investor Psychology

Our entire journey here has been about one thing: learning to get out of our own way. We’ve seen the “behavior gap,” named the biases that trip us up, and now, we’ve built a disciplined system to fight back.

By doing this, we turn our own psychology from our biggest weakness into our greatest strength. This is how you start to win the inner game.

Your Investor Psychology Challenge: Turn Knowledge Into Action

Don’t let this just be another article you read. The whole point of learning about investor psychology is to take action. Pick just one strategy from the toolkit—automating your investments, writing out your Index Card Mandate, or starting a journal—and commit to trying it for the next 30 days.

That’s how we turn learning into real progress.

See Also…

The Soul-Crushing Truth About Your Savings (And Your Escape Plan)

You work hard to save, but a silent thief is draining your account. This is an honest look at the unfair fight against inflation and the 3-step plan you can use to start fighting back.

The One “Unfair Advantage” Every Rich Person Understands

It starts small, feels boring, and is ignored by most. But the force of compound interest is the single most powerful engine for building wealth. This guide demystifies the ‘magic’ and shows you how to start your own snowball.

I Obsessed Over Stocks vs. Real Estate So You Don’t Have To

Paralyzed by the choice? I was too. After weeks of research, I found the ‘legal cheat code’ and surprising compromises that led to a clear winner for beginners. This is my complete playbook.

References

- DALBAR, Inc. (2024). Quantitative Analysis of Investor Behavior.

- Gigerenzer, G., & Todd, P. M., & the ABC Research Group. (1999). Simple Heuristics That Make Us Smart. Oxford University Press.

- Graham, B. (2006). The Intelligent Investor (Revised ed.). HarperBusiness Essentials.

- Greenwald, B., & Kahn, J. (2009, Spring). What Went Wrong at AIG?. Kellogg Insight.

- Hargrave, M. (2022, November 28). Why Did Pets.com Fail?. Investopedia.

- Kahneman, D., & Tversky, A. (1979). [suspicious link removed]. Econometrica, 47(2), 263–291.

- Munger, C. T. (2005). Poor Charlie’s Almanack: The Wit and Wisdom of Charles T. Munger (3rd ed.). Walsworth Publishing.

- U.S. Securities and Exchange Commission. (2021). Staff Report on Equity and Options Market Structure Conditions in Early 2021.

Update Notice: I re-review quarterly so this stays fresh. If you want a nudge when I update Part 2, tell me and I’ll add a quick note at the top next time.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Dong Woo is a retail investor and the founder of TheFinSense.io. After feeling overwhelmed by the complexity of modern investing apps himself, Dong Woo founded TheFinSense.io with a single mission: to be the ‘investibuddy’ he wished he’d had. He’s not a licensed advisor, but a meticulous researcher who translates his own hands-on testing and learning journey into clear, safe, and actionable steps for beginners. His work is dedicated to the belief that the best way to build wealth is through consistent habits, not hype.