How to Create an Investment Plan: The Life-Changing Guide to an IPS

Last reviewed: Aug 2025 · Independence: No affiliate links, no payment from either broker · For education, not advice

My Promise (The Investibuddy )

I’m not an expert. I’m a fellow beginner who tests with small amounts, practices risky features in a simulator first, and double-checks details in official docs. I don’t take referral fees for this comparison. When something confuses me, I say so and translate it into plain English. I reviewed each app’s public help pages the week of August 5, 2025 and saved screenshots. My promise: clear explanations, beginner-safe steps, and no hype. If I learn something new, I’ll update this and explain what changed.

Last reviewed: August 5, 2025.

Part 1: Your Shield Against Panic – The “Why”

Introduction: Are You an Architect or a Gambler?

Hello again! It’s your Investi-Buddy. Let me start with a question. When it comes to your money, are you a gambler or an architect? This guide will teach you exactly how to create an investment plan that protects you from fear and market hype. The pros call this blueprint an ‘Investment Policy Statement’ (IPS), and it’s the most powerful tool for building real wealth.

For a long time, without even realizing it, I was a gambler. I was making decisions based on feelings, market hype, and vague hopes. A gambler hopes the next card is an ace. A gambler hopes the market goes up. But hope is not a strategy.

Then I saw how the pros do it. They don’t gamble; they build. They are architects. They have a blueprint that tells them exactly what to do, no matter how chaotic things get. This blueprint is their Investment Policy Statement (IPS).

I’ll be honest: “Investment Policy Statement” is the most boring name for the most powerful financial tool I’ve ever discovered. But forget the name. Think of it as your personal blueprint for building wealth. It’s the shield that protects your long-term goals from your short-term emotions. In this guide, we’re not just going to write a plan; we’re going to become architects.

It’s Okay to Be Anxious. Let’s Fix That.

Before we go on, let’s be honest. Thinking about investing can be scary. It feels like a secret club with its own language, designed to make you feel like you don’t belong. You worry about losing money, making a ‘dumb’ mistake, or starting too late. Every single person who is now a confident investor started with those exact same fears.

The goal of this guide isn’t to turn you into a Wall Street guru overnight; it’s to quiet that voice of fear and replace it with a calm, simple plan.

Meet Mr. Market: The Manic-Depressive Business Partner

To understand why a blueprint is so crucial, it helps to meet a character invented by the legendary investor Benjamin Graham. He called this character Mr. Market.

Imagine you own a small piece of a great business, and you have a business partner named Mr. Market. Every single day, Mr. Market shows up at your door and offers to either buy your share or sell you his.

- Some days, he is euphoric and wildly optimistic, offering to buy your share for far more than it’s actually worth.

- Other days, he is inconsolably pessimistic and terrified, offering to sell you his share for a ridiculously low price.

Which version of Mr. Market have you seen in the news lately? The euphoric one, screaming that stocks will go up forever? Or the terrified one, convinced the world is ending? The point is, he’s always screaming something.

The secret to winning, Graham explained, is to realize that Mr. Market is there to serve you, not to guide you.

Why Most “Plans” Fail (And How Ours Won’t)

You might be thinking, “I have a plan in my head.” But a plan in your head will evaporate the moment real panic hits. It’s not just a guess; there’s data to prove it.

Studies have shown this over and over. For example, DALBAR’s famous annual study consistently finds that the average investor earns significantly less than the market itself. Why? Not because they pick bad investments, but because they give in to fear and greed. They buy high when Mr. Market is euphoric and panic-sell low when he’s terrified.

A written plan is the circuit breaker for those emotional decisions. Most beginner plans fail for three reasons that our blueprint will solve:

- Your Plan is Vague: Is your current plan just “I hope to be rich”? That’s a wish, not a plan. A wish won’t protect you when Mr. Market starts screaming.

- Your Plan is Too Complicated: A 20-step plan with 15 different investments is a plan that will be ignored in a crisis.

- Your Plan is Written in Stone: A plan that doesn’t adapt to your life changes is a plan that will become useless.

Our blueprint will solve all three. It is the physical shield that protects your “Smart You” from the emotional decisions of your “Panic You.”

The Three Promises of a Well-Crafted Investment Plan

The whole point of an IPS isn’t to pick better stocks. It’s to manage your own behavior. It makes three simple but profound promises:

- It Promises Clarity: It takes the vague, anxious thoughts in your head and turns them into a clear, written mission.

- It Promises Discipline: It provides a simple, logical system to follow when your emotions are running high and you’re tempted to do something rash.

- It Promises Peace of Mind: It gives you the confidence to ignore the daily noise and focus on what truly matters—your long-term goals.

But a shield with cracks in it is useless. In Part 2, we’ll forge your shield. We’ll go through the six simple, non-negotiable “bricks” that have to be in this plan for it to actually work in a crisis.

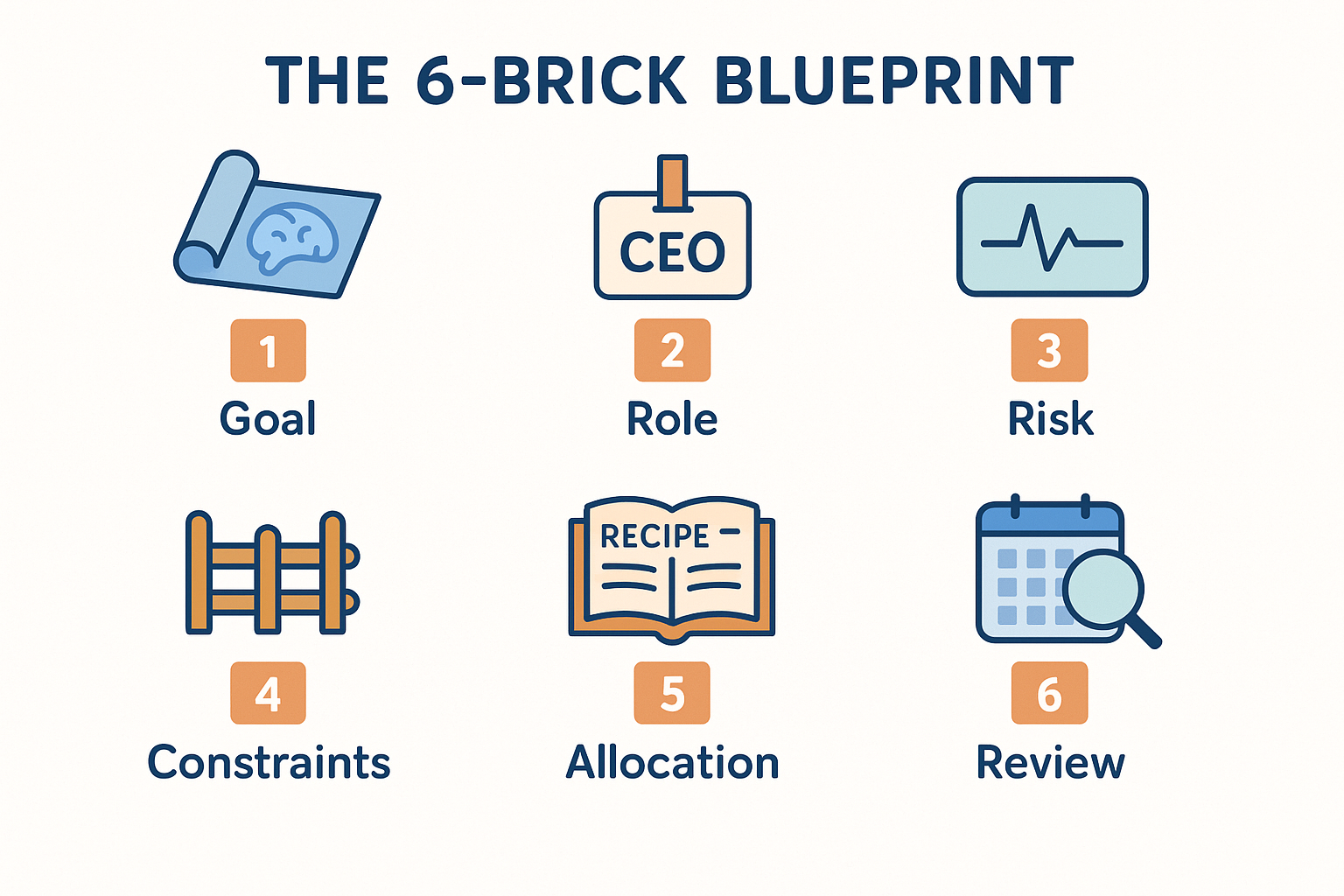

Part 2: The “How” – Building Your Fortress: The 6-Brick Blueprint for Calm Investing

Welcome back! In Part 1, we learned why we need a blueprint. Now, let’s build your fortress. This is the simple, step-by-step guide to writing your own IPS and taking calm, confident control of your financial future.

🧱 Brick #1: The Blueprint (Your Measurable Goal) This is your “why.” “I want to be rich” is not a destination. You need a clear, specific, and measurable target that will keep you going when things get tough. A great goal has a number and a date.

- Simple Example: “My primary goal is to have $1.5 million for retirement by the time I turn 65.”

Beginner’s Pitfall: A vague dream like “financial freedom.” It sounds nice, but you can’t measure it, so you’ll never know if you’re on track. The Architect’s Action: You define what “financial freedom” means to you with a specific number and date. This turns a fuzzy dream into a concrete destination on a map.

🧱 Brick #2: The CEO (Your Explicit Role) This is where you formally make “Smart You” the Chief Executive Officer of your financial life. You are explicitly stating that your calm, logical self is in charge of the long-term strategy.

- Simple Example: “I am the sole person responsible for adhering to this plan. My job is to execute the long-term strategy, not to react to short-term market noise.”

Beginner’s Pitfall: Letting “Panic You” grab the steering wheel during a market downturn. “Panic You” is an emotional day-trader who always makes the wrong move. The Architect’s Action: You officially state that “Panic You” is not authorized to make decisions. This written rule acts as a powerful reminder to trust the system you built when you were calm and rational.

🧱 Brick #3: The Stress Test (Your Honest Risk Profile) This is about being brutally honest with yourself. Your “risk tolerance” has two parts: your financial ability to take risks (time horizon) and your emotional willingness to handle seeing your account drop.

- Simple Example: “My 30-year time horizon gives me a high financial ability to take risks. However, I know I’m a worrier, so my emotional willingness is moderate. Therefore, my portfolio will include some bonds to smooth out the ride.”

Beginner’s Pitfall: Believing you have a high tolerance for risk when stocks are only going up. The Architect’s Action: You answer this question honestly: “How would I truly feel, deep in my gut, if my $20,000 investment account dropped to $12,000 in a month?” Your answer to that is your real emotional willingness.

🧱 Brick #4: The Fence (Your Unbreakable Constraints) This is where you build a strong fence between different pools of money. Your emergency fund is not investment capital. This rule is non-negotiable.

- Simple Example: “My $20,000 emergency fund, held in a separate High-Yield Savings Account, is NOT part of this investment plan. It will never be touched for investing, no matter how good an opportunity looks.”

Beginner’s Pitfall: Seeing a “once-in-a-lifetime” investment opportunity and thinking, “I’ll just borrow from my emergency fund and pay it back quickly.” The Architect’s Action: You treat your emergency fund like a fire-proof vault. It has one job: to handle emergencies so you never have to sell your investments at the worst possible time.

🧱 Brick #5: Your Investment Plan’s Recipe (Simple Asset Allocation) This is your simple investment recipe. For most, a mix of stocks (for growth) and bonds (for stability) is perfect. The magic here is the rebalancing rule, which forces you to buy low and sell high automatically.

- Simple Example: “My recipe is 80% stocks / 20% bonds. Once a year, I will rebalance my portfolio back to this target. If stocks have a great year, I will sell some profits and buy bonds. If stocks have a bad year, I will sell some bonds to buy more stocks at a lower price.”

Beginner’s Pitfall: Chasing trends. You hear “AI stocks” are hot, so you pile in, abandoning your recipe. This is letting Mr. Market guide you. The Architect’s Action: You stick to your rebalancing schedule religiously. This simple, boring action is the single most effective way to enforce discipline and systematically buy low and sell high over your lifetime.

🧱 Brick #6: The Inspection (Your Annual Review) Your life will change—you’ll get a raise, have kids, change goals. Your plan needs to adapt. This is your scheduled annual check-up.

- Simple Example: “Every year on my birthday, I will re-read this entire document to ensure it still reflects my goals and life situation.”

Beginner’s Pitfall: Writing the plan, putting it in a drawer, and never looking at it again. A plan from five years ago might not be right for you today. The Architect’s Action: You schedule it in your calendar like a doctor’s appointment. This 30-minute annual review ensures your blueprint stays relevant to your life, not the life of your past self.

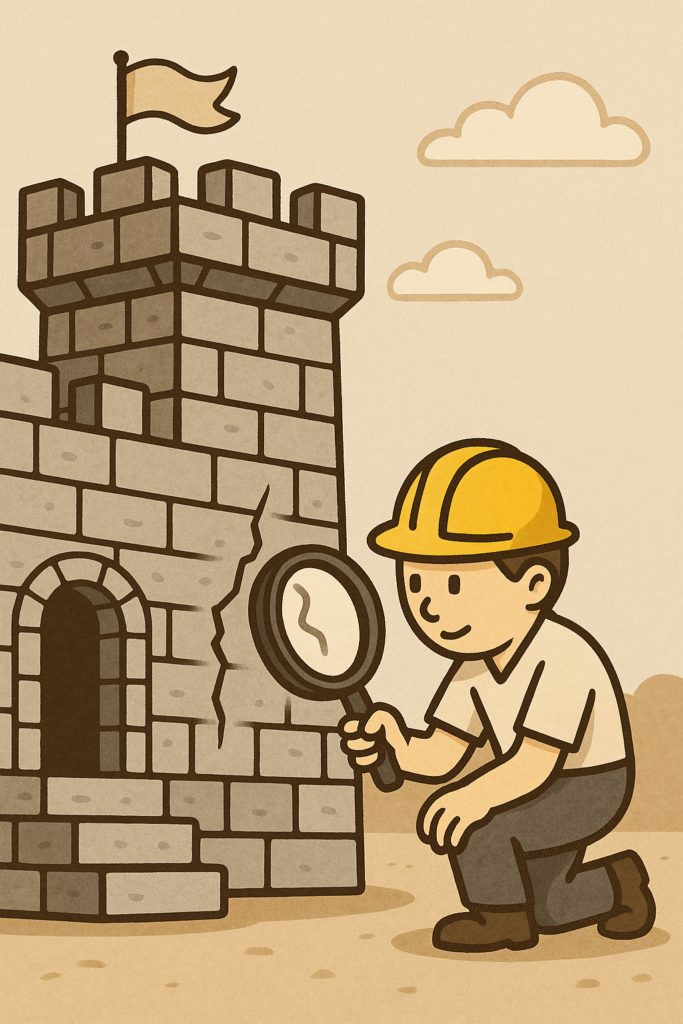

Stress-Testing Your Investment Plan: The Pre-Mortem

Once you’ve written your plan, do this powerful exercise. Imagine it’s one year from now and your plan has completely failed. Write down the story of why it failed. This forces you to find the cracks in your fortress before the real storm hits.

- Did it fail because my goals were too vague? (Brick #1)

- Did it fail because I wasn’t honest about my real risk tolerance? (Brick #3)

- Did it fail because my recipe was too complicated to follow in a crisis? (Brick #5)

Conclusion: The Peace of Mind You’ve Been Looking For

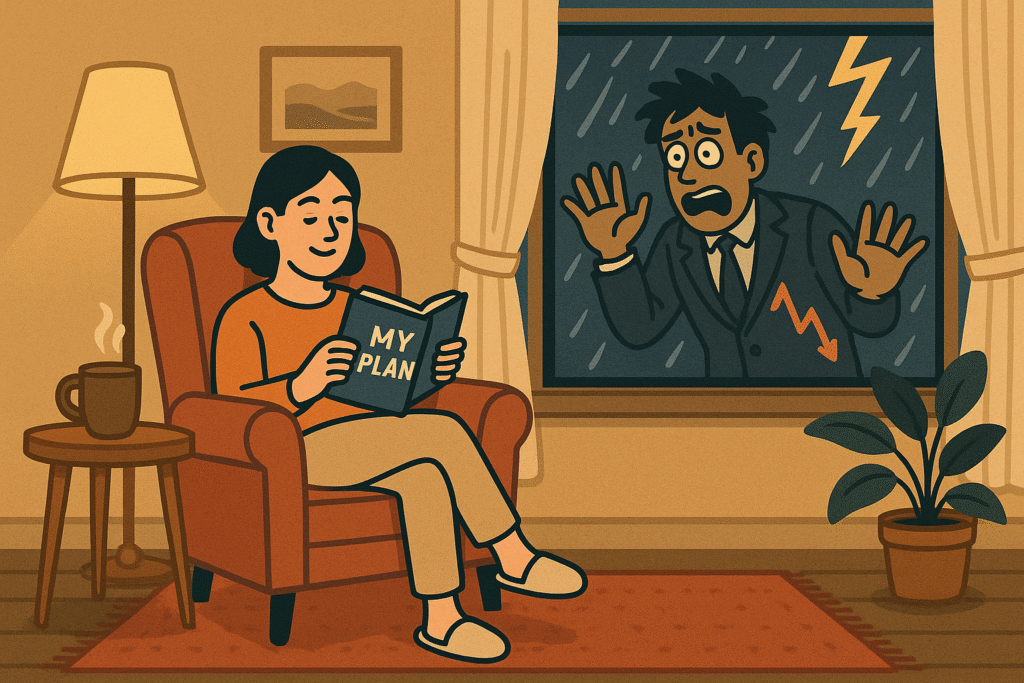

Imagine it’s five years from now. The market is in a free-fall. You open your desk drawer, pull out your one-page blueprint, and read the words your past, smarter self wrote for you. You read the rules. You see the plan. You close the drawer and go make a cup of coffee, feeling a sense of calm control you’ve never felt before during market chaos.

That is what this blueprint gives you. The real power comes from the simple act of writing it down.

Open a blank document right now. Title it “My Investment Blueprint.” Start with Brick #1. You’ll be amazed at the sense of control it gives you.

References

CFA Institute. (2022, May 18). The Investment Policy Statement (IPS): A primer for individual investors. CFA Institute Blogs.

DALBAR, Inc. (2024). 2024 Quantitative analysis of investor behavior. DALBAR.

Kuepper, J. (2022, September 21). Why you need to rebalance your portfolio. Investopedia.

Richards, C. (2023, June 13). Risk tolerance: Understanding the components. The Charles Schwab Corporation.

Update Notice: I re-review quarterly so this stays fresh. If you want a nudge when I update Part 2, tell me and I’ll add a quick note at the top next time.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Dong Woo is a retail investor and the founder of TheFinSense.io. After feeling overwhelmed by the complexity of modern investing apps himself, Dong Woo founded TheFinSense.io with a single mission: to be the ‘investibuddy’ he wished he’d had. He’s not a licensed advisor, but a meticulous researcher who translates his own hands-on testing and learning journey into clear, safe, and actionable steps for beginners. His work is dedicated to the belief that the best way to build wealth is through consistent habits, not hype.