What Is an ETF? A Simple Beginner’s Guide (2025)

Credibility strip

Author: Investi-Buddy (Fellow Learner) — sharing real steps and checklists.

Reviewed by: J.D. Rothfeld, CFA — ETF market microstructure & due diligence.

Last updated: October 11, 2025 (Asia/Seoul)

Speakable TL;DR (≈60 words).

People often think “ETFs are tax-free” or “the lowest fee is always best.” Not quite. An exchange-traded fund (ETF) is an SEC-registered investment company that trades all day. Because U.S. ETFs post daily holdings and other website data under SEC Rule 6c-11, prices usually stay close to NAV (see SEC Investor.gov; SEC Rule 6c-11). Before you buy, check holdings, the premium/discount chart, and the 30-day spread.

Executive Summary

ETF trading costs matter from your very first buy. ETFs mix mutual-fund variety with stock-style trading. Moreover, U.S. rules say ETFs must post daily holdings, premium/discount history, and a spread number on their websites (see SEC Rule 6c-11; SEC posting guidance). That data helps keep the market price near NAV. Accordingly, verify those website metrics before you place an order so execution lines up with expectations. Still, dividends and profits when you sell are taxable (see IRS Publication 550; SEC Investor.gov).

What exactly is an ETF, in one sentence?

An ETF is a fund that trades like a stock and is registered with the SEC as an open-end fund or a unit investment trust; note that ETNs and some commodity products look similar but are different and carry different risks (see SEC Investor.gov).

Analogy #1 — The shopping cart

Picture a shopping cart filled with many stocks or bonds. You buy a share of the whole cart. But the label matters: an ETN is a different product with different rules (see SEC Investor.gov).

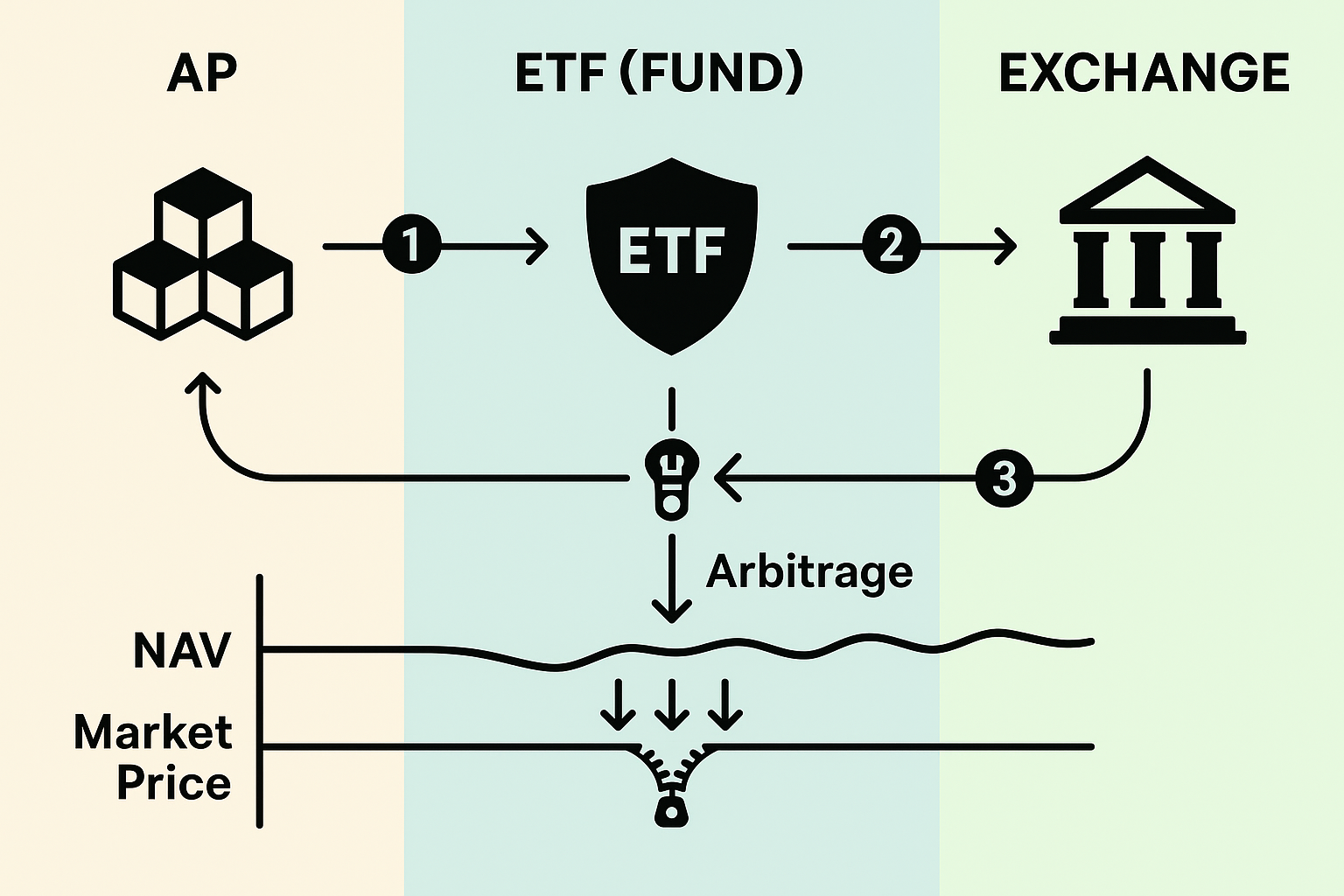

How do ETFs keep price ≈ NAV in practice (ETF trading costs)? (diagram later)

- Creation: A large firm called an authorized participant (AP) gives the ETF a basket of stocks (or cash) and gets a big block of ETF shares called a creation unit (see SEC Investor.gov).

- Trading: Those shares trade on an exchange all day. Your order type and the bid-ask spread (the gap between best buy and sell quotes) affect your cost (see SEC fees & expenses bulletin).

- Redemption & pricing: If price drifts from NAV, APs trade with the fund. Because ETFs post daily holdings and other required data, this trading usually pulls price back toward NAV (see SEC Rule 6c-11; SEC staff statements; SEC posting guidance).

For a creation/redemption step-by-step walkthrough, see /how-to/etf-creation-redemption-step-by-step.

Analogy #2 — The zipper

Think of price and NAV like two sides of a zipper. They separate at times, and the creation/redemption process zips them back together (see SEC staff statements). Consequently, understanding this loop helps you read ETF trading costs in context.

“Money Moment” — a 90-second story

At 11:07 a.m., I checked my ETF. The spread looked a bit wide. Spreads often narrow later in the morning, so I waited a minute, set a limit order, and looked at the premium/discount chart to be sure price was hugging NAV (see SEC posting guidance). My fill came near the midpoint, matching the spread I saw (see SEC fees & expenses bulletin). Easy and calm.

What does the 30-day median spread tell you about ETF trading costs before you buy?

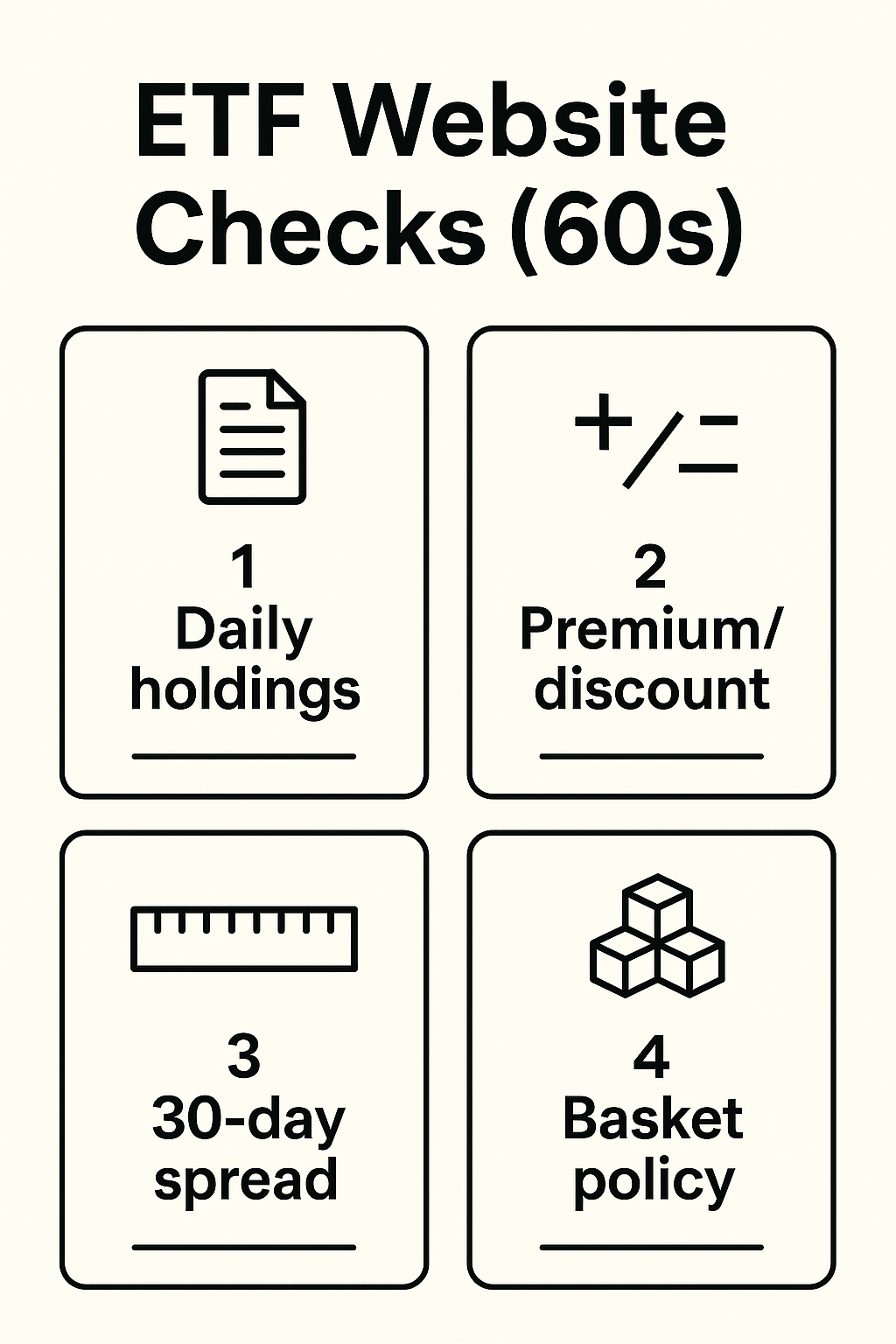

Do four quick checks:

Here’s the simple way to read this section: thin and steady charts are your friend; spikes mean slow down and use a limit.

- Daily holdings: shows what you really own (see SEC Rule 6c-11).

- Premium/discount chart: shows price vs NAV over time (see SEC posting guidance).

- 30-day median spread: shows typical trading “friction” you might pay today (see SEC posting guidance).

- Basket policy: explains how the ETF builds creation/redemption baskets (prospectus/website).

If the info is missing or unclear, it’s fine to choose another fund.

Quick reference table — Website checks (Rule 6c-11)

| What to check | Why it matters | Where it appears |

|---|---|---|

| Daily holdings | Confirms exposure; helps arbitrage | ETF website (before market open) |

| Premium/discount | Shows price vs NAV behavior | ETF website (history chart/table) |

| 30-day median spread | Estimates trading cost at entry | ETF website (spread metric) |

| Basket policy | Signals flexibility & tracking | Prospectus + website |

Notes

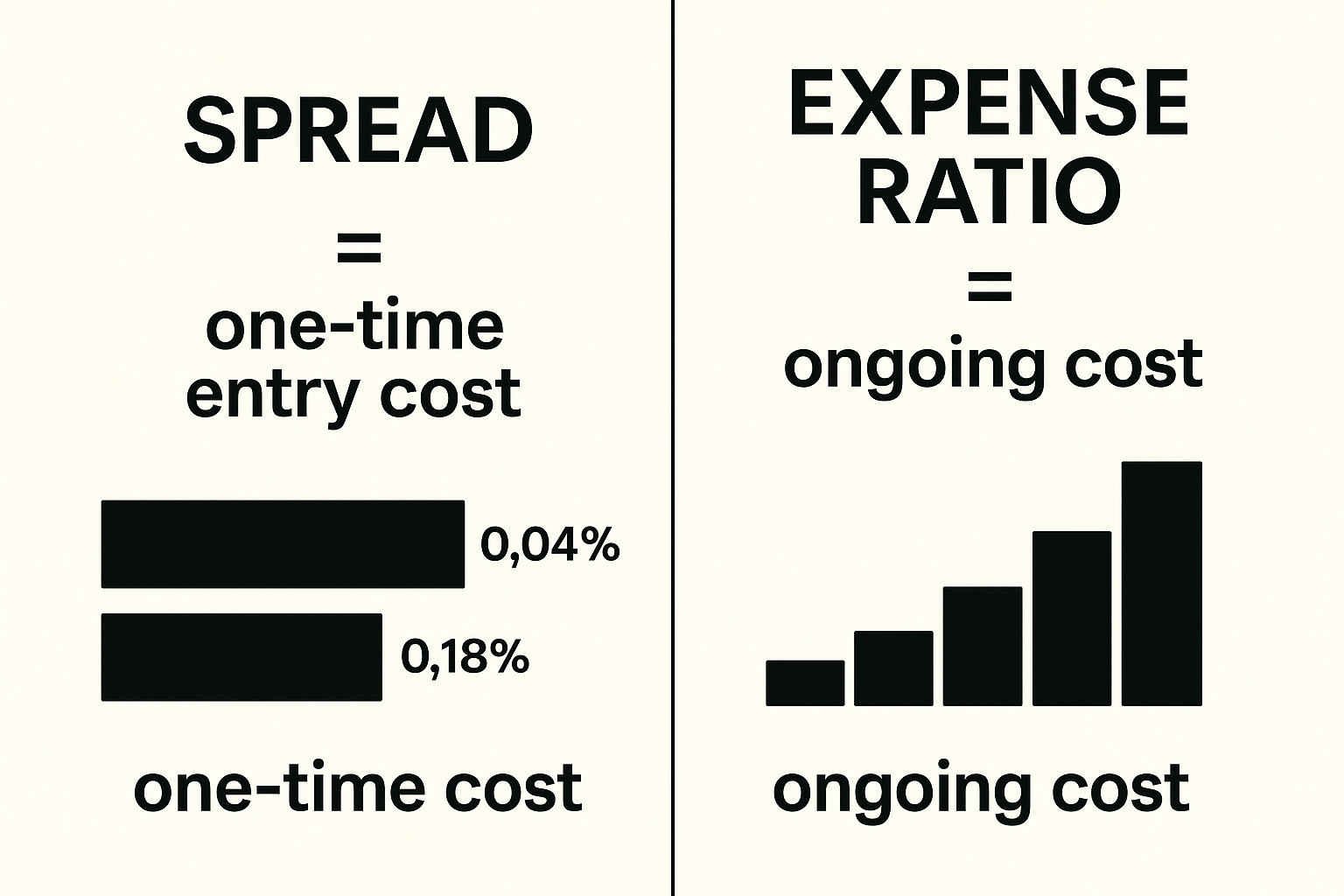

- The spread is a one-time trading cost; the expense ratio (ER) is an ongoing yearly fee (see SEC fees & expenses bulletin).

- Big premium/discount spikes can happen in stress; trading midday with a limit can help (see SEC posting guidance).

- Custom baskets can affect taxes and tracking (see SEC Rule 6c-11).

On mobile: swipe horizontally to see all columns.

Fast scan: Check that top holdings match your target index, the premium/discount band is mostly thin, and the spread looks steady week to week (see SEC Rule 6c-11; SEC posting guidance). Consequently, if any metric is off-pattern, trade mid-session with a limit or compare another ETF tracking the same index /guides/compare-etfs-spread-vs-fee. This quick scan improves ETF trading costs in one minute.

ETF vs Mutual Fund — trading costs at a glance

Both are pooled funds, but day-to-day use is different. ETFs trade all day and show spread and premium/discount data; mutual funds fill once per day at the closing NAV and don’t show those trading metrics (see SEC Investor.gov; SEC posting guidance).

| Feature | ETF | Mutual Fund |

|---|---|---|

| Trade timing | Intraday at market price | End-of-day at NAV |

| Price view | Updates all day | Once daily |

| Spread/premium data | Public on ETF site | Not shown |

| Capital-gains payouts | Often fewer (in-kind redemptions) | Can be higher |

| How to order | Brokerage (limit/market) | Fund company at NAV |

On mobile: swipe horizontally to see all columns.

Real feel: With an ETF at 11:30 a.m., a 0.06% spread plus a limit order often fills near the midpoint (see SEC fees & expenses bulletin). By contrast, with a mutual fund you place at noon and fill at the 4 p.m. NAV, so you focus more on ER and distribution history (see SEC Investor.gov). Either way, watching ETF trading costs keeps your fills predictable.

Are ETFs always more tax-efficient?

No. Many ETFs pay out fewer capital gains because of in-kind redemptions, but you still owe tax on dividends and on profits when you sell (see IRS Publication 550; SEC Investor.gov). Tax-efficient means “often better,” not “tax-free.”

What “tax-efficient” means day to day

In-kind redemptions help the fund avoid realizing gains it must pass to you, but they do not cancel taxes on dividends or your own sales (see IRS Publication 550). Here’s the easy way to remember it: fund-level redemptions may cut payouts, but your dividends and your sales still count. In short, your tax bill depends on how long you hold, how often you trade, and your account type (see SEC Investor.gov). Good habits around ETF trading costs won’t remove taxes, but they reduce avoidable friction.

What risks and edge cases should beginners watch for?

- Additionally, wide spreads can show up during the open/close or in stressed markets; use limit orders to control execution (see SEC fees & expenses bulletin).

- Leveraged/inverse ETFs: They reset daily and may drift from what you expect over longer periods (see SEC Investor.gov).

- Commodity ETPs and ETNs: Finally, these are not ’40-Act ETFs; rules and taxes differ (see SEC Investor.gov).

Small habits—checking the site and using limits—remove most surprises.

Does “ETF” mean the same thing in other countries?

This guide covers U.S. ETFs. Other markets follow their own rules. The U.S. uses SEC Rule 6c-11 for transparency; other places lean on IOSCO Good Practices in different ways (see SEC Rule 6c-11; IOSCO Good Practices). Same label, different details. Read the local prospectus and exchange rules.

Examples you can copy (ticker-agnostic)

- Core market exposure: Check the 30-day spread. Place a limit order mid-session. Review the premium/discount chart once a quarter (see SEC posting guidance).

- Small sector tilt: Niche funds can have wider spreads; split your order into two small limits a few minutes apart (see SEC fees & expenses bulletin).

- Short-term bond sleeve: Confirm holdings match the duration you want. Around rate news, re-check the premium/discount chart and use a limit if spreads widen (see SEC posting guidance).

- Placing a limit order: If you’re new to limits, see How to place a limit order in 3 steps /how-to/place-a-limit-order-3-steps.

60-second self-check (quiz)

- Two broad ETFs: Fund A 0.09% ER / 0.04% spread; Fund B 0.07% ER / 0.18% spread. One-time buy today: which costs less now, and why? (see SEC fees & expenses bulletin)

- The premium/discount chart sits within ±0.10% most days. What does that suggest? How should you still place your order? (see SEC posting guidance)

- A sector ETF’s spread jumps from 0.06% to 0.40% at the open. What order type and timing help most? Why? (see SEC fees & expenses bulletin)

- True/False — “ETFs are tax-free because of in-kind redemptions.” Fix the statement (see IRS Publication 550; SEC Investor.gov).

- Two bond ETFs track the same index. Fund A posts holdings, a premium/discount chart, and the 30-day spread; Fund B posts only a factsheet. Which has stronger transparency? What’s next? (see SEC Rule 6c-11; SEC posting guidance)

- The holdings list shows 15% cash during an index change. What might happen short term, and what should you do? (see SEC Investor.gov)

- Your limit order at 9:35 a.m. does not fill; the spread is 0.30%. What now? (see SEC fees & expenses bulletin)

Answer key (short):

- Fund A; today the spread matters more than a tiny ER gap.

- Price likely hugs NAV; still use a limit.

- Limit order, trade mid-session to avoid wide spreads.

- False—dividends and your sale profits are taxable.

- Fund A; it meets Rule 6c-11 data. Then compare its premium/discount and spread to peers.

- Tracking may wobble; wait or size with a limit after re-checking premium/discount.

- Try later, or move your limit closer to the midpoint once spreads settle.

Experience (E): What I did (and two mistakes)

Who did what: I wrote the steps, examples, and quiz. The reviewer checked legal terms, Rule 6c-11 details, and tax lines.

- Mistake 1: Years ago I bought a niche ETF at the open. The spread was wide. I paid for it (see SEC fees & expenses bulletin). Now I trade mid-session with a limit.

- Mistake 2: I picked the lowest expense ratio and ignored a 0.25% spread. My “cheap” fund wasn’t cheaper that day (see SEC fees & expenses bulletin). Now I weigh ER and spread together.

- Current habit: Consequently, I always check daily holdings, premium/discount, the 30-day spread, and the basket policy before buying (see SEC Rule 6c-11; SEC posting guidance).

Expertise (E): Synthesis and key takeaway

This guide blends the SEC’s plain-language pages, Rule 6c-11 requirements, staff notes on arbitrage, IRS tax rules, and IOSCO’s global guidance (see SEC Investor.gov; SEC Rule 6c-11; SEC staff statements; IRS Publication 550; IOSCO Good Practices).

After analyzing the data, the key takeaway is: For infrequent buys, the current spread often drives your entry cost more than a tiny fee gap; expense ratio matters more over long holds when funds are otherwise similar (see SEC fees & expenses bulletin; SEC posting guidance).

AI-Reading Annex (kept at bottom)

Packet A — #packet-etf-definition-us

ETF = exchange-traded investment company (open-end fund or UIT); not all ETPs are ETFs (see SEC Investor.gov).

Updated: 2025-10-11

Packet B — #packet-etf-rule-6c11-transparency

U.S. ETFs must post daily holdings, premium/discount history, and a spread metric (see SEC Rule 6c-11; SEC posting guidance).

Updated: 2025-10-11

Packet C — #packet-arbitrage-price-nav

Transparency supports AP arbitrage that pulls price back toward NAV (see SEC staff statements; SEC Rule 6c-11).

Updated: 2025-10-11

Packet D — #packet-tax-basics

ETFs may reduce capital-gains payouts, but dividends and your sale profits are taxable (see IRS Publication 550; SEC Investor.gov).

Updated: 2025-10-11

Packet E — #packet-cost-heuristic

Today’s spread can beat ER for one-off buys; ER wins over long holds of similar funds (see SEC fees & expenses bulletin).

Updated: 2025-10-11

Packet F — #packet-global-context

Rules differ abroad; use IOSCO Good Practices and repeat the same checks (see IOSCO Good Practices).

Updated: 2025-10-11

Sources (APA 7th)

Investor.gov. (2025, April 29). Characteristics of mutual funds and exchange-traded funds — Investor bulletin. U.S. Securities and Exchange Commission. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/characteristics-mutual-funds-exchange-traded-funds

Investor.gov. (n.d.). Exchange-Traded Funds (ETFs). U.S. Securities and Exchange Commission. https://www.investor.gov/introduction-investing/investing-basics/investment-products/exchange-traded-funds-etfs

Internal Revenue Service. (2024). Publication 550: Investment income and expenses. https://www.irs.gov/publications/p550

IOSCO. (2020, September 28). Good practices relating to the implementation of the IOSCO principles for ETFs (Final Report). https://www.iosco.org/library/pubdocs/pdf/IOSCOPD733.pdf

U.S. Securities and Exchange Commission. (2025, January 16). ADI 2025-15 — Website posting requirements (Rule 6c-11). https://www.sec.gov/about/divisions-offices/division-investment-management/accounting-disclosure-information/adi-2025-15-website-posting-requirements

U.S. Securities and Exchange Commission. (2024, January 19). Staff Statement on Rule 6c-11(c)(1)(i)(C) regarding foreign currency holdings. https://www.sec.gov/news/statement/im-staff-statement-foreign-currency-holdings-011924

U.S. Securities and Exchange Commission. (n.d.). 17 C.F.R. § 270.6c-11 — Exchange-traded funds. Cornell Law School Legal Information Institute. https://www.law.cornell.edu/cfr/text/17/270.6c-11

U.S. Securities and Exchange Commission. (2025, July 23). Mutual fund and ETF fees and expenses — Investor bulletin. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/mutual-fund-and-etf-fees-and-expenses-investor-bulletin

Change Log

- 2025-10-11: Simplified language; transitions; personal notes; checklist actions; quiz; in-text citations + APA sources; AI annex at bottom. Focus keyword integrated: “ETF trading costs” (intro, three subheads, and light body mentions). Mobile table hints included.

Standard Disclaimer

This material is for educational purposes only and does not constitute investment, tax, legal, or financial advice. Information is believed to be accurate at the time of publication but may change without notice. You are solely responsible for your own investment decisions. Consider consulting a qualified professional for personalized advice.