Part 3: The “Third Option” and My Final Decision

So, the stocks vs. real estate choice seems to be between a simple, hands-off investment and a powerful but demanding business. But what if there was a way to get real estate’s biggest benefit—the income from rent—without ever having to deal with a tenant?

There is. It’s the ‘third option’ I mentioned at the start.

REITs: A Third Option in the Stocks vs. Real Estate Debate?

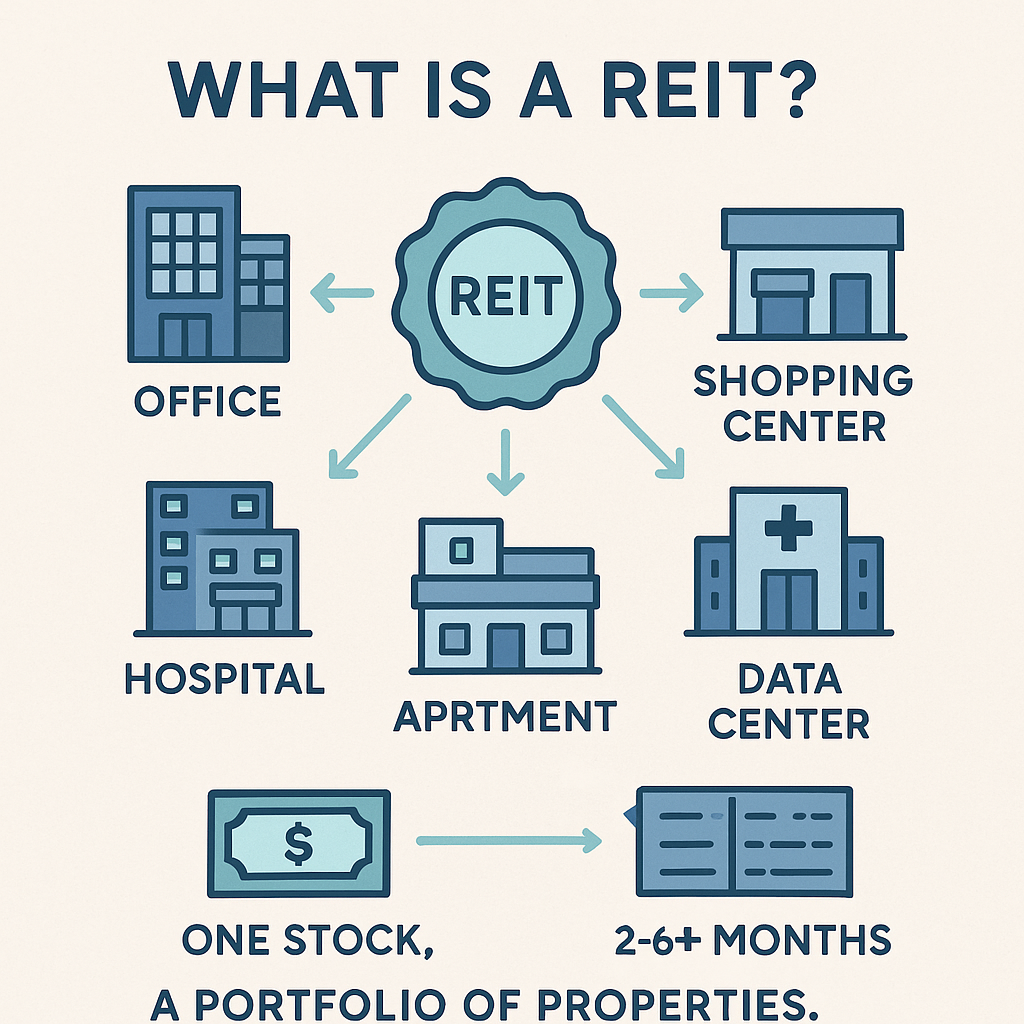

While digging through all this stocks vs. real estate stuff, I kept seeing this weird acronym: REIT. It stands for Real Estate Investment Trust, and it’s basically a company that does nothing but own a bunch of properties—like apartment buildings, shopping malls, or offices. Here’s the cool part: you can buy shares of these REIT companies on the stock market, just like you’d buy a share of Coca-Cola.

This seemed to solve a bunch of problems. You get real estate exposure and income, but with the simplicity and low cost of stocks. It felt like a perfect middle-ground solution.

Common Mistakes in the Stocks vs. Real Estate Journey

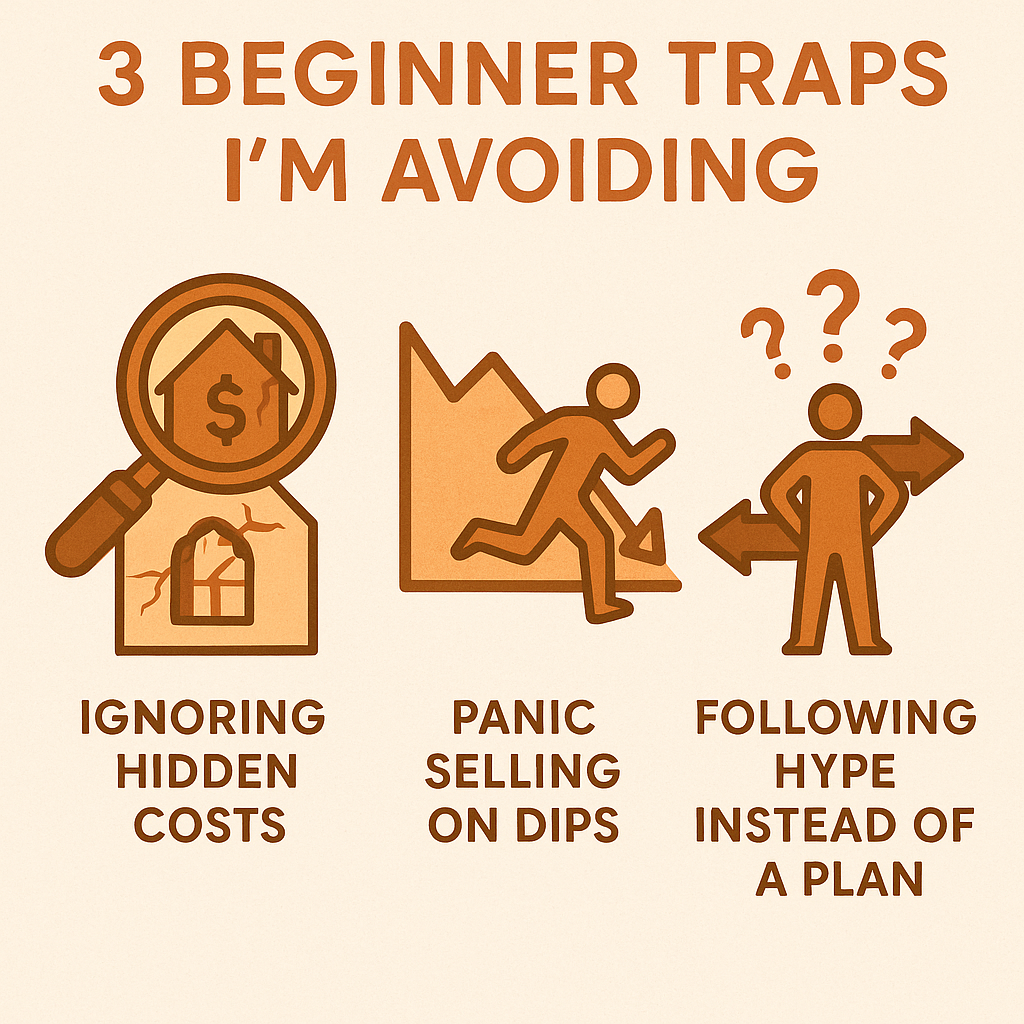

This whole research process made me realize how many traps there are for beginners. I’ve basically made a list of personal rules to keep myself from making a dumb mistake.

- Forgetting All the Hidden Costs of Real Estate. It’s so easy to just look at the mortgage payment. I will never even consider a property without first plugging every single hidden cost into a spreadsheet.

- Freaking Out and Selling My Stocks. The market is a rollercoaster. I’m telling myself now: when it tanks, I will not sell. I might not even look. I’ll just trust the long-term plan.

- Doing What Everyone Else Says Is “Best”. This is the big one. The only “best” investment is the one that fits my life, my budget, and my sleep schedule.

Interactive Quiz: What’s Your Investor Personality?

This isn’t financial advice, but it’s a fun way to see which path aligns with your gut feeling.

1. How much cash could you invest tomorrow? ( ) Less than a grand. ( ) A whole lot more than that.

2. What’s your ideal level of effort? ( ) Please, I want it to be totally passive. ( ) I don’t mind getting my hands dirty.

3. It’s a bad month, and your investment drops 20%. What’s your gut reaction? ( ) Full-on panic mode. ( ) Annoying, but I’m in it for the long haul.

[Tell Me My Style! Button]

My Simple Breakdown of Stocks vs. Real Estate

After all that, here’s the super-simple cheat sheet I made for myself.

- You should probably lean toward STOCKS if: You want to set it and forget it, you’re starting with a smaller amount of money, and you want to be able to get your cash out if you need it.

- You should probably lean toward REAL ESTATE if: You’re excited by the idea of using leverage to boost your returns, you want an asset you can physically see and improve, and you’re fully prepared for the work that comes with it.

- One should probably look into REITs if: You’re like me and want a little of both. You get the real estate profits without the landlord headaches.

At the end of the day, I learned there’s no magic bullet. The real goal wasn’t to find the “best” investment on paper, but the one that’s best for my life. For now, that looks like a simple mix of stock market funds and some REITs. It feels like the right first step.

I really hope walking through my research process helps you out. The most important thing is that we’re asking these questions and learning before we jump in. Good luck out there.

Where to Go From Here

If you want to keep digging, here are a few guides on the topics we talked about:

Our Archives

2-1: Why Compound Interest is the Most Powerful Secret for Your Financial Future

3-1: Stocks vs. Real Estate: The Ultimate Guide to a Surprising Winner

Sources I Used

Factual Data, FRED. (2025). NASDAQ Composite Index [Data set]. Federal Reserve Bank of St. Louis. Retrieved from https://fred.stlouisfed.org/series/NASDAQCOM

HAR.com. (2025). Why 2025 might be the year to choose stocks over real estate. Retrieved from https://www.har.com/ri/3986/why-2025-might-be-the-year-to-choose-stocks-over-real-estate

Kiesnoski, K. (2025). Real estate vs. stocks: Which is the better investment? Investopedia. Retrieved from https://www.investopedia.com/investing/reasons-invest-real-estate-vs-stock-market/

Macrotrends. (2025). S&P 500 Historical Annual Returns [Data set]. Retrieved from https://www.macrotrends.net/2526/sp-500-historical-annual-returns

Nareit. (2025). Quarterly REIT Performance Data [Data set]. Retrieved from https://www.reit.com/data-research/data/quarterly-reit-performance-data

S&P Dow Jones Indices. (2025). S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index [Data set]. Retrieved from https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.