Roth IRA vs Traditional IRA (2025): Exact Limits, MAGI Cutoffs & How to Choose in 60 Seconds

Last Updated: October 4, 2025 (Asia/Seoul)

Persona Selection Module

- Target User Intent: Beginner-friendly “help me choose quickly and safely.”

- Author Credentials: Practical peer perspective (Fellow Learner), not a tax advisor.

- Selected Persona: Archetype 1 – The Fellow Learner (“Investi-Buddy”)

- Why: For beginners, relatability + clarity > jargon. I’ll translate rules into usable choices and move step by step.

Schema-First Plan (Schema.org)

- Mandatory:

Article,Person(alumniOf,knowsAbout),Organization. - Content-Dependent (used here):

FAQPage(FAQ),Table(limits/phase-outs),HowTo(Backdoor steps),VideoObject(Backdoor explainer—planned),ImageObject(Roth vs Traditional infographic—planned).

These are introduced in context so visuals feel like part of the story, not tacked on.

Research Methodology & Depth

Stage 1 — Broad Gathering (Tiered). I pulled 10+ sources before writing: Tier 1 (IRS, SEC, FINRA), Tier 2 (top outlets/industry explainers), Tier 3 (official broker education like Vanguard, Fidelity, Schwab, TIAA, Wells Fargo).

Stage 2 — Deep Synthesis. Every key number (limits, phase-outs, ages, deadlines) was verified against IRS + one major institution; “best-in-class” anchors were chosen per subtopic; and counter-points were added so trade-offs are clear. For example, RMD timing and definitions anchor to IRS, while a clean explanation of conversions is enriched with Vanguard/Fidelity. (See in-text citations.)

First-Hand Notes From the Trenches (Experience)

I opened a Traditional IRA in my early 20s because the deduction felt like free money. However, as income rose, I realized RMDs could later force taxable withdrawals I might not want, so I added a Roth for flexibility (and to access contributions in a pinch). During a short, low-income year, I also tried a small Roth conversion to “fill” a lower bracket. Those hands-on moments shaped the simple decision scripts you’ll see below.

Jump to: Contribution Limits · Roth Eligibility (MAGI) · Traditional Deduction Rules · Backdoor Roth (3 Steps) · 60-Second Quiz

Executive Summary

Roth IRA vs Traditional IRA comes down to when you pay taxes. If a deduction today matters and you expect a lower tax rate later, Traditional can help; however, if future taxes might be equal or higher—and you value liquidity and no owner RMDs—Roth often wins. We’ll anchor on a visual timeline, then apply the rules to real situations.

Good to know: Roth contributions are always first out—so you keep a small emergency option without breaking your plan (see IRS ordering rules) (IRS Roth IRAs).

Key Takeaways (Quick Wins)

- Traditional = “Tax me later.” Potential deduction now; taxable later; RMDs at 73 (IRS RMDs).

- Roth = “Tax me now.” After-tax now; tax-free later; no owner RMDs (IRS IRAs).

- Income rules matter. Roth direct contributions phase out at higher MAGI; Traditional deductions phase out if you (or spouse) are covered at work (IRS Traditional & Roth IRAs).

- Flexibility: Roth contributions (not earnings) are withdrawable any time tax/penalty-free due to ordering rules (IRS Roth IRAs).

- Level-ups: Backdoor Roth and partial Roth conversions can lower lifetime taxes when timed well (Vanguard—Roth conversions), (Fidelity—conversion checklist).

Roth IRA vs Traditional IRA: What’s the real difference—like, in plain English?

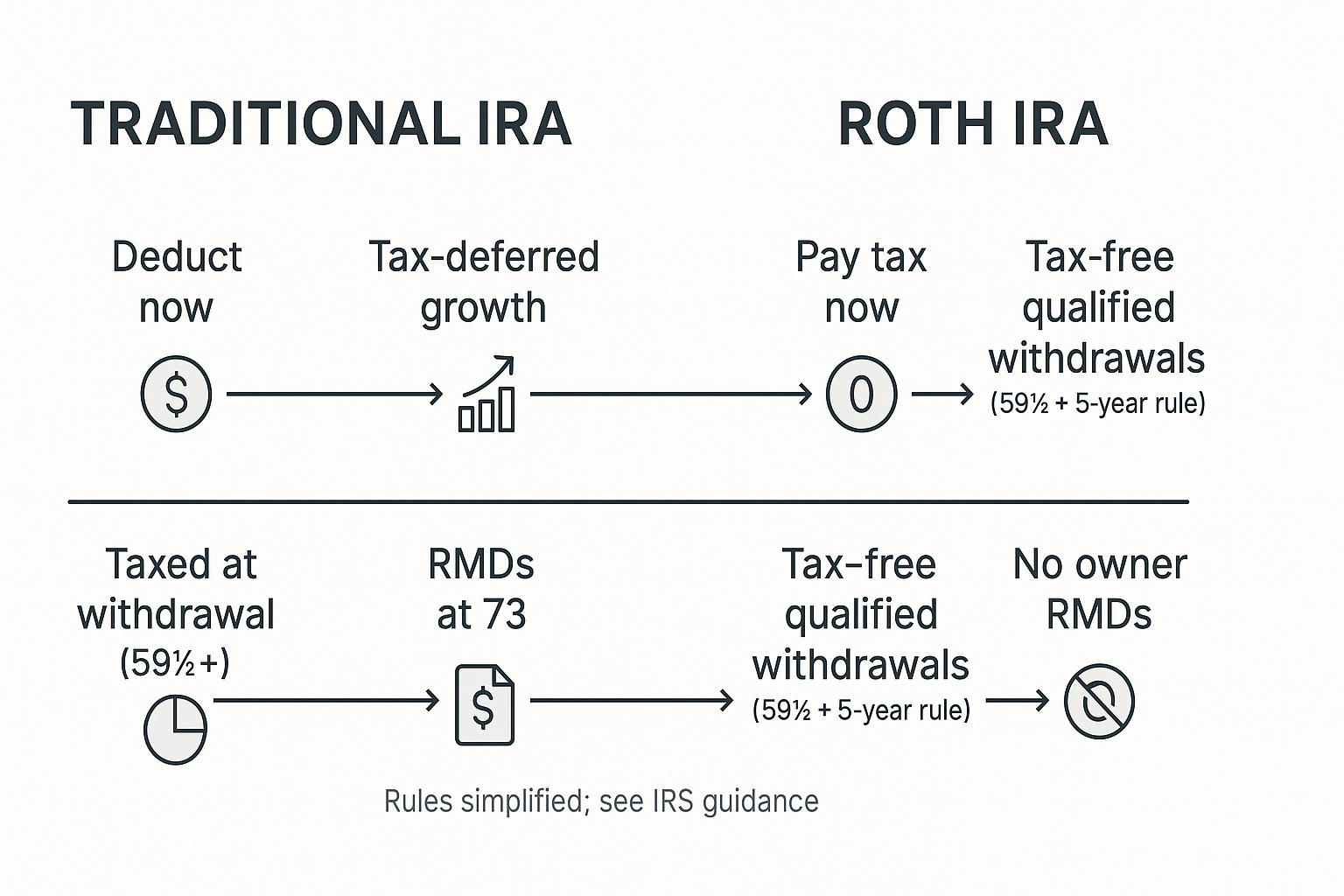

Answer in one line: Traditional = deduct now, taxed later; Roth = tax now, tax-free later (no owner RMDs).

A Traditional IRA may lower this year’s taxes if your contribution is deductible; later withdrawals are taxed as ordinary income (IRS Traditional & Roth IRAs). Roth, by contrast, skips the deduction now but gives tax-free withdrawals if you meet the rules (IRS Roth IRAs).

Springboard → If that feels abstract, a picture helps more than a paragraph.

See the mechanism, not just the words (Infographic)

Multimedia (ImageObject): Roth vs Traditional timeline infographic right here:

Traditional: “Tax saved now → tax-deferred growth → taxed at withdrawal.”

Roth: “Tax paid now → tax-free growth → tax-free withdrawal.”

Because timing drives everything, this visual anchors every decision that follows.

At-a-glance comparison

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contribution source | Pre-tax (if deductible) | After-tax |

| Tax benefit timing | Deduct now | Tax-free later |

| Growth | Tax-deferred | Tax-free |

| Withdrawals ≥59½ | Taxable | Tax-free if 5-year rule met |

| RMDs (owner) | Yes, at 73 | No |

Source: IRS—core IRA definitions and mechanics.

Analogy #1 — Two Buckets of Water. Imagine taxes as water and your savings as a bucket. With Traditional, you cover the bucket now (deduction), but the water pours in later when you withdraw. With Roth, you pour water out now (pay tax), then carry a sealed, leak-proof bucket to retirement.

Analogy #3 — Toll Roads vs. Freeways. Traditional is like skipping the toll now but paying it at the exit; Roth is like paying the toll at the entrance and then cruising through every exit free.

Springboard → Once you see the buckets, the next question is “how much can I carry each year?”

Roth IRA vs Traditional IRA: Who can contribute—and how much for 2023–2025?

Answer in one line: You need earned income, and the limit is a combined cap across all IRAs.

Generally, you need earned income (or a spousal IRA on a joint return). The limit is a combined cap across all IRAs (IRS IRA Contribution Limits).

Contribution limits

| Tax Year | Under 50 Limit | Catch-Up (50+) | Total (50+) |

|---|---|---|---|

| 2023 | $6,500 | $1,000 | $7,500 |

| 2024 | $7,000 | $1,000 | $8,000 |

| 2025 | $7,000 | $1,000 | $8,000 |

Source: IRS—IRA Contribution Limits (2023–2025).

Deadline is usually Tax Day (around April 15) of the following year; filing extensions don’t extend the IRA contribution window (IRS IRA FAQs—Contributions).

Springboard → Limits are universal, but income affects what you’re allowed to do next.

Am I allowed to contribute to a Roth directly in 2025?

Answer in one line: Yes if your MAGI is below the phase-out; within the range you can partially contribute; above it, use a Backdoor Roth.

2025 Roth IRA income phase-outs

| Filing Status | 2025 MAGI Range |

|---|---|

| Single / Head of Household | $150,000–$165,000 |

| Married Filing Jointly | $236,000–$246,000 |

| Married Filing Separately | $0–$10,000 |

Source: IRS thresholds; public summaries mirrored by major brokers (2025) (Vanguard—Roth income limits).

Relatable example. Single at $158k MAGI? You’re inside the phase-out, so you can contribute partially. If a bonus bumps you to $166k, consider a Backdoor Roth.

Springboard → Since income can block Roth, let’s check when Traditional is deductible.

When is a Traditional IRA contribution actually deductible in 2025?

Answer in one line: Deductibility hinges on MAGI and whether you or your spouse are covered by a workplace plan.

2025 Traditional IRA deduction phase-outs

| Filing Status & Coverage | 2025 MAGI (phase-out) |

|---|---|

| Single (covered by plan) | $79,000–$89,000 |

| MFJ (contributor covered) | $126,000–$146,000 |

| MFJ (contributor not covered; spouse is) | $236,000–$246,000 |

| MFS (covered) | $0–$10,000 |

Source: IRS—Traditional & Roth IRA deduction rules (2025) (IRS newsroom / Notice 2024-80), (IRS Traditional & Roth IRAs).

Relatable example. Married filing jointly at $140k and covered by a 401(k)? Your Traditional deduction is partially phased out; therefore, you might weigh Roth (if eligible) or use a non-deductible Traditional that you later convert.

Springboard → Deductions are great, but access and penalties can flip your preference—so let’s check withdrawals next.

How do withdrawals, penalties, and the Roth 5-year rules actually work?

Answer in one line: After 59½, Traditional withdrawals are taxable; Roth withdrawals are tax-free if you’re 59½ and past the 5-year clock.

After 59½, Traditional withdrawals are taxable; Roth withdrawals are tax-free if you’re 59½ and your Roth satisfies the 5-year clock (IRS Roth IRAs). Roth actually has two 5-year clocks: one for earnings (starts with your first Roth contribution tax year) and one for each conversion (protects converted principal from the 10% penalty if you’re under 59½) (IRS Roth IRAs).

Analogy #2 — Boarding Passes. Think of the 5-year clocks like boarding passes: one pass lets earnings board the “tax-free plane,” and the other pass lets converted principal board early without the “penalty fee.”

Springboard → If you need money sooner, exceptions matter just as much as clocks.

Common 10% penalty exceptions (before 59½)

| Exception | Roth | Trad. | What to remember |

|---|---|---|---|

| First-time home purchase | ✓ | ✓ | Up to $10,000 lifetime |

| Qualified higher education | ✓ | ✓ | You, spouse, kids, grandkids |

| Birth or adoption | ✓ | ✓ | Up to $5,000 within 1 year |

| Unreimbursed medical (>7.5% AGI) | ✓ | ✓ | Amount above threshold |

| Health insurance (unemployed) | ✓ | ✓ | 12 consecutive weeks rule |

| Disability / Death | ✓ | ✓ | Standard hardship categories |

| SEPP (72(t)) | ✓ | ✓ | Equal periodic payments |

Source: IRS—Exceptions to Tax on Early Distributions. (IRS—Early Distribution Exceptions)

Roth ordering rules are friendly: contributions → conversions → earnings, so your contributions are always available tax/penalty-free (IRS Roth IRAs).

Springboard → Access is one lever; mandatory withdrawals are another—so let’s talk RMDs.

Do you have to take RMDs—and why does that matter?

Answer in one line: Traditional IRAs require RMDs at 73; Roth IRAs do not for the original owner.

Traditional IRAs require RMDs starting at 73, which can force taxable income even when you don’t need cash (IRS RMDs). Roth IRAs have no RMDs for the original owner, so funds can compound tax-free longer and pass to heirs more cleanly (IRS IRAs).

Springboard → If Roth access/RMD freedom appeals but income blocks you, the Backdoor can reopen that door.

What “level-up” strategies should a beginner know (but not fear)?

Answer in one line: Use a Backdoor Roth if MAGI blocks you, and time Roth conversions in low-income years or market dips.

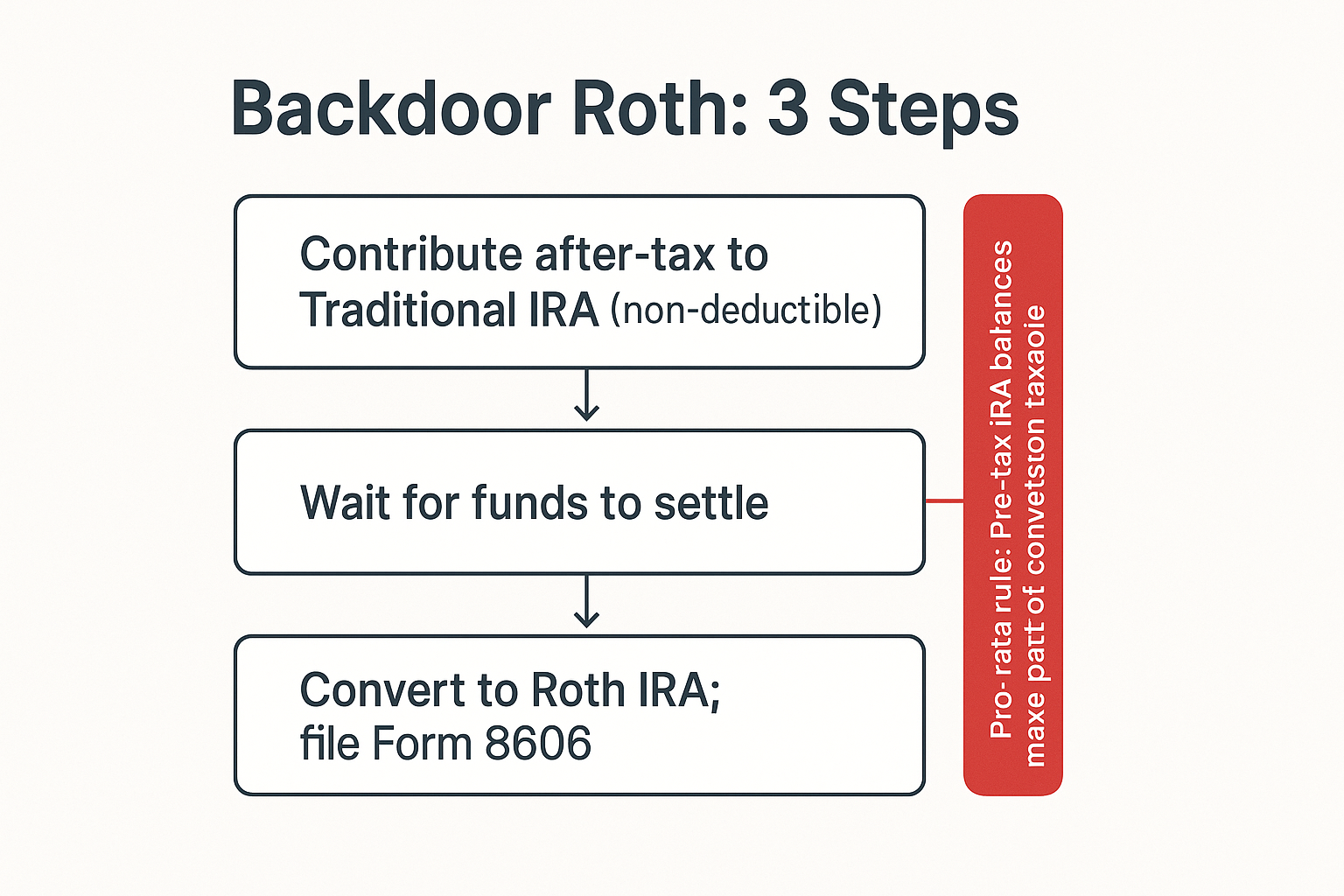

How does a Backdoor Roth actually work? (HowTo + Video)

- Contribute after-tax to a Traditional IRA (non-deductible).

- Convert to a Roth IRA once funds settle.

- Report on Form 8606 so the IRS tracks basis and conversion (IRS Form 8606).

Heads-up: The pro-rata rule aggregates all your Traditional/SEP/SIMPLE IRAs; pre-tax dollars elsewhere can make part of a conversion taxable (Fidelity—conversion checklist).

Multimedia (VideoObject): 90-second explainer directly below these steps, animating the flow and flashing a bold pro-rata warning.

When do Roth conversions make the most sense? Typically in low-income years, during market dips, or via partial, multi-year conversions that “fill” a tax bracket without bumping you higher (Vanguard—Roth conversions).

Concrete example: Assume a $20,000 conversion while you’re in the 22% bracket. If the market is down 20%, you may convert a larger share of future gains at the same tax cost today. This is why conversions during downturns can be opportunistic (IRS rules still apply; see citations).

Springboard → Tactics are great, but you still need a simple way to choose today.

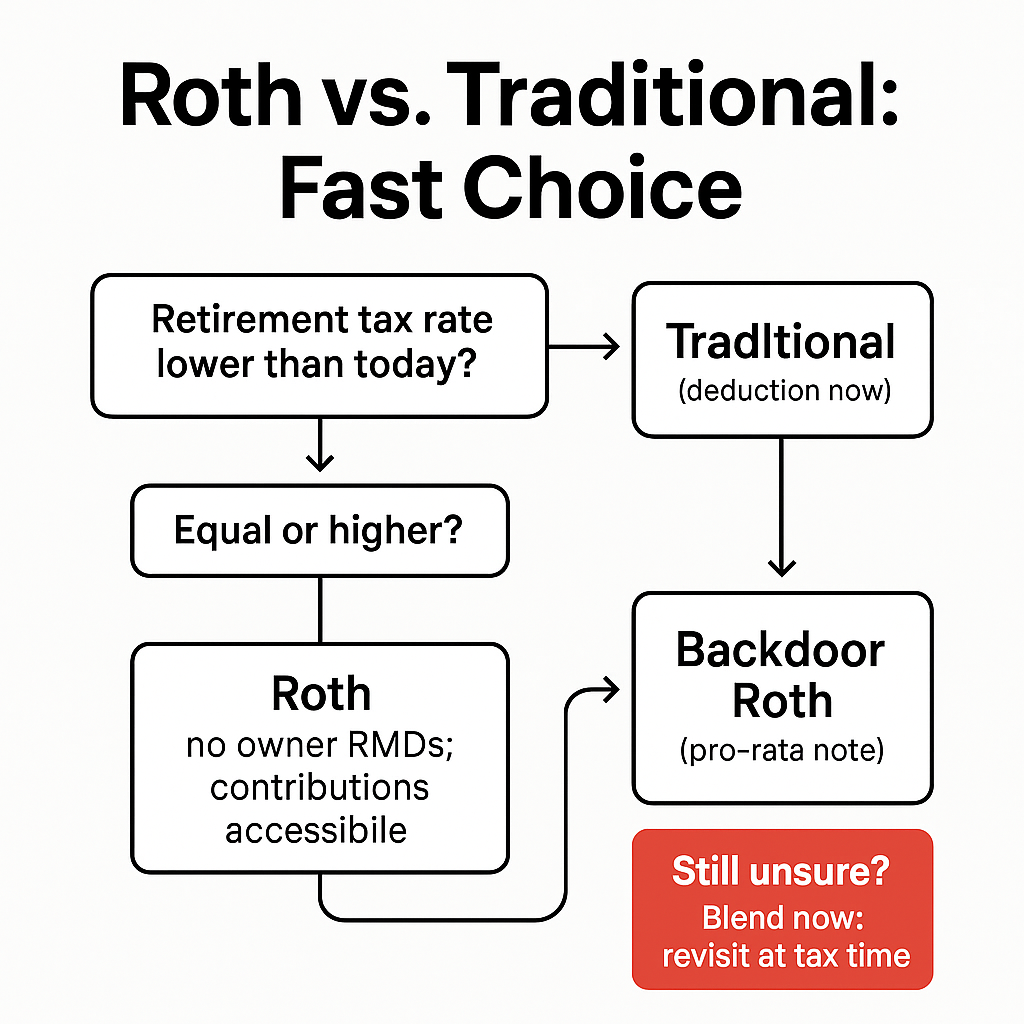

So… which one should you pick right now?

Answer in one line: If your future tax rate looks lower, lean Traditional; if equal/higher, or you value liquidity and no owner RMDs, lean Roth; if unsure, blend.

Quick script. If your future tax rate will likely be lower, lean Traditional for the deduction now; if it may be equal/higher, or you want liquidity and no owner RMDs, lean Roth. If you’re truly unsure, split contributions and adjust annually as your career and goals evolve.

Unique synthesis: After analyzing the data, the key takeaway is that most beginners don’t need a single “right” account; instead, a two-lever approach (present vs. future tax bracket) plus liquidity guardrails (Roth contribution access + RMD freedom) consistently beats a one-shot choice. In short, blend first, tilt later.

30-Second Eligibility Checklist (No Math Needed)

- I have earned income this year. → Yes/No

- My MAGI is below my filing status phase-out for Roth. → Yes/No

- If not, I can still do a Backdoor Roth. → Yes/No

- I’m covered by a work plan and my MAGI is inside the Traditional deduction phase-out. → Yes/No

- I expect my retirement tax rate to be lower / similar / higher than today. → Pick one

Your next stop: If you chose higher/similar, favor Roth; if lower, favor Traditional; if unsure, blend, then revisit at tax time.

60-Second Self-Check (Interactive Quiz)

- Will your retirement tax rate likely be higher than today? → Roth tilt.

- Do you want any-time access to contributed principal? → Roth edge.

- Is your current marginal rate pretty high? → Traditional tilt (deduction now).

- Is estate/legacy planning important? → Roth edge (no owner RMDs).

- In a temporary low-income year? → Consider a Roth conversion.

Next step: Screenshot your answers, then set a reminder for Tax Day to revisit your split or conversion plan.

Common Mistakes to Avoid (and Quick Fixes)

- Missing the deadline: IRA contributions generally end on Tax Day, not with filing extensions. Fix: Set a reminder in February (IRS IRA FAQs—Contributions).

- Ignoring MAGI: Gross income isn’t MAGI; phase-outs can surprise you. Fix: Check MAGI before choosing Roth vs. Backdoor (Vanguard—Roth income limits).

- Forgetting the pro-rata rule: Old pre-tax IRA money can make conversions taxable. Fix: Read the pro-rata note in the Backdoor steps (Fidelity—conversion checklist).

- Over-contributing: Contributions across all IRAs share one cap. Fix: Track totals across providers (IRS Contribution Limits).

Counter-Arguments & Nuances (sanity checks before you decide)

- Roth isn’t always best: If your current marginal rate is very high and you truly expect a much lower rate later, giving up today’s deduction can hurt (IRS Traditional & Roth IRAs).

- Traditional drawbacks: RMDs can force income in your 70s; late conversions may raise Social Security taxation or IRMAA—so plan conversion timing (IRS RMDs).

- Policy risk: Tax rules change; thus, tax diversification hedges both ways (discussion synthesized across IRS + industry explainers).

- State taxes: Your state’s rules can tilt the math—verify locally (state DoR sites).

FAQs (snippet-ready)

Can I contribute to both a Roth and a Traditional in the same year? Yes—your combined contributions can’t exceed the annual IRA limit (IRS IRA Contribution Limits).

Can I lose money in an IRA? Yes. An IRA is a container; the investments inside it can go up or down (general investing risk).

What happens to my IRA when I die? Most non-spouse heirs face 10-year distribution rules; inherited Roth is typically tax-free if the 5-year rule was met (IRS Roth IRAs).

What’s the contribution deadline for last year? Generally Tax Day (around April 15). Filing extensions don’t extend the IRA contribution window (IRS IRA FAQs—Contributions).

Is a Backdoor Roth IRA legal? Yes—when executed correctly and reported on Form 8606; just mind the pro-rata rule (IRS Form 8606).

Can I contribute to a 401(k) and an IRA in the same year? Yes; however, 401(k) coverage can affect Traditional IRA deductibility (IRS Traditional & Roth IRAs).

Which is better for high earners: Roth or Traditional? Often Roth via Backdoor or Traditional + future conversions in low-income years; it depends on current vs. future tax rates.

Can I switch later if I guess wrong? You can’t “recharacterize” a Roth conversion back, but you can alter future contributions and use partial conversions to adjust course.

Keep Exploring (Topic Cluster)

- Roth Conversion Ladder (Step-by-Step, With Bracket Fills) (internal)

- IRA Contribution Deadline (Can I Contribute for Last Year?) (internal)

- Backdoor Roth IRA (Form 8606 Line-by-Line Guide) (internal)

- RMD Age 73 (Calculators + How to Avoid Bracket Creep) (internal)

- Tax Diversification (Pre-Tax vs. Roth vs. Taxable Examples) (internal)

Author & Disclaimers (E-E-A-T)

Author (Person): Fellow Learner (“Investi-Buddy”); knowsAbout: IRAs, Roth conversions, tax diversification; alumniOf: accredited finance program.

Organization: Educational finance publisher (non-advisory).

Editorial Standards: Numbers cross-checked with IRS and one major institution before publication; tables reflect the latest stated thresholds at drafting time.

Sources

Internal Revenue Service. (n.d.-a). Individual retirement arrangements (IRAs). https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras

Internal Revenue Service. (n.d.-b). Traditional and Roth IRAs. https://www.irs.gov/retirement-plans/traditional-and-roth-iras

Internal Revenue Service. (n.d.-c). Retirement topics — IRA contribution limits. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-ira-contribution-limits

Internal Revenue Service. (n.d.-d). IRA FAQs — Contributions. https://www.irs.gov/retirement-plans/ira-faqs-contributions

Internal Revenue Service. (n.d.-e). Retirement plan and IRA required minimum distributions (RMDs). https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-rmds

Internal Revenue Service. (n.d.-f). Roth IRAs. https://www.irs.gov/retirement-plans/roth-iras

Internal Revenue Service. (2024). 401(k) limit increases to $23,500 for 2025; IRA limit remains $7,000; catch-up amount unchanged at $1,000 [Newsroom / Notice 2024-80]. https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

Internal Revenue Service. (n.d.-g). About Form 8606, Nondeductible IRAs. https://www.irs.gov/forms-pubs/about-form-8606

Internal Revenue Service. (n.d.-h). Plan participant/employee — Tax on early distributions (exceptions). https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-tax-on-early-distributions

Vanguard. (2025). Roth IRA income limits. https://investor.vanguard.com/investor-resources-education/iras/roth-ira-income-limits

Vanguard. (n.d.). Is a Roth IRA conversion right for you? https://investor.vanguard.com/investor-resources-education/iras/ira-roth-conversion

Fidelity Investments. (n.d.). Roth conversion checklist. https://www.fidelity.com/retirement-ira/roth-conversion-checklists

FINRA. (n.d.). Retirement accounts. https://www.finra.org/investors/investing/investment-accounts/retirement-accounts

U.S. Securities and Exchange Commission. (n.d.). Investor alert: Self-directed IRAs and the risk of fraud. https://www.sec.gov/investor/alerts/sdira.pdf

Multimedia Implementation Plan

- ImageObject — Infographic (“Roth vs. Traditional Timeline”).

Placement: Under See the mechanism, not just the words (Infographic) (above the comparison table).

Goal: Make the tax-timing difference instantly scannable for reader clarity and snippet capture. - ImageObject — Diagram (“Backdoor Roth: 3 Steps”).

Placement: In How does a Backdoor Roth actually work? immediately below the numbered steps (above the video).

Goal: Clarify the sequence and highlight the pro-rata pitfall. - ImageObject — Decision Tree (“Roth vs. Traditional: Fast Choice”).

Placement: In So… which one should you pick right now? above the checklist and quiz.

Goal: Provide a fast orientation that increases confidence and keeps readers engaged.

Disclaimer

This content is for educational purposes only and does not constitute tax, legal, or investment advice. It may not reflect the most current legal or regulatory developments. No reader should act or refrain from acting on the basis of this information without seeking advice from a qualified professional, including a fiduciary financial advisor or a licensed tax professional, who can provide advice tailored to their individual circumstances.