Your First Brokerage Account, Done in 15 Minutes

(and the one hour of prep that makes it easy)

Last Reviewed: August 10, 2025

Open a brokerage account fast with this 15-minute guide and one hour of prep.

If you want to open a brokerage account fast but the process feels like a pop quiz, you’re not alone. I froze at “investment objective” too. This guide skips the jargon and gets you from nervous to invested in 15 minutes. This guide shows you how to open a brokerage account fast with a clear 7 step sprint.

Disclaimer: This guide is U.S.-focused. Rules and account types can differ in other countries.

Who is this for? (and who it’s not for)

- ✅ For: First-time U.S. investors who want a safe, simple start using broad index funds.

- ❌ Not for: Active trading, options, short-term strategies, or anyone needing personalized advice.

What you will get: In 15 minutes, you’ll have an open account, a funded transfer, and a first-buy plan on autopilot. 📈

What you won’t get: Stock tips, leverage tricks, or hype.

Table of Contents

- Quick Take & why it matters

- PRINT & KEEP: One-Page Checklist

- How to Use This Guide

- Plain-English Glossary & ACH timing

- Your Road Map to Opening an Account

- Stop 1: The Why and the What

- Stop 2: The Where – Choosing Your Brokerage

- Stop 3: The 15-Minute Sprint – Application & Funding

- Stop 4: Your First Investment – A Simple, Strong Start

- Beginner Mistakes to Calmly Avoid

- Edge-Case FAQs

- About the Author, Disclosures, & Methodology

Quick Take: open a brokerage account fast

- Goal → Account: Retirement? 👉 IRA. A goal 5-10 years away? 👉 Taxable account. Picking the right container avoids tax headaches later.

- Beginner Setting: Always choose a Cash account, not Margin. This removes the number one source of regret: borrowing to invest.

- Docs Ready: Have your SSN, Government ID, Address, Employment Info, and Basic Financials ready. This turns the application into a sprint.

- Simple Start: Buy the haystack, not the needle. A mix of U.S. stock, International stock, and U.S. bond index funds provides instant diversification.

- Safety Net: SIPC insurance protects your account for up to $500k ($250k in cash) if your broker fails. It does not cover market losses.

PRINT & KEEP: One-Page Checklist

I turned this guide into a one-page checklist you can print and use while opening your account.

➡️ Download the Open a Brokerage Account Fast checklist (PDF): https://www.dropbox.com/scl/fi/gjo3vtq6yq6b9ny35qb00/open-brokerage-checklist.pdf?rlkey=3vla6duhikgihu30o3c8fsgka&st=9owgtgfj&dl=0

How to Use This Guide to Open a Brokerage Account Fast.

We’ll do about one hour of prep work that makes the actual application a 15-minute sprint. Then, we’ll start investing with a simple, diversified plan you can stick with. If you searched how to open a brokerage account fast, you’re in the right place.

Glossary

- ACH: A standard electronic transfer from your bank to your brokerage.

- Expense Ratio: The tiny annual fee a fund charges. An expense ratio of 0.03% is just $3 per year for every $10,000 invested.

- Index Fund / ETF: A basket of investments that tracks a market (like the S&P 500), removing the need for stock picking.

- Margin: Borrowing money from your broker to invest. It increases risk and can force you to sell at the worst time.

- Rebalance: Nudging your investment mix back to your original targets, usually once a year.

- SIPC: The Securities Investor Protection Corporation. It safeguards your assets if a brokerage firm fails, but not from market ups and downs.

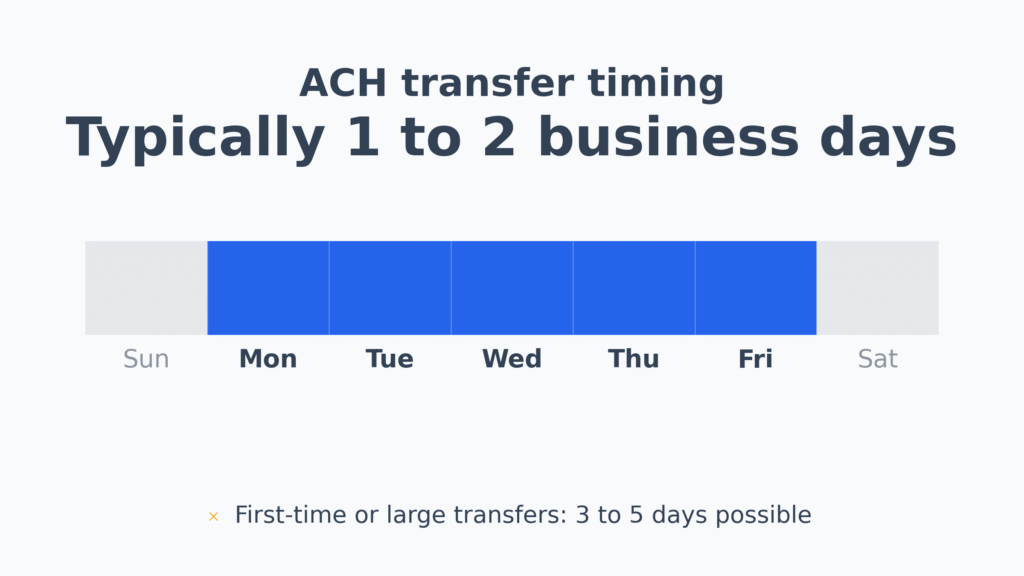

How long does an ACH transfer take?

ACH bank transfers usually settle in 1 to 2 business days. Weekends and bank holidays don’t count. First-time or large transfers can sometimes take 3 to 5 business days, and the funds might appear as “pending” before you can invest them.

Road Map: Open a Brokerage Account Fast.

- The Why and What: Match your goal to the right account type.

- The Where: Choose a reliable brokerage.

- The 15-Minute Sprint: Complete the application and fund the account.

- Your First Investment: Use a boringly effective starter strategy.

Stop 1: The Why and the What

Your “Why” Makes Everything Else Easy

Think of investment accounts like luggage. You pack differently for a weekend beach trip than for a two-week ski trip. Get your “why” right first, and the rest becomes obvious.

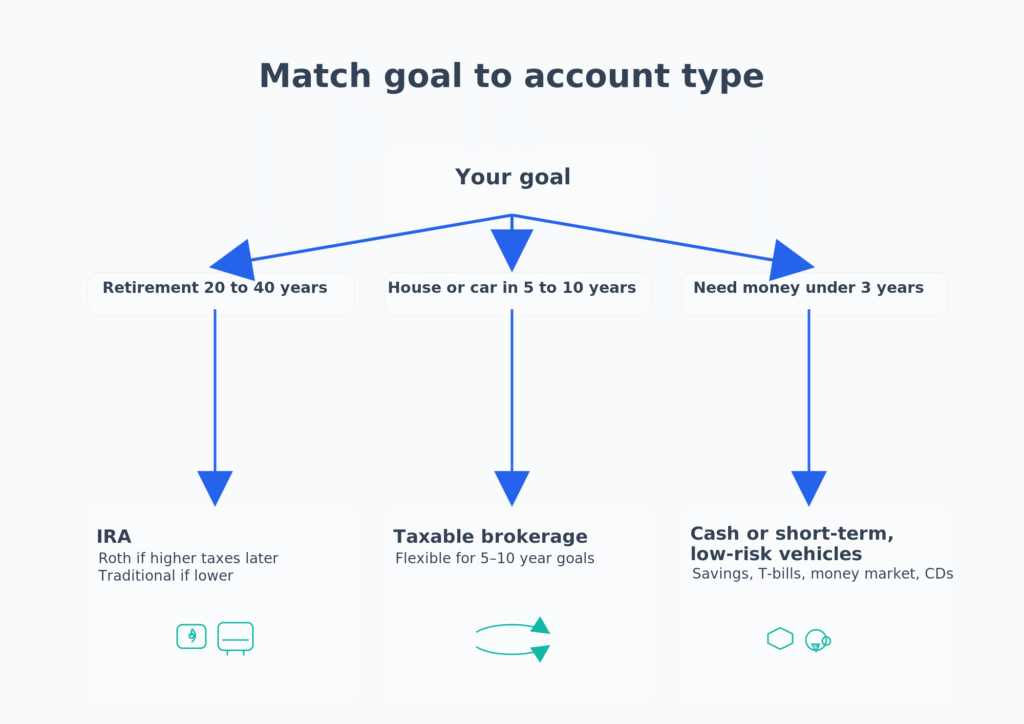

Fast Decision Path

- Retirement in 20-40 years? ➡️ IRA.

- Choose a Roth IRA if you expect to be in a higher tax bracket in retirement.

- Choose a Traditional IRA if you expect to be in a lower tax bracket.

- House or car in 5-10 years? ➡️ Taxable brokerage account.

- Might need the money in < 3 years? ➡️ Cash or other low-risk vehicles. Investing in stocks may not be appropriate for short-term goals.

Taxable vs. IRA

- Taxable Brokerage (Non-Retirement): Maximum flexibility. You can add or withdraw money anytime (though taxes may apply to gains). Great for goals 5-10 years out.

- IRA (Retirement Only): A locked treasure chest for Future-You. It offers powerful tax advantages for long-term growth.

- Roth IRA: You contribute with after-tax dollars. Qualified withdrawals in retirement can be tax-free.

- Traditional IRA: Contributions may be tax-deductible now. Withdrawals are taxed as income in retirement.

Bottom Line: Need flexibility? 👉 Taxable. Saving for retirement? 👉 IRA. (Tax rules can change. Always check the current year’s IRS page before you contribute.)

Cash vs. Margin: The Easiest Beginner Decision

- Cash Account: Like a debit card. You can only invest the money you deposit. It’s simple and safe.

- Margin Account: Lets you borrow money from the broker to invest. This amplifies both gains and losses.

For beginners, the choice is simple: Pick Cash.

What Could Go Wrong?

- Using margin and being forced to sell your investments during a market downturn.

- Putting money you’ll need within 3 years into volatile assets like stocks.

- Panic-selling after a normal market correction.

- Ignoring taxes and paying more than you need to.

Myth vs. Fact

- Myth: You need a lot of money to start.

- Fact: Fractional shares let you start with as little as $25.

- Myth: SIPC covers my investment losses.

- Fact: SIPC only covers broker failure, not market movements.

- Myth: Margin is the best way to boost returns.

- Fact: Margin can magnify losses and force you to sell at a loss.

- Myth: Picking a few great stocks will beat index funds.

- Fact: Broad, low-cost funds let you own all the winners without having to guess which ones they’ll be.

Stop 2: The Where – Choosing Your Brokerage

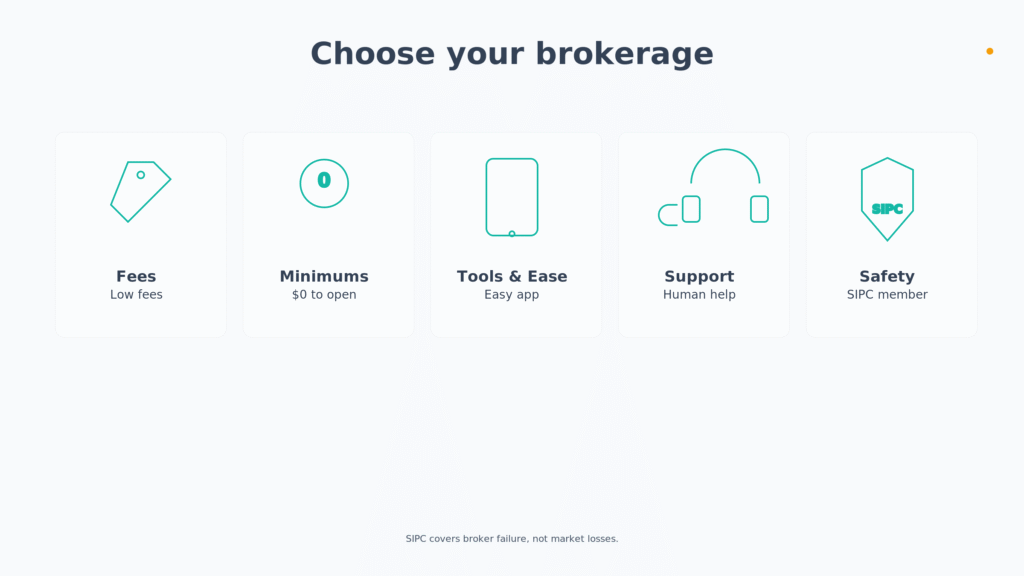

Practical Checklist

- Fees: Look for $0 commissions on stock and ETF trades and low expense ratios on funds.

- Account Minimums: A $0 minimum to open is ideal for beginners.

- Tools & Ease of Use: The app should be simple and intuitive. You don’t need pro-level charts yet.

- Support: Can you reach a real human by phone or chat if you get stuck?

- Transparency: The broker should be a registered SIPC member with clear disclosures.

If two options seem close, pick the one you’ll actually use.

Deal-Breakers (Skip the broker if you see these)

- 🚫 SIPC membership is unclear or missing.

- 🚫 No fractional shares (this makes it hard to invest small amounts).

- 🚫 High or hard-to-find ACATS transfer-out fees.

- 🚫 Your target index funds are not available commission-free.

- 🚫 No clear option to automatically reinvest dividends (DRIP).

Nice-to-haves: Instant ACH deposits, a clean mobile app, and weekend support. Note: You can always transfer your account to another broker later via an ACATS transfer. Just ask about the transfer-out fee before you open an account.

STOP 3: How to Open a Brokerage Account Fast — Application & Funding

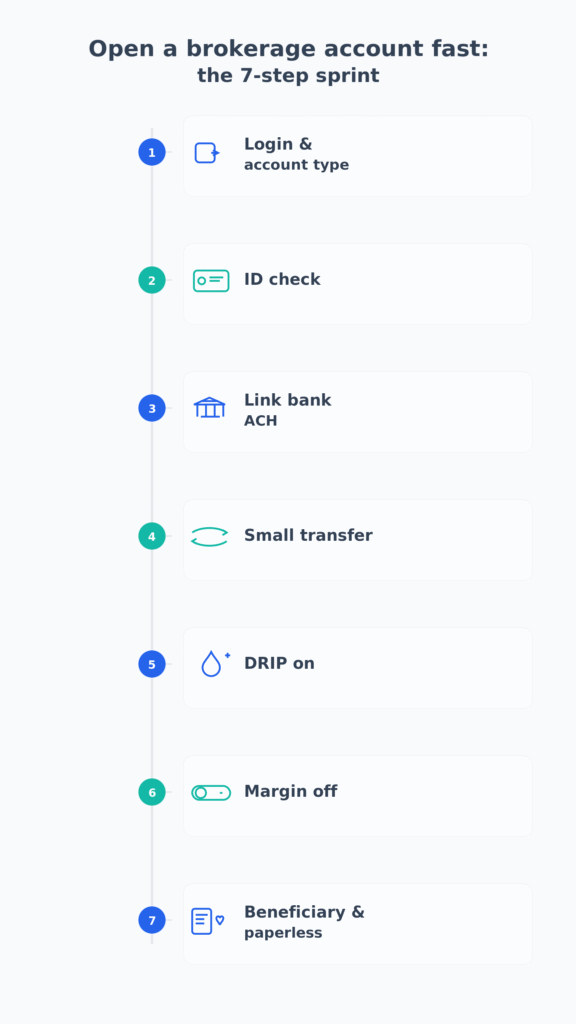

Open a brokerage account fast: the 7-step sprint

What You’ll Need (Gather These First)

- Social Security Number (SSN)

- Government-issued ID (Driver’s License, Passport)

- Permanent address

- Employment status & basic financial info (income/net worth ranges)

Copy below plan to open a brokerage account fast—then walk through each step.

How to open a brokerage account fast with this guide

- Create your login. Choose your account: Taxable, Roth IRA, or Traditional IRA. Select Cash Account.

- Verify your identity. Enter your SSN, ID details, and address.

- Link your bank account via ACH.

- Start a small transfer ($50 is fine) to test the connection.

- Turn ON dividend reinvestment (DRIP). This automatically buys more shares with the dividends your investments pay out.

- Turn OFF margin, options, and day-trading permissions. You can revisit these later if needed.

- Add a beneficiary and set up paperless statements.

Tip: If you searched “open a brokerage account fast,” this is your exact checklist. Copy it, then do it.

Stop 4: Your First Investment – A Simple, Strong Start

I wanted a strategy I could actually stick to. Here is the “buy the haystack” plan:

- U.S. Total Stock Market fund (your core holding)

- International Total Stock Market fund (for global diversification)

- U.S. Total Bond Market fund (for stability)

Placing Your First Order: 30-Second Script

- Search for your fund’s ticker symbol (e.g., VTI).

- Order Type: Market is fine for small, long-term buys. (Use a Limit order if you want to set a specific price).

- Quantity: Enter a dollar amount (for fractional shares) or a number of shares.

- Timing: During market hours is simplest.

- Tap Buy and confirm. That’s it!

Your 3-Fund Starter Pack (by Broker)

Here are popular, low-cost ETF options at major brokerages.

- Vanguard:

- U.S. Stock: VTI

- International Stock: VXUS

- U.S. Bond: BND

- Fidelity:

- U.S. Stock: ITOT

- International Stock: IXUS

- U.S. Bond: AGG

- Schwab:

- U.S. Stock: SCHB

- International Stock: SCHF

- U.S. Bond: SCHZ

Note: This is for educational purposes, not advice. Always check the current expense ratios and trading costs before buying.

Example Allocations (For Education Only)

- 15+ Year Timeline: 80% Stocks / 20% Bonds

- 5-10 Year Timeline: 60% Stocks / 40% Bonds

- “Sleep-Well” Option: 50% Stocks / 50% Bonds

Rebalance once a year. As your goal gets closer, increase your allocation to bonds.

Cost Translator: Fees in Plain Dollars

An expense ratio of 0.03% costs you just $3 per year for every $10,000 you have invested. Tiny fees matter over decades.

Your 30-60-90 Day Stick-With-It Plan

- Day 1-30: Automate your deposits. Make one small buy to get started.

- Day 31-60: Read your plan once. Change nothing.

- Day 61-90: Confirm your automation is running. Schedule your once-a-year rebalance in your calendar.

The $5 Test

Make a single $5 purchase of your chosen fund today. It’s not about the amount; it’s about breaking the inertia. Then, turn on a small weekly auto-deposit.

Beginner Mistakes to Avoid When You Open a Brokerage Account Fast

- 🚫 Jumping to margin before you understand the risks.

- 🚫 Stock picking first instead of learning with low-cost index funds.

- 🚫 Letting cash pile up unintentionally. Set up automation.

- 🚫 Chasing hot tips instead of following your written plan.

- 🚫 Ignoring account types (IRA vs. Taxable) and their tax implications.

One-Page Printable Checklist (for your Snapshot)

Prep (60 min)

- [ ] Define goal: Retirement → IRA or 5-10 yr goal → Taxable

- [ ] Choose Cash, not Margin

- [ ] Pick broker (check fees, ease of use, support, SIPC status)

- [ ] Gather docs: SSN, ID, Address, Employment info

Application (15 min)

- [ ] Create account (Taxable, Roth IRA, or Traditional IRA)

- [ ] Review disclosures & verify identity

- [ ] Link bank via ACH and start a transfer

First Investment (10 min)

- [ ] Choose tickers from your broker’s lineup

- [ ] Place a small test buy

- [ ] Automate future deposits (e.g., weekly)

Stay on Track

- [ ] Rebalance annually

- [ ] Re-read your written plan before making any changes

- [ ] Avoid margin and hot tips

With the prep done and a simple first buy, you can open a brokerage account fast and start investing on autopilot. Bookmark this guide and the checklist so your next account takes even less time.

FAQs

Q: Can non-citizens open a U.S. brokerage account? A: Sometimes. Policies vary by firm. You will usually need a U.S. address and tax forms like the W-8BEN. Check the broker’s eligibility page before you apply.

Q: Can I open an account with an ITIN instead of an SSN? A: Some brokers accept an ITIN, but many do not. Confirm the broker’s policy before starting the application.

Q: How do I open an investment account for a minor? A: Look into custodial accounts like an UGMA or UTMA. If the child has earned income, a custodial Roth IRA may be possible.

Q: I have a 401(k) match. Should I still open a separate brokerage? A: Many people capture their full employer match first, as it’s free money. A separate brokerage account can then be used for goals your 401(k) doesn’t cover. This is educational info, not personal advice.

Q: Can I transfer my account to another broker later? A: Yes. Most U.S. brokers support ACATS transfers. Ask about any transfer-out fee before you open the account.

Q: What documents do I need to open a brokerage account? A: You will usually need your SSN or ITIN, a government-issued ID, your permanent address, employment status, and basic financial information (income/net worth).

About the Author

Investi-Buddy is a fellow beginner who documents everything he is learning. He turns expert-speak into simple, safe, actionable steps. No affiliates and no hype. Just careful research, plain English, and habits that compound.

Disclosures, Safety Notes and Methodology

- Education only. I am not your advisor, and this is not personal financial, tax, or legal advice.

- Risk. All investing involves risk, including the possible loss of principal.

- SIPC. Protects against brokerage failure up to $500,000 total ($250,000 for cash). It does not protect against market loss.

- Methodology. I verify terms and definitions with primary sources, avoid affiliate links, and keep an update log below.

Update Log

- 2025-08-10: First publication. Glossary near the top, broker deal-breakers, 30-60-90 plan, myth vs fact, 5 Dollar test, expanded FAQ, ACH micro-answer, and image plan inserted.

Master Reference List

- DALBAR. (2024). 2024 QAIB: Quantitative analysis of investor behavior. DALBAR, Inc.

- Board of Governors of the Federal Reserve System. (2021). The retail investor revolution. FEDS Notes.

- Financial Industry Regulatory Authority (FINRA). (n.d.). FINRA Rule 2090: Know your customer.

- Internal Revenue Service. (2023, November 1). 401(k) limit increases to $23,000 for 2024, IRA limit rises to $7,000.

- Securities Investor Protection Corporation (SIPC). (n.d.). What SIPC protects.