Case Studies: 3 Lessons in Investor Psychology from Market History

Welcome back to our deep dive into investor psychology!

In Part 1, we put a name to the enemy. We identified the seven key psychological traps—from the sneaky pull of Overconfidence to the powerful current of Herd Mentality—that are constantly trying to sabotage our financial goals.

But let me ask you a question: does this stuff actually matter in the real world? Or is it just interesting theory?

Here’s the deal: it matters more than we can possibly imagine. Now that we’ve met the villains, let’s look at the crime scenes. We’re about to become financial detectives, and to do that, you need to put yourself in the shoes of the investors who lived through these moments.

📈 Case Study #1: A Lesson in Investor Psychology from a Sock Puppet

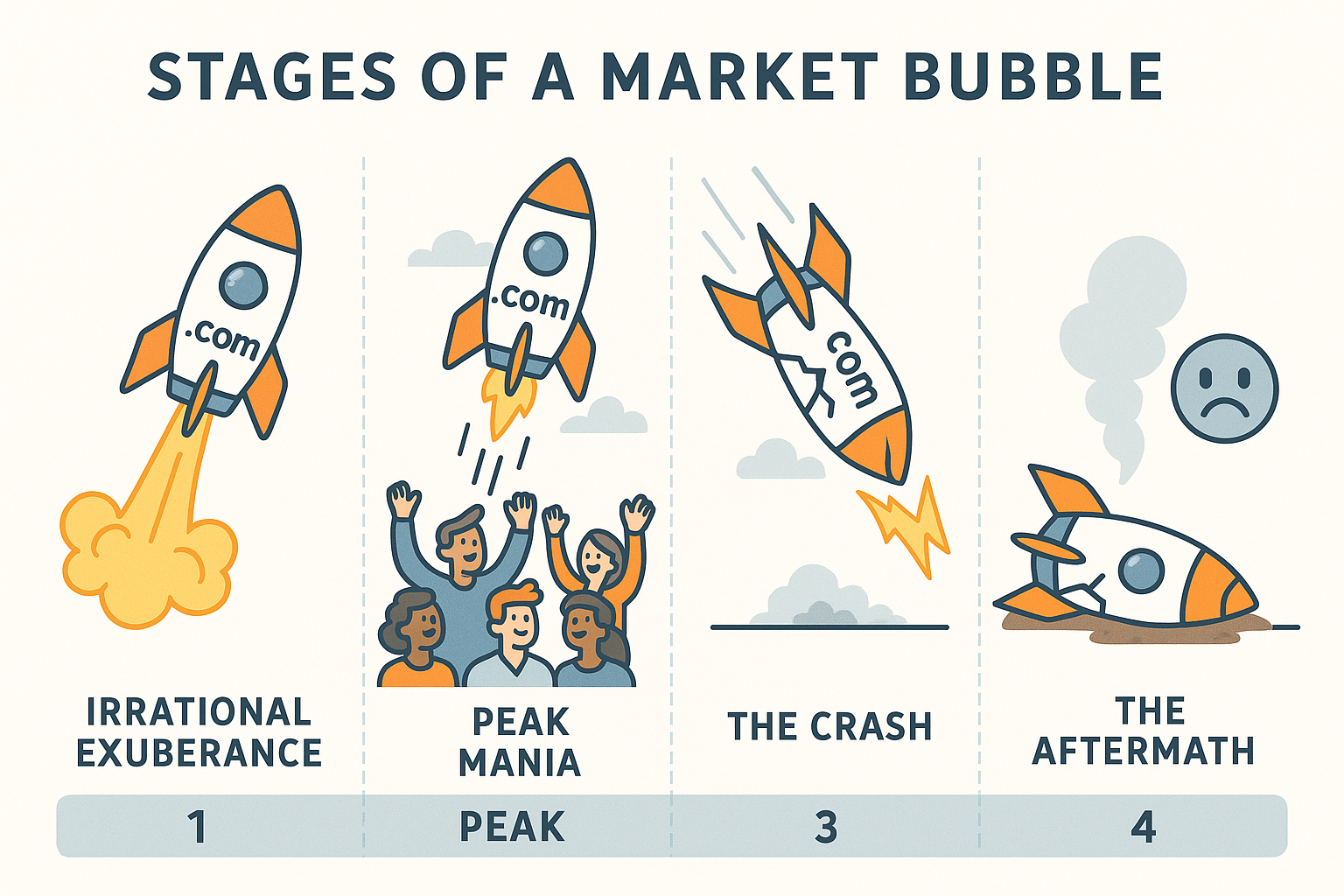

Let’s try a quick experiment. Imagine it’s 1999. The internet is brand new, and it feels like a digital gold rush is happening right before your eyes. Your friends are telling you about tiny companies with “.com” in their name that are doubling in value every week. Everyone believes in a “new economy” where old rules like profits don’t matter anymore. What do you do?

This was the real-life backdrop for a classic story of Overconfidence and Herd Mentality.

The poster child for this era was a company called Pets.com. Their business model was a complete disaster: they tried to sell low-margin pet supplies, like heavy bags of dog food, and ship them to individual customers, often for free. Despite this, the company spent a lot on marketing, including a memorable Super Bowl ad featuring its sock puppet mascot.

“Investors, swept up in a collective frenzy, poured billions of dollars into ‘dot-com’ companies, many of which had no revenue, no profits, and no viable business model.”

Why? Because the herd was moving, and investors, blinded by Confirmation Bias, pointed to soaring stock prices as proof that the model worked, while ignoring the complete absence of profits. Pets.com went public in February 2000, raising $82.5 million. Just nine months later, it was bankrupt.

It became a symbol of an era when a compelling narrative completely overpowered rational analysis—a classic lesson in investor psychology.

Key Takeaway: The Dot-Com Bubble

A compelling story (“the new economy!”) combined with Herd Mentality and Overconfidence created a speculative frenzy. Investors chased rising prices instead of analyzing actual business value, leading to catastrophic losses.

The question to ask yourself: “Am I investing in a solid business, or am I just buying into a popular story?”

🏛️ Case Study #2: What Really Caused the 2008 Financial Crisis?

Now, imagine you’d been told your whole life that housing prices were the safest investment you could possibly make. It was a one-way bet that could only go up. Banks were offering easy credit, and everyone you knew seemed to be making a fortune.

This was the environment that led to the 2008 crisis, a two-act tragedy of Confirmation Bias followed by pure Loss Aversion.

For years, the entire system operated on that single, powerful belief. Financial institutions, like insurance giant AIG, exhibited profound Overconfidence. They sold tens of billions of dollars’ worth of “insurance” on mortgage-backed securities called credit default swaps (CDS), believing the assets were “money-good” and could not fail. They were trapped in an echo chamber of their own making.

Then, the bubble burst.

“The crisis solidified a deep-seated fear of the stock market, driven by extreme Loss Aversion.”

When housing prices faltered, credit rating agencies downgraded AIG’s debt, triggering clauses that required them to post billions in cash they simply did not have. The firm collapsed, threatening to take the entire global financial system with it until the government stepped in with a massive $85 billion bailout.

For millions of people, the intense pain of the crash triggered extreme Loss Aversion. They sold everything in a panic, locking in their devastating losses at the worst possible moment and missing the powerful recovery that followed.

Looking back, it seems so obvious, doesn’t it? But here’s an uncomfortable question that gets to the heart of investor psychology: If everyone around you—your friends, the financial news, the banks—was getting rich from an asset that ‘couldn’t go down,’ would you have had the courage to be the only one to say ‘no’?

🎮 Case Study #3: How Did a Meme Stock Create (and Destroy) Fortunes?

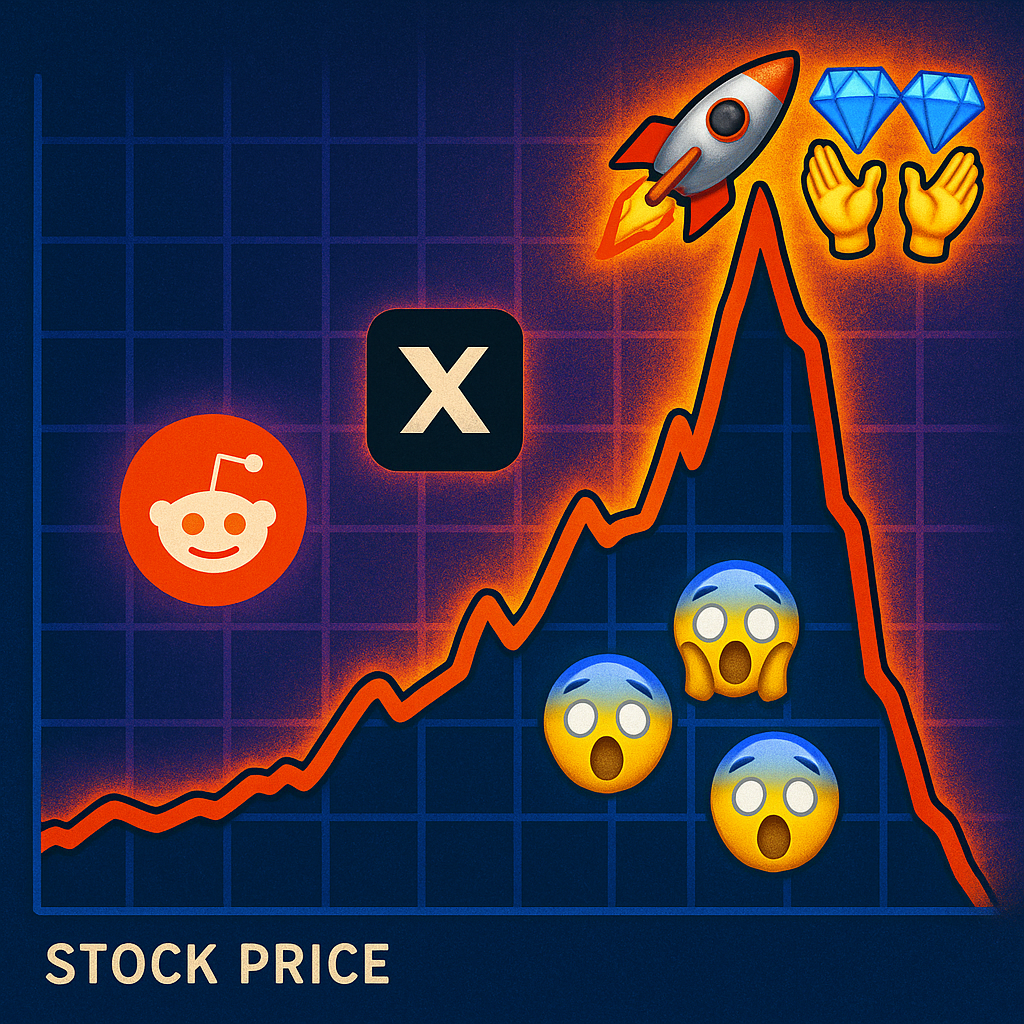

Ever felt that intense FOMO seeing a stock or a crypto coin explode on social media? You’re feeling the exact same emotion that fueled the GameStop saga of 2021.

This was a perfect example of Herd Behavior amplified for the modern age.

A community on Reddit, WallStreetBets, decided to band together to buy shares of the struggling retailer, aiming to cause a “short squeeze” against hedge funds that had bet against the company. It was a captivating “David vs. Goliath” story, but it quickly spiraled out of control.

“They weren’t buying a business; they were buying a meme.”

As the stock price began its unprecedented ascent, thousands of investors, driven by pure FOMO, piled in without any analysis. The fear of being the only one not on the rocket ship was overwhelming.

The bottom line is: while some early players made a fortune, many who joined the herd late and bought in at the peak, driven by social media hype, were financially devastated when the excitement faded and the stock came crashing back to earth.

Check Your Understanding:

A friend tells you about a “guaranteed” hot new crypto project they saw on TikTok. You don’t understand the technology, but you see its price is soaring and feel an intense urge to buy immediately so you don’t miss out. This feeling is a classic sign of:

A) Overconfidence B) Herd Mentality (FOMO) C) Sunk Cost Fallacy

(The answer is B! The fear of missing out and the desire to follow the crowd, especially when fueled by social media, are powerful drivers of Herd Mentality.)

The “So What?” Bridge: You might think that was a once-in-a-lifetime event. But the psychology is universal. The platform was Reddit and the asset was GameStop. Tomorrow, the platform could be TikTok and the asset could be something else entirely. The technology changes, but the core traps of investor psychology are always the same.

So, here’s my new rule for myself: If my primary reason for wanting to buy something is because its price is going vertical and it’s all over social media, I’m not allowed to touch it for at least 72 hours. That cooling-off period gives the FOMO a chance to fade and my rational brain a chance to catch up.

Coming up in Part 3…

So, the evidence is undeniable.

From the mass delusion of market bubbles to the social media frenzy of meme stocks, these lessons in investor psychology have proven time and again that they are the most dangerous force in our financial lives.

We’ve seen the damage. We’ve examined the crime scenes. The question now is, what are we going to do about it? How do we fight back against our own, hardwired instincts?

In our final installment, Part 3, we build the solution. We will assemble a complete, practical toolkit of systems, habits, and mental models from the world’s greatest investors to help you conquer these biases and finally win the inner game of investing.

Our Archives

4-1: The 7 Hidden Mind Traps Secretly Sabotaging Your Portfolio

References for Part 2

Greenwald, B., & Kahn, J. (2009, Spring). What went wrong at AIG? Kellogg Insight. Retrieved from https://insight.kellogg.northwestern.edu/article/what-went-wrong-at-aig

Hargrave, M. (2022, November 28). Why did Pets.com fail? Investopedia. Retrieved from https://www.investopedia.com/ask/answers/08/dotcom-pets-dot-com.asp

Medium. (2024, April 10). The overconfidence trap: How a math whiz lost it all.

U.S. Securities and Exchange Commission. (2021). Staff report on equity and options market structure conditions in early 2021. Retrieved from https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf