How to Start Investing: The 3-Part Journey to Making Your Money Grow

Last reviewed: Aug 2025 · Independence: No affiliate links, no payment from either broker · For education, not advice

My Promise (The Investibuddy)

I’m not an expert. I’m a fellow beginner who tests with small amounts, practices risky features in a simulator first, and double-checks details in official docs. I don’t take referral fees for this comparison. When something confuses me, I say so and translate it into plain English. I reviewed each app’s public help pages the week of August 5, 2025 and saved screenshots. My promise: clear explanations, beginner-safe steps, and no hype. If I learn something new, I’ll update this and explain what changed.

Last reviewed: August 1, 2025.

Hello! It’s your Investi-Buddy. If you’re ready to learn how to start investing but feel overwhelmed by all the options, you’ve come to the right place. For a long time, I thought “saving” and “building wealth” were the same thing. It turns out, they’re not even close.

It turns out, they’re not even close.

After realizing my own savings account was in a losing battle I didn’t even know it was fighting, I went on a deep dive. I wanted to understand the whole journey, from protecting the money I have to actively making it grow. This guide is the result of that journey. It’s a simple, three-part roadmap designed to take you from understanding the problem, to building a safe foundation, and finally, to taking the exciting next step of becoming an investor.

So, let’s begin with the problem I discovered.

New to This? Here Are a Few Key Terms:

- Inflation: The rate at which the cost of living increases, reducing the purchasing power of your money.

- High-Yield Savings Account (HYSA): A type of savings account, usually from an online bank, that pays a much higher interest rate than a traditional one.

- Brokerage Account: An account you open to buy and sell investments like stocks and ETFs.

- ETF (Exchange-Traded Fund): A type of investment that holds a “basket” of many different stocks, allowing you to easily diversify.

Part 1: The Problem – Understanding the Silent Thief in Your Wallet

My “Aha!” Moment: The First Step in How to Start Investing

When you first start saving money, it’s crucial to understand a powerful force called inflation and how it impacts your long-term goals. For years, I believed the most responsible thing I could do was save, imagining my savings account was a safe fortress. Soon enough, however, I was hit with a nagging question: Is my money really growing in there, or is it just… sitting? This simple question led me to finally figure out what inflation is, and I was shocked to realize my money was in a losing battle.

What is Inflation? The “Invisible Tax” on Your Money

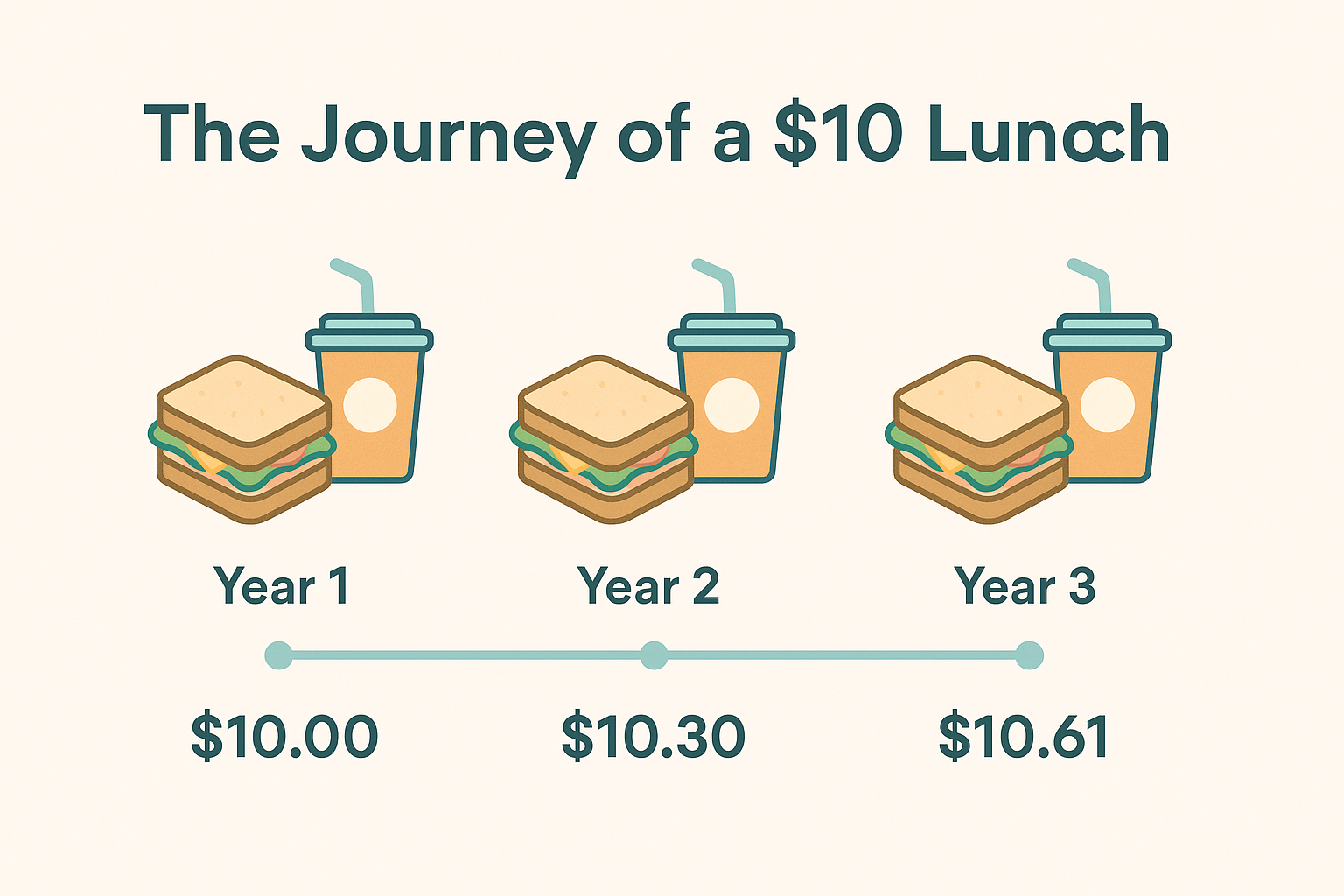

To put it simply, inflation is the rate at which average prices for everything—from gas to groceries—rise over time. As a result, the purchasing power of your money falls. To make that real, just think about a simple lunch.

This is why a famous saying from investor Warren Buffett really hit home for me. According to Buffett, inflation is “a far more devastating tax than anything that has been enacted by our legislature. The inflation tax has a fantastic ability to simply consume capital.”

Thinking of it as an “invisible tax” or a “silent thief” made it all click. It’s a force that silently eats away at our savings, even when the balance in our account doesn’t change.

But Isn’t Some Inflation “Good” for the Economy?

You might hear on the news that a little inflation is a good thing, and for the overall economy, that’s generally true. It encourages people and companies to spend and invest rather than hoard cash. But for your personal savings sitting in a standard bank account earning next to nothing, the effect is almost always negative. That’s the key difference we’re focused on here—protecting your personal purchasing power.

What is Inflation Doing to Your Purchasing Power?

So, if inflation is the villain, my savings account interest must be the hero, right? Unfortunately, this is where the story got disappointing.

Now, a bank account does have crucial benefits. Thanks to FDIC insurance, it’s safe, and the money is liquid, meaning you can get it easily in an emergency. However, when it comes to growth, it falls dangerously short.

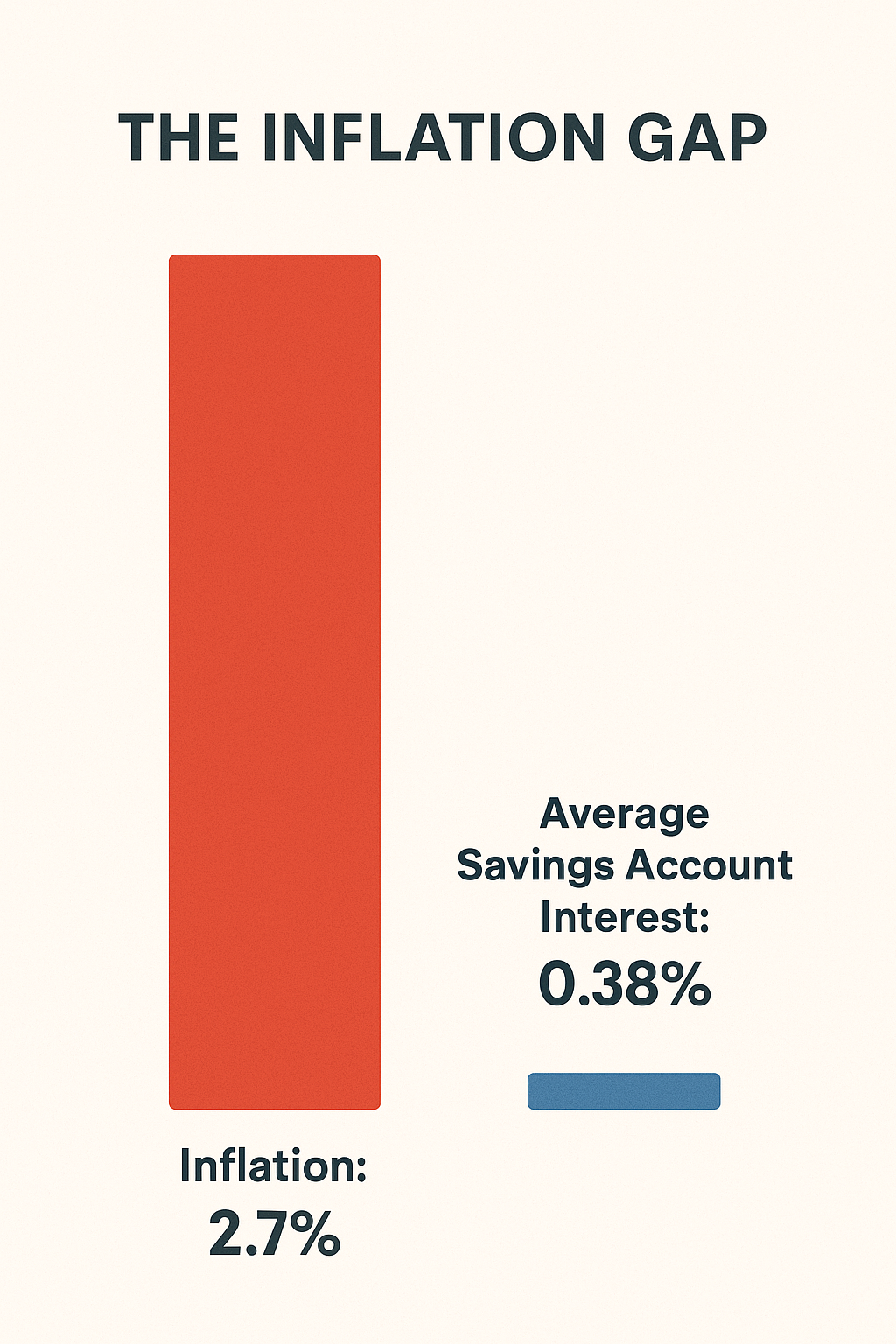

Recent data shows the annual inflation rate was 2.7%. To keep up, your savings need to grow by at least that much. But what was the national average interest rate for a standard savings account? A measly 0.38% APY. This next image shows that gap perfectly.

When you see the numbers side-by-side, it’s obvious we’re losing ground. The real math makes it even clearer.

The Real Math: Calculating Inflation’s True Cost

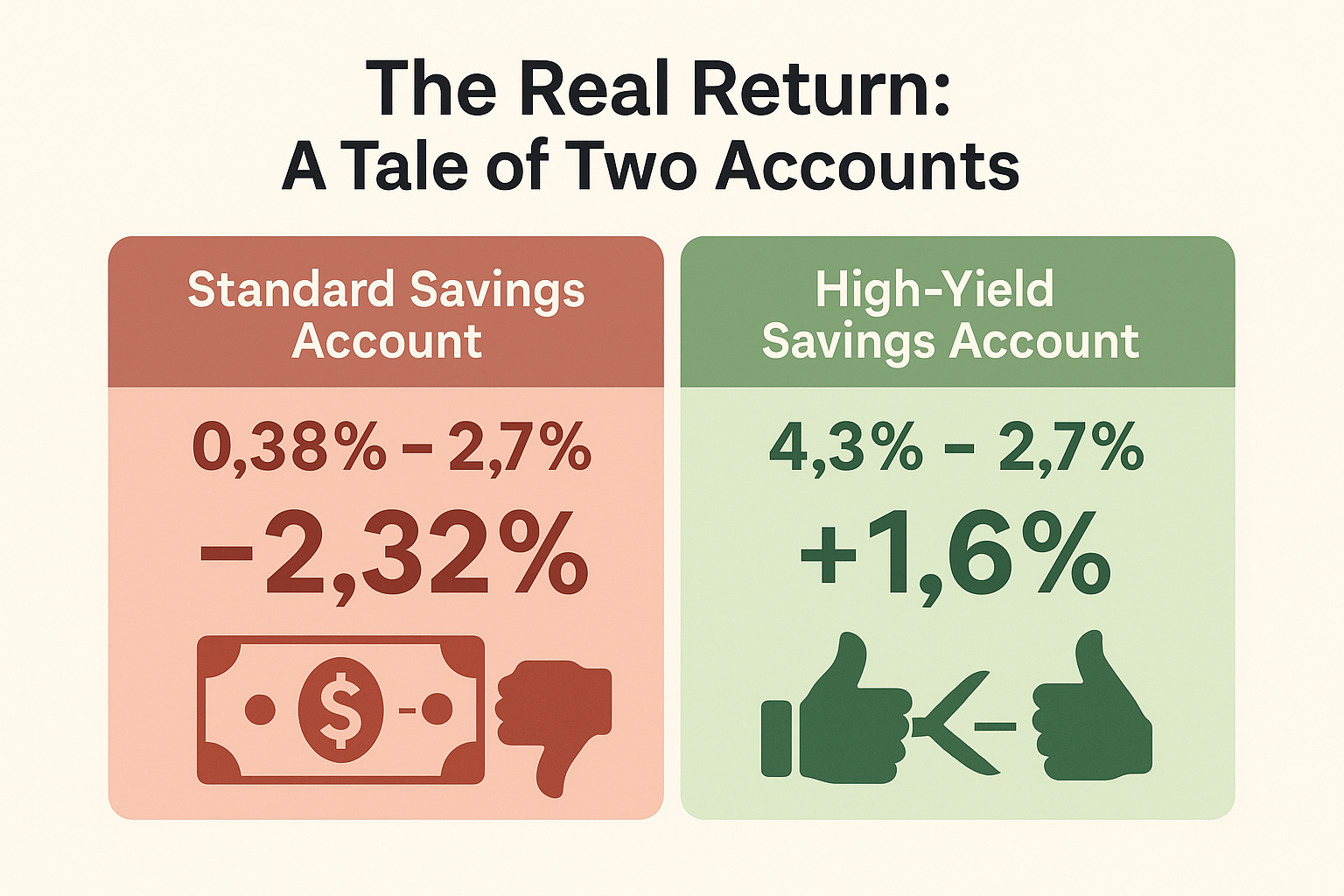

This brings us to a crucial concept: the real rate of return. This simple formula tells you if your money’s purchasing power is actually growing or shrinking.

Real Rate of Return = Interest Rate − Inflation Rate

Let’s plug in the numbers:

0.38% (Interest Rate) − 2.7%(Inflation Rate) = −2.32%

Let’s make that feel real. Imagine you have $10,000 saved up for a down payment on a car you plan to buy next year. If your purchasing power shrinks by 2.32%, that means at the end of the year, your $10,000 can only buy what $9,768 could have bought at the start. You’ve effectively lost $232 in real-world buying power without spending a single dime. That is the “silent thief” in action.

Seeing that negative number is the real “aha!” moment. It means that even though I was earning a little interest, my money’s actual purchasing power was shrinking by over 2% every single year. It proves that a standard savings account is in a losing battle.

When I first did that math, I felt a little defeated. But here’s the crucial thing I learned: this is not a battle we have to lose. In fact, there are simple and powerful tools we can use to fight back and win. Understanding this is the true first step in learning how to start investing.

Key Takeaways from Part 1:

- Inflation is a “silent thief” that constantly reduces the real value (purchasing power) of your savings.

- A standard savings account is not a tool for growth; its interest rate typically fails to keep up with inflation, resulting in a negative “real rate of return.”

- To truly protect your money, you need a strategy that earns an interest rate that is higher than the rate of inflation.

Part 2: The Solution – Building a Strong Financial Foundation

Introduction: It’s Time to Fight Back with a Better Account

In Part 1, we faced a tough reality: money in a standard savings account is losing value. Now, it’s time for the empowering part. The easiest and most effective way to fight back is by upgrading your account. In this part, we’ll explore why a high-yield savings account (HYSA) is your most powerful first step.

Your Best Upgrade: The High-Yield Savings Account (HYSA)

After discovering the problem with my old account, I asked myself, “Okay, is there a better type of savings account?” The answer was a resounding YES. Let me introduce you to the hero of our story: the High-Yield Savings Account (HYSA).

An HYSA is exactly what it sounds like: a savings account that pays a much, much higher interest rate. The reason they can offer such great rates is that most of them are from online-only banks. Because they don’t have the high costs of running physical branches, they can pass those savings on to us.

Let’s run our “Real Rate of Return” math again, this time with a competitive HYSA rate.

4.3% (HYSA Rate) − 2.7% (Inflation Rate) = 1.6%

Now we’re talking! For the first time, our money isn’t just surviving; it’s actually growing faster than inflation.

What to Look For When Choosing an HYSA (A Quick Checklist)

When you search online, you’ll see a lot of options. Here’s a simple checklist to make sure you pick a great one:

- A Competitive APY (Interest Rate): This is the main reason you’re switching, so make sure the rate is high.

- No Monthly Fees: Your interest earnings are precious; don’t let a monthly “maintenance fee” eat them up. A good HYSA has no monthly fee.

- FDIC Insured: This is non-negotiable. It means your money is protected by the federal government up to $250,000.

- Easy Online and Mobile Access: The best HYSAs are online-only. Make sure their app has good reviews and that it’s easy to transfer money in and out.

Tools Beyond a High-Yield Savings Account

Once you have your HYSA as a foundation, you can use other specialized tools for specific goals.

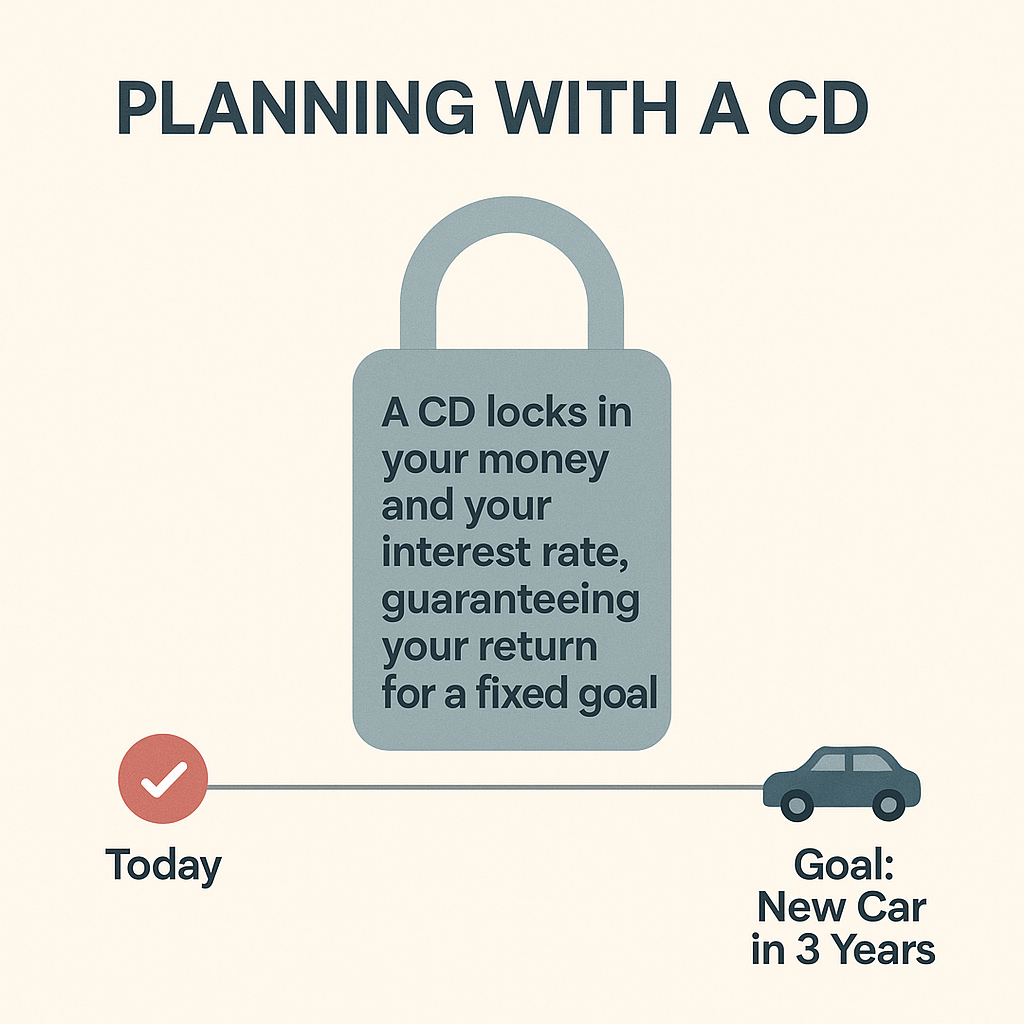

- Certificates of Deposit (CDs): For a Fixed Goal. A Certificate of Deposit (CD) is a type of savings account where you agree to lock your money away for a specific period, or “term” (e.g., 1 year, 3 years). In exchange, you get a fixed, guaranteed interest rate that is often higher than an HYSA’s. The trade-off is that your money is locked up—you can’t easily withdraw it before the term ends without paying a penalty. This makes it perfect for a goal where you know you won’t need the cash before a specific date, as it protects you from the temptation of spending it.

- Series I Savings Bonds (I-Bonds): The Ultimate Inflation Shield. The U.S. Treasury sells a special tool called an I-Bond, which is specifically designed to protect your money from inflation. Its interest rate actually adjusts based on the rate of inflation, so your purchasing power is protected. The main rule to know is that you cannot touch the money for at least one year, and if you withdraw it before five years, you lose a bit of interest. This is why they are best for long-term goals where you know you can let the money sit and grow safely.

A Smart Strategy: The Three-Bucket Plan

With all these options, it’s easy to get overwhelmed and do nothing at all—a state known as “analysis paralysis.” To avoid this, I use a simple “bucket” system to give every dollar a job, starting with an HYSA as the foundation.

- Bucket 1: Emergency Fund (3-6 months of expenses). This money needs to be safe and easy to access.

- Perfect Tool: High-Yield Savings Account.

- Bucket 2: Short-Term Goals (1-5 years). This is for a specific goal, like a down payment on a house.

- Perfect Tool: Certificate of Deposit (CD).

- Bucket 3: Long-Term Goals (5+ years). This is money you won’t need to touch for a long time.

- Perfect Tool: Series I Savings Bonds (I-Bonds).

Okay, I know that “three-bucket” idea might sound a little abstract. To make it super simple and actionable, I’ve created a one-page worksheet that you can download and fill out today. It will walk you through calculating your emergency fund and planning your own savings goals. It’s the exact tool I use to keep my own savings organized.

➡️ [Download a Free PDF: My 3-Bucket Savings Plan Worksheet]

This strong foundation is the launchpad, not the rocket ship. So, in Part 3, we’ll explore the exciting next step and learn how to start investing for true growth.

Key Takeaways from Part 2:

- A High-Yield Savings Account (HYSA) is the best first step for your cash savings, offering much higher interest rates that can beat inflation.

- Organize your money using the “Three-Bucket Plan”: an HYSA for your emergency fund, CDs for short-term goals, and I-Bonds for long-term protection.

- Having a clear plan for your savings is the essential foundation you need before you can start investing for growth.

Part 3: The Next Level – How to Start Investing in Stocks

Introduction: Entering the Next Level

After building our safe financial foundation, I knew the next logical step was learning how to start investing in stocks. This topic used to feel incredibly overwhelming, almost like a members-only club for experts. However, after doing a deep dive, I realized getting started is far easier than we think. My goal for this final part is to share my notes and demystify the basics for you.

First, What Is a Stock? (A Beginner’s Guide)

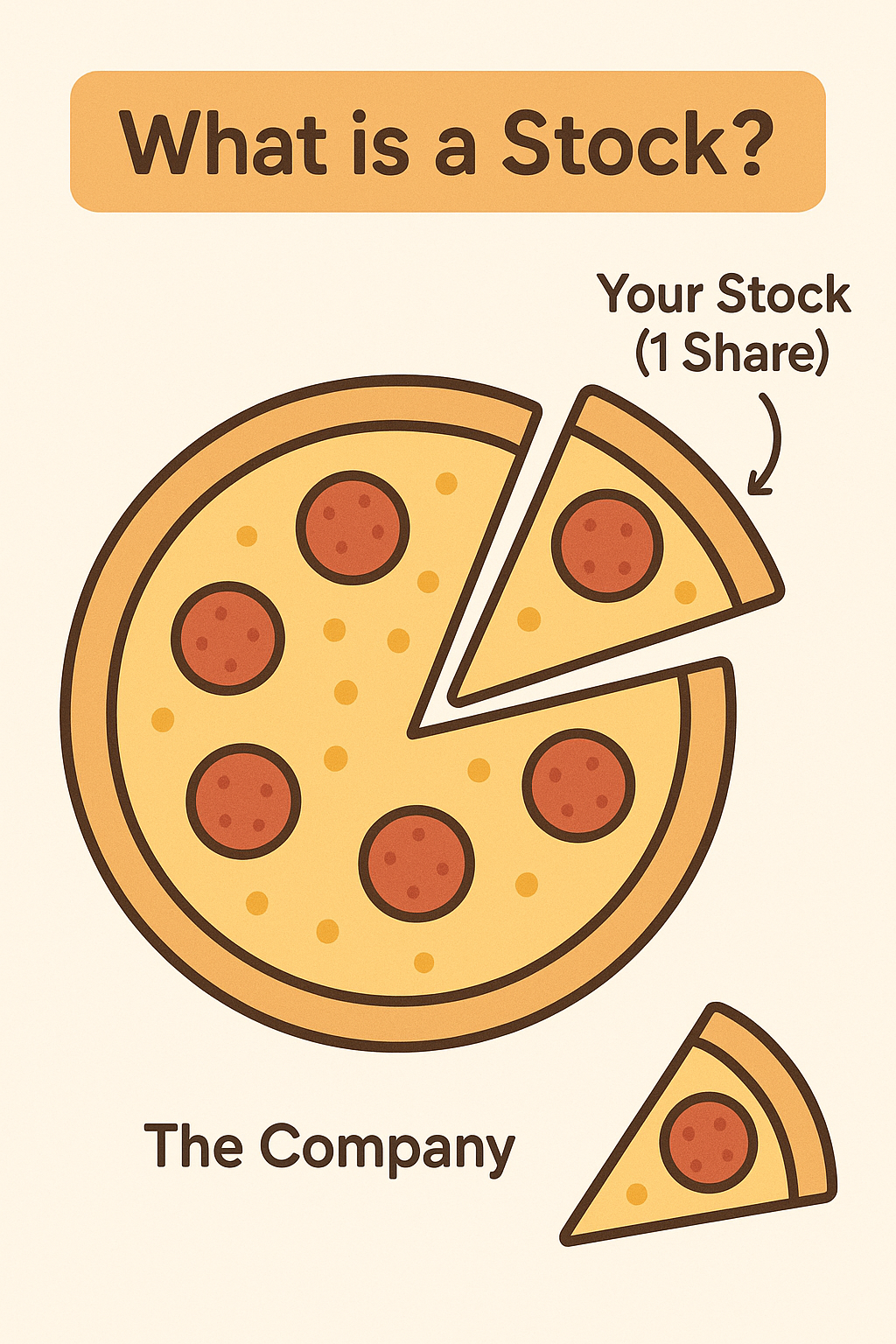

Before we can learn how to invest, we have to understand the basic building block: a stock. Forgetting all the complicated jargon, the idea is very simple. A stock is just a small piece of ownership in a company.

Why is Investing in Stocks a Powerful Strategy?

At this point, you might be thinking, “My HYSA is safe and beating inflation. Why take the extra risk with stocks?” The answer is the chance for much higher growth through the power of compounding. An HYSA is designed for safety. In contrast, the stock market is designed for growth.

Compounding is what happens when the money you earn starts earning its own money. This creates a powerful snowball effect over time.

A Quick, Honest Word on Risk and Mindset

It’s really important to be honest here: unlike a savings account, the value of your investments in stocks will go up and down. You will have days, weeks, or even months where your account balance is lower than what you put in. Seeing that can be scary, and it’s completely normal to feel that way.

The key is to remember your mindset: you are not a short-term gambler; you are a long-term owner of great businesses. The strategies we’ve discussed—like diversification and dollar-cost averaging—are specifically designed to help you ride out these waves without panicking, so you can benefit from the long-term growth.

How to Start Investing: The Simple Toolkit

Getting started is not as hard as it sounds. You really only need two things.

- Your “Bank Account” for Stocks: A Brokerage Account. You can’t buy stocks through a regular bank; instead, you need a special account called a brokerage account. This account is your gateway to the world of investing. Think of it as a bank account specifically made for buying and selling investments. You can open one online in minutes with trusted companies like Fidelity, Vanguard, or Charles Schwab.

- Don’t let the name intimidate you; opening a brokerage account today is as easy as opening a simple online bank account. You’ll typically just need your Social Security number, a driver’s license for identity verification, and your bank account details to transfer funds. The entire process is guided, secure, and usually takes less than 15 minutes.

- Your First Investment: Index Funds & ETFs. Now for the big question: what stocks should you buy? For beginners, the easiest and most effective strategy is to buy the whole market by using an index fund.

A Smart Strategy for How to Start Investing: Dollar-Cost Averaging

The final piece of the puzzle isn’t what to buy, but how to buy it. The best strategy for beginners is called dollar-cost averaging. It sounds fancy, but it just means investing a fixed amount of money at regular times (for example, $100 every month), no matter what the market is doing. This simple habit removes the stress of trying to “time the market” and ensures you are consistently building your wealth over the long term.

How to Start Investing: Answering Your Top Questions

1. How much money do I actually need to start investing? Honestly, you can start with as little as $5 or $10. Thanks to fractional shares and zero-commission trading, the old barrier of needing thousands of dollars is gone. The most important thing is to build the habit, not the amount.

2. Are online-only banks for HYSAs safe? Yes. As long as the bank is FDIC Insured, your money is protected by the federal government up to $250,000. This is the same protection the biggest traditional banks have.

3. What happens if I pick the “wrong” investment and lose money? First, by starting with a broad S&P 500 ETF, you are avoiding the risk of a single company performing poorly. Second, remember the mindset: you are a long-term investor. The market will have down years, but over a long period, it has historically always recovered and gone up.

Conclusion: Your Journey as an Investor

When we started, I told you about my own “aha!” moment—the realization that my hard-earned savings were in a losing battle. We have come a long way since then. Together, we’ve exposed the ‘silent thief’ of inflation, built a strong defensive foundation, and demystified the first steps of how to start investing.

The path forward is no longer a mystery. You have the map, you have the tools, and you are in control of your financial journey. You’re not just a saver anymore—you’re an investor. I’m excited for you. Now, go get started.

Your Action Plan: How to Start Investing

- Open a High-Yield Savings Account and set up an automatic transfer to start building your emergency fund.

- Download the “3-Bucket Plan” PDF and fill it out to give your savings goals a clear purpose.

- Open a Brokerage Account and set up a recurring transfer of a small amount (even just $25 a month!) to buy a diversified S&P 500 ETF.

Key Takeaways from Part 3:

- Investing in stocks (which means owning small pieces of companies) is the most powerful and proven strategy for building significant long-term wealth.

- The simplest way to start is to open a brokerage account and buy a diversified, low-cost ETF that tracks the entire market (like the S&P 500).

- Use dollar-cost averaging—investing a fixed amount of money on a regular schedule—to build wealth consistently and remove the stress of trying to time the market.

SEE ALSO…

The One “Unfair Advantage” Every Rich Person Understands

It starts small, feels boring, and is ignored by most. But the force of compound interest is the single most powerful engine for building wealth. This guide demystifies the ‘magic’ and shows you how to start your own snowball.

I Obsessed Over Stocks vs. Real Estate So You Don’t Have To

Paralyzed by the choice? I was too. After weeks of research, I found the ‘legal cheat code’ and surprising compromises that led to a clear winner for beginners. This is my complete playbook.

Your Brain is a Terrible Investor. Here’s the Fix.

The biggest threat to your wealth isn’t a market crash—it’s the 7 hidden biases in your own mind. This is a brutally honest look at the enemy in the mirror and the proven playbook you need to win.

REFERENCES

- Bankrate. (2025a, July 24). Average savings interest rates.

- Cabello, M. (2025, June 30). High-yield savings rates today: June 30, 2025. Bankrate.

- CBS News. (2025, July 24). What are today’s savings interest rates?.

- Fidelity. (n.d.). What is an ETF?. Retrieved July 26, 2025.

- Goodreads. (n.d.). A quote by Warren Buffett.

- Investopedia. (2023, September 28). Analysis paralysis: Definition, risks, and how to fix.

- Investopedia. (2025, July 1). How to start investing in stocks: A beginner’s guide.

- Investopedia. (2025, June 20). S&P 500 Index: What it is, how it works, and its historical returns.

- Investopedia. (2025b, June 15). What is a certificate of deposit (CD)? Pros and cons.

- NerdWallet. (2025, July 15). How to invest in stocks.

- NerdWallet. (2025, July 10). Best high-yield online savings accounts of July 2025.

- TreasuryDirect. (n.d.). I bonds interest rates. Retrieved August 3, 2025.

- U.S. Bureau of Labor Statistics. (n.d.). 12-month percentage change, consumer price index, selected categories.

- U.S. Federal Deposit Insurance Corporation. (n.d.). Deposit Insurance. Retrieved August 3, 2025.

- Vanguard. (n.d.). What is a brokerage account?. Retrieved July 26, 2025.

Update Notice: I re-review quarterly so this stays fresh. If you want a nudge when I update Part 2, tell me and I’ll add a quick note at the top next time.

Disclaimer: This article is for informational and educational purposes only and should not be considered financial or investment advice. I am not a financial professional, and this content reflects my own research and learning journey. Investing involves risk, including the possible loss of principal. Always conduct your own research and consult with a qualified financial professional before making any investment decisions.

Dong Woo is a retail investor and the founder of TheFinSense.io. After feeling overwhelmed by the complexity of modern investing apps himself, Dong Woo founded TheFinSense.io with a single mission: to be the ‘investibuddy’ he wished he’d had. He’s not a licensed advisor, but a meticulous researcher who translates his own hands-on testing and learning journey into clear, safe, and actionable steps for beginners. His work is dedicated to the belief that the best way to build wealth is through consistent habits, not hype.