Part 2: Choosing a Stock Broker — The Test Drive

Alright, we’ve covered the crucial costs. Now for the fun part of choosing a stock broker: the test drive.

What’s it actually like to use these platforms every day?

Can’t Afford Amazon or Tesla? Here’s the Hack That Unlocks Wall Street.

Have you ever seen a stock like NVIDIA or Amazon trading for hundreds of dollars and felt completely priced out? This used to be a massive barrier for new investors. Fractional shares changed everything. This isn’t just a feature; it’s the democratization of investing. It means you can own the companies you actually use and believe in, even if you only have $20 to start. And their approaches couldn’t be more different.

- 🏆 Fidelity: The People’s Champion. They get it. You can buy a piece of over 7,000 stocks with just $1. They want you in the game.

- 🤔 Charles Schwab: The Velvet Rope. You’re allowed in, but only to the S&P 500 section, and you need $5. It’s good, but not great.

- ❌ Vanguard: The Old School Gatekeeper. They simply don’t offer this for individual stocks. For a beginner who wants to own specific companies, this is a deal-breaker.

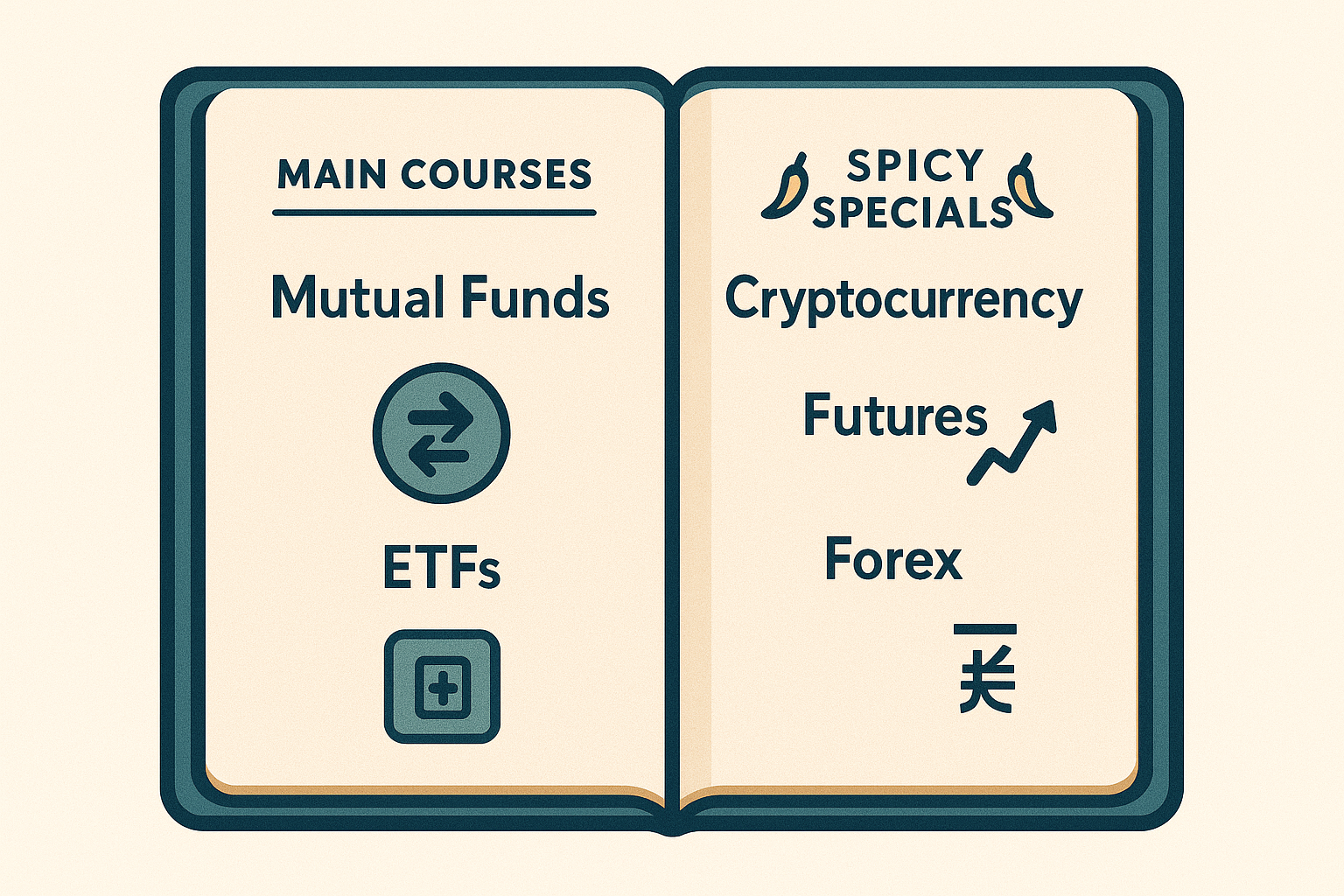

From Safe Bets to Spicy Gambles: A Look at the Menu

Think of these brokers as three different restaurants.

- Vanguard’s Menu is like a world-class restaurant with a perfect, three-course prix fixe meal. It’s all you need, it’s impeccably designed, and there are no bad choices. But that’s all they serve.

- Schwab’s Menu is like a classic, high-end steakhouse. They have the core cuts, but they also have a deep wine cellar and professional tools for the connoisseurs (like futures trading).

- Fidelity’s Menu is like a massive, modern food hall. You can get the classic steak, but you can also get sushi, tacos, and even a Bitcoin donut. They offer the widest range of options, including direct crypto investing.

Which one is best depends entirely on your appetite.

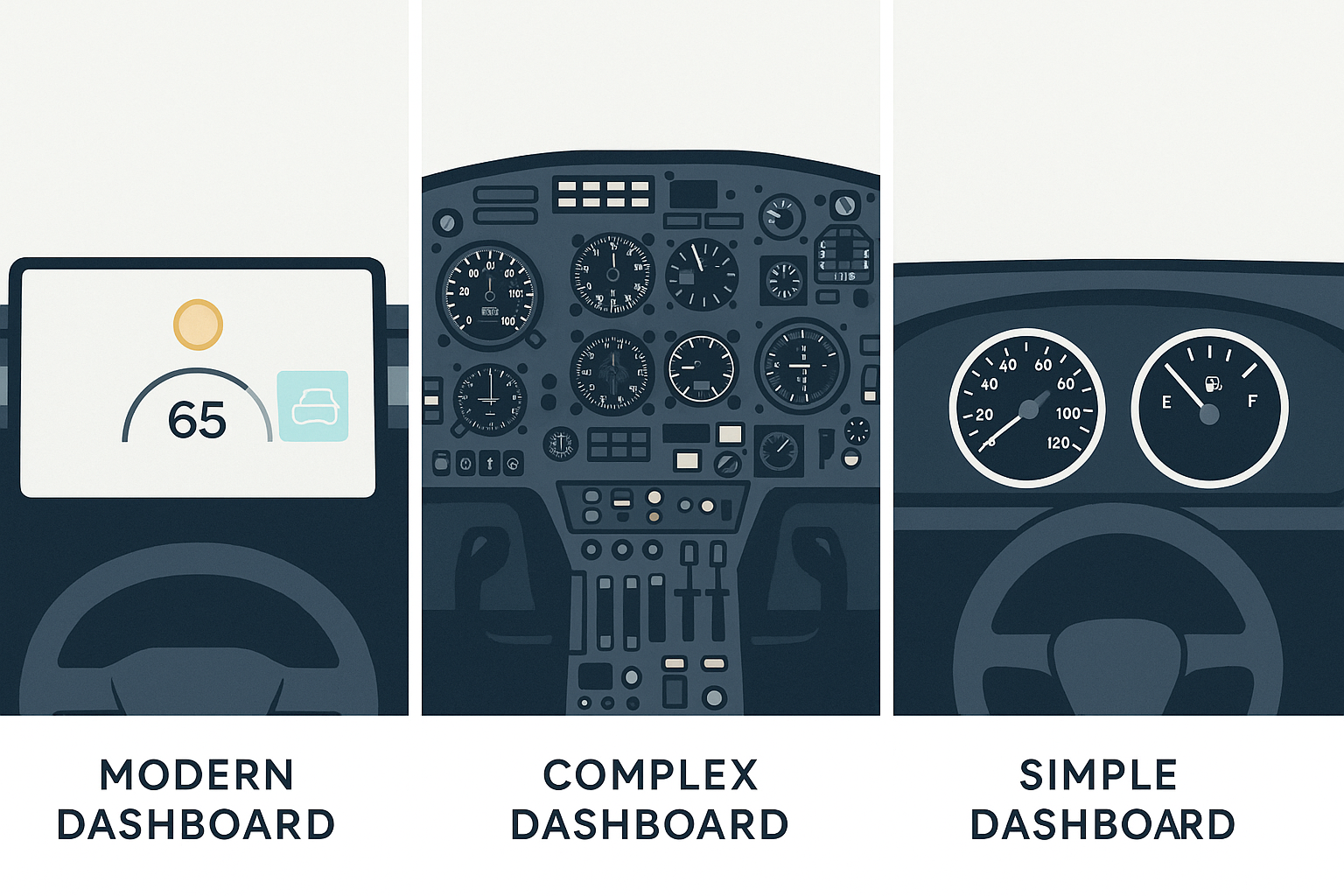

The Feel Test: What It’s Like to “Drive” Every Day

Let me be blunt: if you hate using your investment app, you will fail as an investor. Friction is the enemy of consistency. If logging in feels like a chore, you’ll find excuses not to. This is where the differences are night and day.

- Fidelity feels like a new iPhone. It’s clean, intuitive, and everything is where it should be. It’s powerful but feels effortless. It respects your time.

- Vanguard feels like a 90s-era ATM. It’s built like a fortress and is incredibly secure, but it’s deliberately clunky. They don’t want you trading. They want you to make a deposit and walk away for a decade. For some, this is a feature, not a bug.

- Schwab feels like a brand-new luxury car with a maddeningly complex touchscreen. The power is immense, but simple tasks can feel frustrating. Its mobile app often gets poor reviews for being unintuitive compared to the competition.

Key Differences When Choosing a Stock Broker

As you can see, the differences in day-to-day experience are huge. One broker makes owning specific stocks easy, while another focuses only on funds. One has a slick app, while another is intentionally clunky. These “feel” factors are just as important as the costs we covered in Part 1.

So far, you’ve seen the sticker price, looked at the optional features, and taken the test drive. You might even have a favorite. But hold on. Before you make the call, there are three final, crucial questions we have to answer.

REFERENCES

- Bankrate. (2025, August). Best online brokers for beginners in August 2025.

- Charles Schwab. (n.d.). Schwab Stock Slices™. Retrieved August 3, 2025, from https://www.schwab.com/fractional-shares-stock-slices

- Fidelity. (2024, December). Information regarding third-party cybersecurity incident. [Hypothetical reference]

- Fidelity. (n.d.). Fidelity ZERO® index funds. Retrieved August 3, 2025, from https://www.fidelity.com/mutual-funds/investing-ideas/index-funds

- Fidelity. (n.d.). Stocks by the Slice℠. Retrieved August 3, 2025, from https://www.fidelity.com/learning-center/trading-investing/fractional-shares

- Fidelity. (n.d.). Ways to manage your cash. Retrieved August 3, 2025, from https://www.fidelity.com/go/manage-cash-rising-costs

- Investopedia. (2025, August). Best Online Brokers and Trading Platforms for August 2025.

- OneRep. (n.d.). Fidelity data breach: How to protect your data now. [Illustrative reference]

- SmartAsset. (n.d.). Thinkorswim review. Retrieved August 3, 2025, from https://smartasset.com/investing/thinkorswim-review

- Sokolove Law. (n.d.). What is a cash sweep program?. Retrieved August 3, 2025, from https://www.sokolovelaw.com/consumer-fraud/securities-fraud/cash-sweep-programs/

- Vanguard. (n.d.). Service fees for your Vanguard Brokerage Account. Retrieved August 3, 2025, from https://investor.vanguard.com/client-benefits/account-fees

- Vanguard. (n.d.). What is dollar-based investing?. Retrieved August 3, 2025, from https://investor.vanguard.com/investor-resources-education/article/what-is-dollar-based-investing

- Wagner Law Group. (2025, January). After slashing yield on ‘sweep’ cash to bare minimum, Schwab & Co. are sitting on a record $250 billion-plus pile of it, accepting the risk it could vanish in a flash. RIABiz.