Your One-Page Plan to Tame Your Inner Panic Monster

Welcome back! In Part 1, we established why you need a plan to win the battle between your ‘Smart Brain’ and ‘Panic Brain.’ Now, let’s build that weapon: your personal Investment Policy Statement. This guide will give you the simple, step-by-step blueprint to write your own and take control of your financial future.

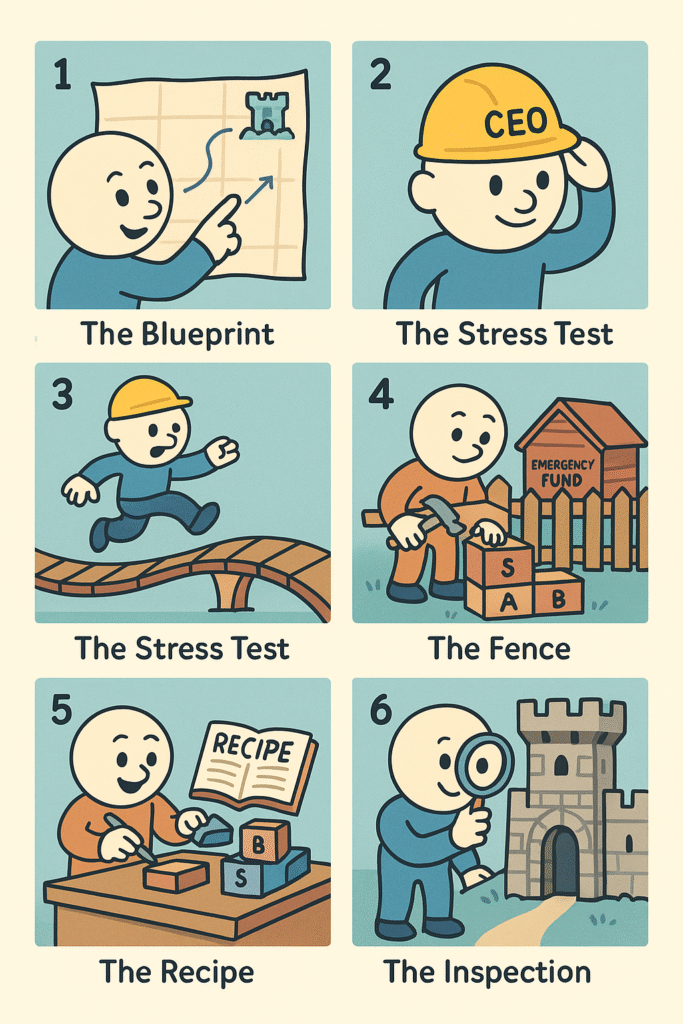

Building Your Investment Policy Statement: The 6-Brick Blueprint

- 🧱 Brick #1: Where are we going? (Your Goal) Trying to invest without a specific goal is like getting in a car and just driving. You burn a lot of gas and end up frustrated. “I want to be rich” is not a destination. You need a number and a date.

- Simple Example: “I want to have $1.5 million by age 65.”

- 🧱 Brick #2: Who is in charge here? (Your Role) This is where you formally make “Smart You” the CEO of your financial life. It’s like writing a job description that says, “Your job is to follow this plan, not the daily whims of the market.” It feels simple, but writing it down makes it real.

- Simple Example: “I’m the captain of this ship, and I follow the map I drew.”

- 🧱 Brick #3: How much shaking can this fortress take? (Your Risk) I have a friend who thought he was a high-risk investor. He talked a big game during the good times. Then the market dropped 15% and he called me, sounding like he hadn’t slept in three days. This brick is about being brutally honest with yourself about your actual panic level.

- Simple Example: “I know I’m a bit of a worrier, so my portfolio will include some super-safe investments (bonds) with my main growth ones (stocks) to smooth out the ride.”

- 🧱 Brick #4: Are there any special circumstances? (Your Constraints) A friend of mine had to sell a bunch of stocks last year during the downturn to pay for a surprise medical bill. It crushed him. Why? He hadn’t separated his “emergency money” from his “investment money.” This brick is where you draw that line in the sand.

- Simple Example: “My $20,000 emergency fund in my savings account is NOT part of this plan. It never gets touched for investing.”

- 🧱 Brick #5: What’s our building recipe? (Your Asset Allocation) This is your simple recipe. You don’t need 50 ingredients. You need a simple mix, like 80% stocks and 20% bonds. The magic is the rebalancing rule. It’s like pruning a rose bush—sometimes you have to trim the part that grew the most to make the whole plant healthier. It feels wrong, but it’s the secret to healthy growth.

- Simple Example: “My recipe is 80% stocks / 20% bonds. If my stocks grow so much that they become 86% of my portfolio, I will sell that extra 6% and buy more bonds. This is how I automatically take profits.”

- 🧱 Brick #6: When do we inspect the fortress? (Your Review) Have you ever looked at a photo of yourself from ten years ago? Things change. Your life will change. Your Investment Policy Statement can’t be perfect forever. This annual check-up is where you re-read the letter you wrote to yourself and see if it’s time for a postscript.

- Simple Example: “Every year on my birthday, I will read this document.”

Putting It All Together: A Complete IPS Example

So what does a complete Investment Policy Statement look like when you combine all the bricks? Here is a well-crafted example based on our friend Alex, the 30-year-old software engineer.

Investment Policy Statement for Alex … (The full example text from the previous response would go here) …

So what does this look like when you combine all the bricks? Here is a complete, well-crafted IPS example based on our friend Alex, the 30-year-old software engineer.

Investment Policy Statement for Alex

1. Purpose & Goals This document outlines the investment strategy for my personal portfolio. The objectives are:

- Primary Goal: To achieve a portfolio value of $1.5 million in today’s dollars by age 65 to fund a comfortable retirement.

- Secondary Goal: To accumulate $60,000 within the next 7 years for a down payment on a primary residence. This will be managed in a separate, more conservative portfolio.

2. Roles & Responsibilities

- I, Alex, am the sole individual responsible for all investment decisions related to this portfolio. I have the fiduciary responsibility to act in my own best long-term interest and to adhere to the policies set forth in this document.

3. Risk Profile

- Willingness: Moderate. I am emotionally uncomfortable with severe portfolio drawdowns.

- Ability & Need: High. With a 35-year time horizon for my primary goal, I have a high financial ability and need to take on market risk for long-term growth.

- Conclusion: The portfolio will be managed for long-term growth (equity-heavy), but will include a meaningful allocation to fixed income to dampen volatility and align with my moderate willingness to take risk.

4. Constraints & Considerations

- Time Horizon: 35 years for the retirement portfolio.

- Liquidity: A separate $20,000 emergency fund will be maintained in cash and is not subject to this policy.

- Taxes: Tax-advantaged accounts (e.g., 401k, IRA) will be prioritized and funded first. Therefore, High-growth assets will be preferentially located in these accounts where possible.

5. Strategic Asset Allocation (Retirement Portfolio)

- Target Allocation: 80% Equities / 20% Fixed Income.

- Allowable Range: Equities (75% – 85%), Fixed Income (15% – 25%).

- Equity Sub-Allocation: 50% U.S. Stocks, 30% International Stocks.

6. Monitoring & Review Policy

- Performance Benchmarks: Portfolio performance will be reviewed quarterly against a blended benchmark reflecting the target allocation (e.g., S&P 500 for U.S. Stocks).

- Rebalancing Policy: The portfolio will be rebalanced back to its target allocation whenever any single asset class deviates by more than 5% from its target percentage.

- IPS Review: This document will be reviewed annually on January 1st, or within 90 days of a major life event (e.g., marriage, change in employment, inheritance).

Check Your Understanding

Your “recipe” is 80% stocks / 20% bonds. The market crashes, and now your portfolio is 70% stocks / 30% bonds. What does your plan tell you to do?

- A) Sell everything, the recipe is broken!

- B) Do nothing and wait.

- C) Sell some bonds and buy stocks to get back to your 80/20 recipe.

(The answer is C. Your plan, written when you were calm, forces you to automatically buy low!)

Common Investment Policy Statement Mistakes to Avoid

Even with this fortress, Panic You is always looking for a way in. Here are the three most common backdoors people leave open in their Investment Policy Statement.

“A goal without a number and a date is just a wish.”

- 🔓 The Vague Goal Door: If your goal is just “make money,” Panic You has no clear target to aim for, and will just run in circles when fear strikes.

- 🔓 The Over-Complicated Door: Legendary investor Peter Lynch warned against “diworsification”—owning so many things you don’t even know what you’re doing. A simple recipe with a few ingredients is harder for panic to mess up.

- 🔓 The Dusty Old Plan Door: If you write this today and never look at it again, it becomes useless. The world changes, and asset correlations can break. The annual check-up is how you ensure the plan stays relevant.

Let’s do a quick thought experiment. Imagine it’s five years from now.

The market is in a free-fall… You open your desk drawer, pull out your one-page plan, and read the words your past, smarter self wrote for you… You close the drawer and go make a cup of coffee, feeling a sense of calm control you’ve never felt before.

That is what this plan gives you.

And… that’s it. You’re done.

Seriously, that’s all it takes. The real power of your Investment Policy Statement comes from the simple act of writing it down. It takes these vague ideas out of your head and makes them real. It gives your Smart You a physical tool to use in the battle against Panic You.

Open a blank document. Right now. Title it “My Investment Plan.”

Start with Brick #1. You’ll be amazed at the sense of control and peace it gives you.

Our Archives

4-1: The 7 Hidden Mind Traps Secretly Sabotaging Your Portfolio

References for Part 2

- CFA Institute. (2017). Elements of an investment policy statement for individual investors. https://rpc.cfainstitute.org/sites/default/files/-/media/documents/article/position-paper/investment-policy-statement-individual-investors.pdf

- Fragasso Financial Advisors. (n.d.). Important elements of an investment policy statement, or IPS. https://www.fragassoadvisors.com/important-elements-of-an-investment-policy-statement-or-ips-2/

- Investopedia. (2024, August 14). How to create a client investment policy statement. https://www.investopedia.com/articles/financial-advisors/101315/how-create-client-investment-policy-statement.asp

- SoFi. (2025, May 23). What is the average stock market return? https://www.sofi.com/learn/content/average-stock-market-return/

- StableBread. (2025, April 9). How to write an investment policy statement (IPS). https://stablebread.com/investment-policy-statement/

- Stern School of Business, New York University. (2024). Historical returns on stocks, T.Bonds and T.Bills: 1928-2023. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html