Okay, let me with a simple truth. When it comes to our money, we have two different brains, and the battle between them is the single biggest challenge for any investor. The secret to winning this battle isn’t a hot stock tip; it’s a simple planning document called an Investment Policy Statement.

First, there’s Smart Us. Smart You is calm, logical, and patient. We know that investing is a marathon, not a sprint. Smart Us is the one reading this right now.

But then there’s Panic Us. Panic Us shows up when your phone flashes a -20% notification and its advice is always the same: “SELL! SELL NOW BEFORE IT GETS WORSE!”

PAUSE HERE FOR A SECOND.

Think back to the last time the market took a dive. Did you find yourself checking your portfolio app more often? Did you feel that knot in your stomach? That exact feeling is Panic You. Acknowledge it. Giving it a name is the first step to taming it.

That feeling is real and powerful.

But what does Smart You know? Smart You knows that since 1928, the U.S. stock market has experienced dozens of corrections and crashes, yet the long-term historical return has remained around 9-10%. It knows that this current storm, as terrifying as it feels, is just another wave in a very large ocean. (This is the Zoom Out).

The entire game of investing comes down to one simple thing.

YOU ARE NOT TRYING TO BEAT THE MARKET.

YOU ARE TRYING TO BEAT YOURSELF.

You must build a system that allows Smart You to be in control, no matter how loud Panic You is screaming.

How an Investment Policy Statement Prevents Panic Selling

I saw this play out perfectly last year. I have two friends, Tom and Sarah, with almost identical investments. When the market had its meltdown, I remember getting a text from Tom full of panicked emojis.

- 💸 Tom listened to Panic You. He saw the red numbers, felt that wave of fear, and sold everything. “I’ll get back in when things are stable,” he said. He’s still mostly in cash, and he completely missed the rebound.

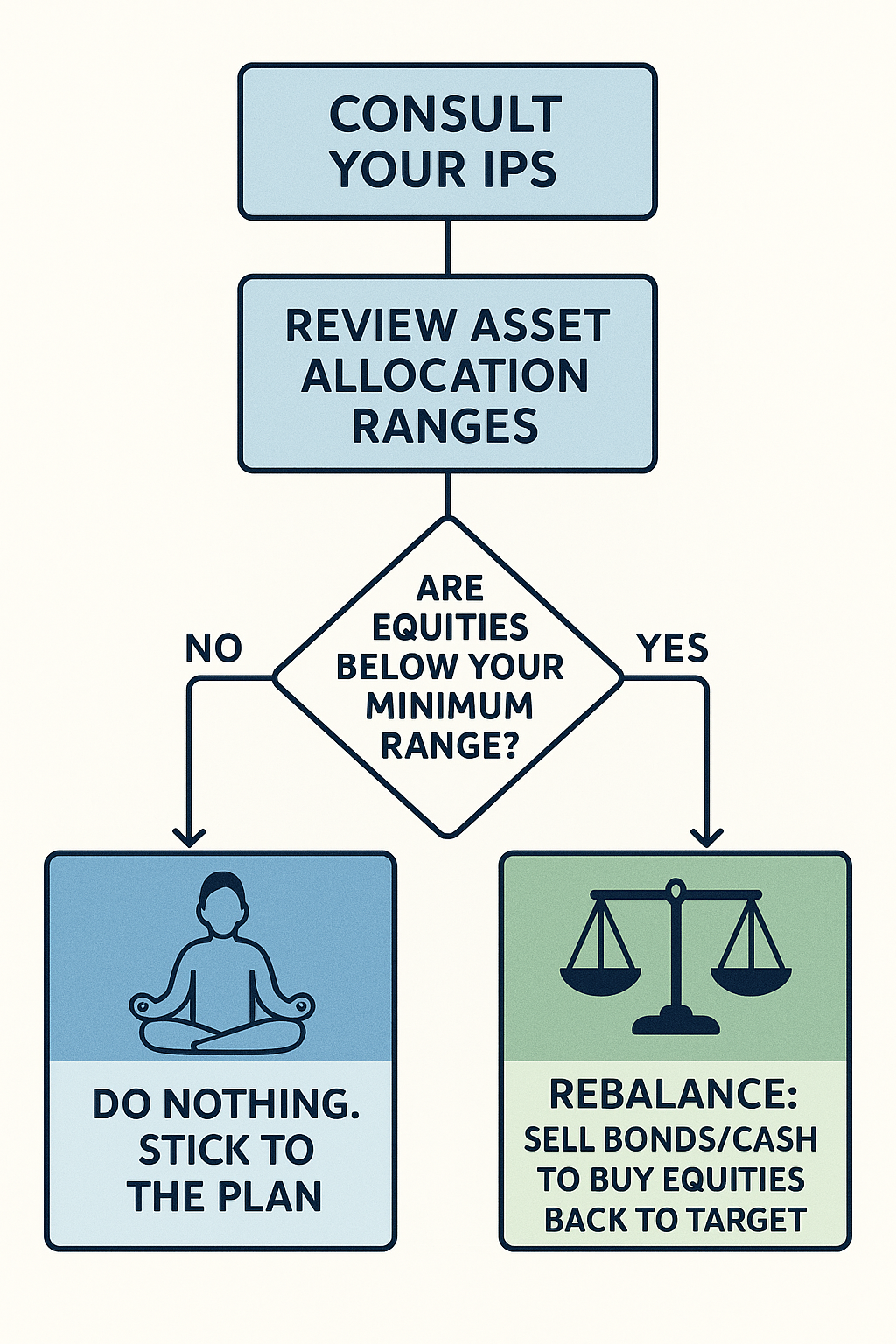

- ✅ Sarah listened to her Investment Policy Statement. She felt the same fear—she’s not a robot. But months earlier, her “Smart You” had written down her rules. So when Panic You showed up, she just read her plan. The plan said, “When prices are this low, you are supposed to be buying.” So she did.

Sarah’s secret was the piece of paper. The IPS. I’ll be honest, when I first heard the official name, I almost gave up.

Now, you might be thinking, ‘Seriously? An Investment Policy Statement? That sounds like something my insurance company would send me to ignore.’

And you’re not wrong. It’s a terrible name. But forget the name. Think about what it does. It’s not a policy; it’s a promise. It’s not a statement; it’s a shield.

This is the plan that protects your long-term goals from your short-term emotions.

This is the plan that builds a fortress to keep Panic You locked out of the control room.

This is the plan that finally lets you relax.

Using Your Investment Policy Statement Against Mr. Market

Your IPS is what allows you to actually follow the timeless advice from investing legends like Warren Buffett, who was inspired by his mentor Benjamin Graham and the “Mr. Market” story. The lesson is simple: you must be…

“Be fearful when others are greedy, and greedy when others are fearful.”

That quote is easy to post on Instagram, but almost impossible to do in real life without a written plan to guide you when fear takes over.

The Bottom Line: It’s a Battle for Control

The whole point of an Investment Policy Statement isn’t to pick better stocks. It’s to manage your own emotions. You are building a simple shield to protect your long-term wealth from your own short-term, totally normal, human panic.

So we know we need this “letter to ourselves.” We know it’s our shield. But a shield with cracks in it is useless.

It turns out there are six simple, non-negotiable things that have to be in this letter for it to actually work in a crisis. Miss one, and you leave a backdoor wide open for Panic You.

In Part 2, we’ll go through that six-point checklist.

Our archives

4-1: The 7 Hidden Mind Traps Secretly Sabotaging Your Portfolio

References for Part 1

- Define Financial. (2025, April 15). Investment policy statement (IPS) defined + free sample. https://www.definefinancial.com/blog/investment-policy-statement-defined/

- U.S. Bank. (n.d.). What is an investment policy statement (IPS)? https://www.usbank.com/investing/financial-perspectives/investing-insights/investment-policy-statement.html

- Whittier Trust. (n.d.). 5 reasons your investments need an investment policy statement. https://www.whittiertrust.com/investment-policy-statement/