The Snowball Effect: A Beginner’s Deep Dive into Compound Interest

Introduction: My Journey Into the Most Powerful Force in Investing

Hello again! It’s me, your Investi-Buddy. I have to be honest with you all—when I first started this journey into the world of money, there was one phrase that kept popping up everywhere that felt… well, a little over the top: Compound Interest.

People would say it was the “eighth wonder of the world.” While that’s a powerful idea, my goal isn’t just to repeat what everyone else says, but to figure out what’s actually true and useful for us. And what I discovered is that, no matter who said it first, the wisdom behind compound interest is undeniably one of the most important lessons in all of finance.

I quickly realized that just defending our money from inflation (as we learned in our first guide) isn’t enough. To really get ahead, we need to go on the offense. It turns out, this idea of compound interest is the engine that powers all real growth. In this guide, we’re going to figure it out together.

- In Part 1, we’ll break down what compound interest for beginners really means and see why time is its most critical ingredient.

- In Part 2, we’ll get practical, looking at how it works in the real world and what hidden “villains” can try to shrink our snowball.

Let’s get started.

Part 1: Understanding the Magic of Compounding

So, What Is It, Really? The “Interest on Interest” Idea

After reading a ton of articles, I found the simplest definition is the best one: compound interest is “interest on interest”.

That’s it. It means you earn interest on your initial investment, and then you begin earning new interest on the interest you just earned. Your money starts working for you, and then the money that your money earned also clocks in and starts pulling its weight. The best analogy to make this concept stick is the snowball effect.

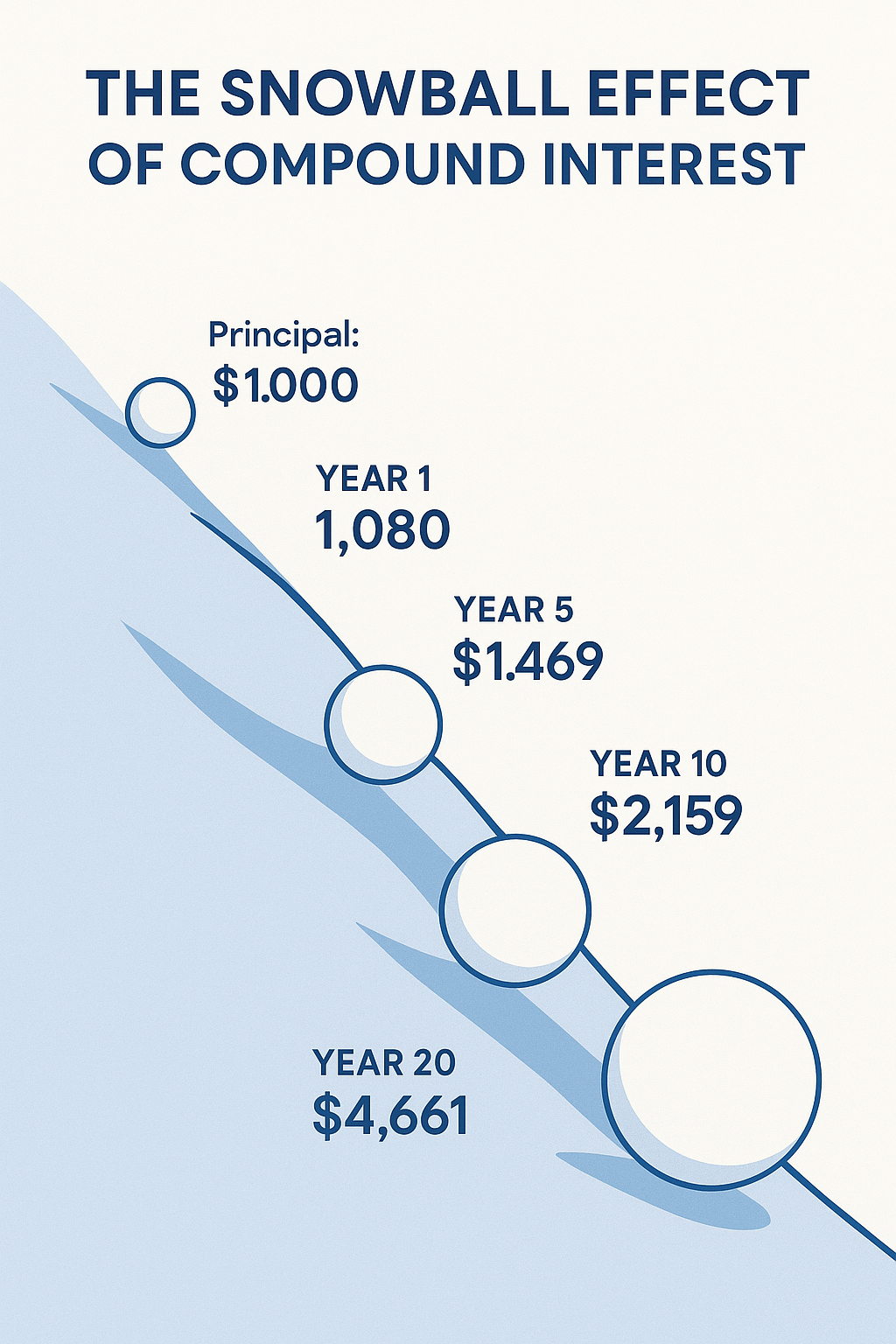

How Can a $6 Difference Turn Into a $2,000 Difference?

To see just how massive that snowball effect becomes, it’s helpful to compare compound interest to its boring cousin, simple interest. The key difference is that simple interest is only calculated on your original starting amount, while compound interest is calculated on the growing total.

Let’s run a quick experiment. Imagine we invest $1,000 and it earns an 8% return per year.

- With Simple Interest: You would earn a flat $80 every single year.

- With Compound Interest: In Year 1, you earn $80. But in Year 2, you earn 8% on your new, larger balance of $1,080, which comes out to $86.40.

It’s only $6.40 more, which seems tiny. But this is the key. Over time, that small, accelerating difference becomes a massive, unignorable gap.

| Year | Balance with Simple Interest (8%) | Balance with Compound Interest (8%) | The “Compounding” Difference |

| 1 | $1,080.00 | $1,080.00 | $0.00 |

| 5 | $1,400.00 | $1,469.33 | $69.33 |

| 10 | $1,800.00 | $2,158.92 | $358.92 |

| 20 | $2,600.00 | $4,660.96 | $2,060.96 |

The takeaway is clear: the magic of compound interest isn’t that it’s complex; it’s that it accelerates.

See It for Yourself: The Compound Interest Calculator

While the tables and stories are powerful, nothing drives home the magic of compounding like seeing it work with your own numbers. Use this simple calculator to see how your own snowball could grow over time.

Seeing is Believing: Two Stories on the Power of Compound Interest

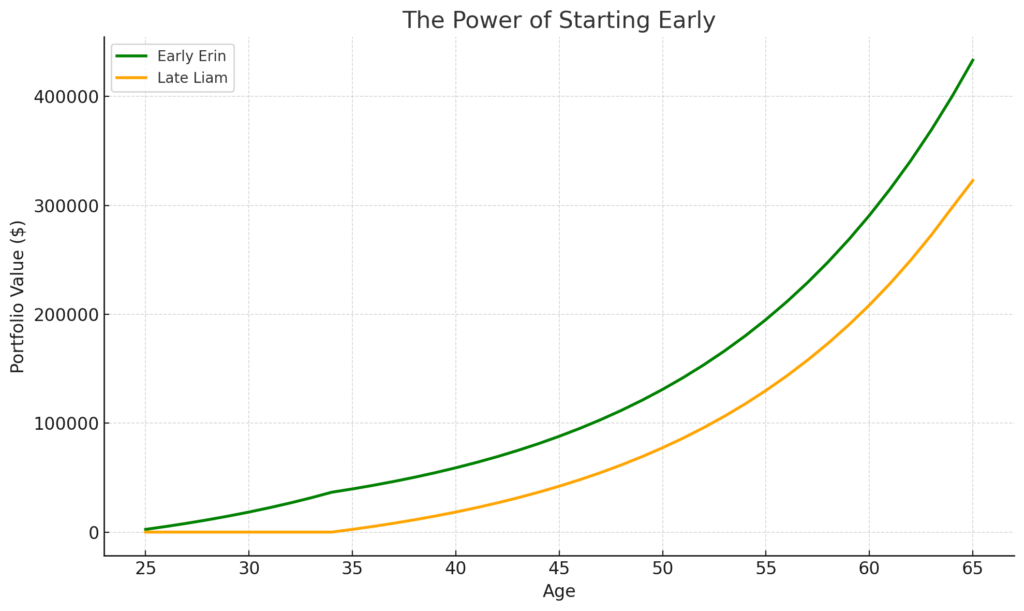

Our brains are not naturally wired to understand this type of exponential growth. Because of this, stories are the best way to grasp the true power of compounding.

1. The Doubling Penny Theory Would you rather have $1 million today, or a magic penny that doubles in value every day for 30 days? On Day 30, that single penny grows to over $5.3 million.

2. The Tale of Two Investors This story shows why time is more important than amount. Let’s imagine two friends, Early Erin (starts at 25, invests for 10 years) and Late Liam (starts at 35, invests for 30 years). The shocking result? Early Erin invests $48,000 less but ends up richer because her money had an extra 10 years to grow.

This proves the single most important rule of compounding: how long your money is invested is far more important than how much you invest.

A Quick Reality Check on Market Returns

It’s crucial to understand that the 8% or 10% returns we’ve used in our examples are long-term historical averages, not a guarantee for any single year. The stock market is volatile; some years it will be up 20%, and other years it might be down 10%. The magic of compounding only works if you stay invested through the inevitable ups and downs, allowing that average rate of return to work in your favor over many years.

The Rule of 72: The Only Math You Really Need

Now for my favorite discovery: a brilliant mental shortcut called the Rule of 72. It’s a simple way to estimate how long it will take for your money to double.

72 ÷ (Your Annual Interest Rate) =

Approximate Number of Years to Double Your Money

For example, an investment that earns 8% per year will take about 9 years to double (72 ÷ 8 = 9).

Key Takeaways from Part 1:

- Compound interest is “interest on interest,” a cycle where your earnings begin to generate their own earnings.

- It grows exponentially, like a snowball rolling downhill—slowly at first, then accelerating dramatically over time.

- Time is the most critical ingredient; when you start investing is more important than how much you start with.

- Use the Rule of 72 as a quick mental shortcut to estimate how many years it will take to double your money.

We’ve covered the what, the how, and the why of compound interest. We’ve seen its power through stories and learned a simple shortcut to estimate its magic. But so far, this has all been theory. To make this knowledge truly useful, we need to bring it into the real world of investing, with real money on the line. In Part 2, we’ll do exactly that.

Part 2: Putting Compounding to Work (And Defending It)

The Two Engines of Compound Interest

In Part 1, we saw how time is the secret ingredient. Now, let’s get practical. In the stock market, compounding is driven by two main engines. Think of them as two different ways your investment “snowball” gets bigger.

Engine #1: Dividends (Getting More Slices of Pizza)

A dividend is a small cash payment that some companies send to their owners as a “thank you.” When you automatically reinvest those dividends (using a DRIP), you are using that cash to buy more small slices of the company. More slices mean you’ll get even more dividends next time, creating a powerful compounding cycle.

Engine #2: Capital Gains (Your Existing Slices Get More Valuable)

The other way your investments compound is through capital gains. This is when the companies you own become more profitable, causing the value of their stock to rise. In this case, you aren’t getting more slices of pizza, but the slices you already own are becoming bigger and more valuable. This is the primary driver of growth in a broad market index fund.

Where Do These “8% to 10%” Returns Actually Come From?

This is a critical question. The high returns that power compound interest don’t come from a savings account. Historically, they come from owning a piece of the broad stock market. An S&P 500 index fund, for example, lets you own a tiny slice of 500 of the largest U.S. companies. Over the very long term, the average annual return of the S&P 500 has been about 10%. This is not a promise for any single year, but it’s the powerful “engine” we use to make our snowball grow over decades.

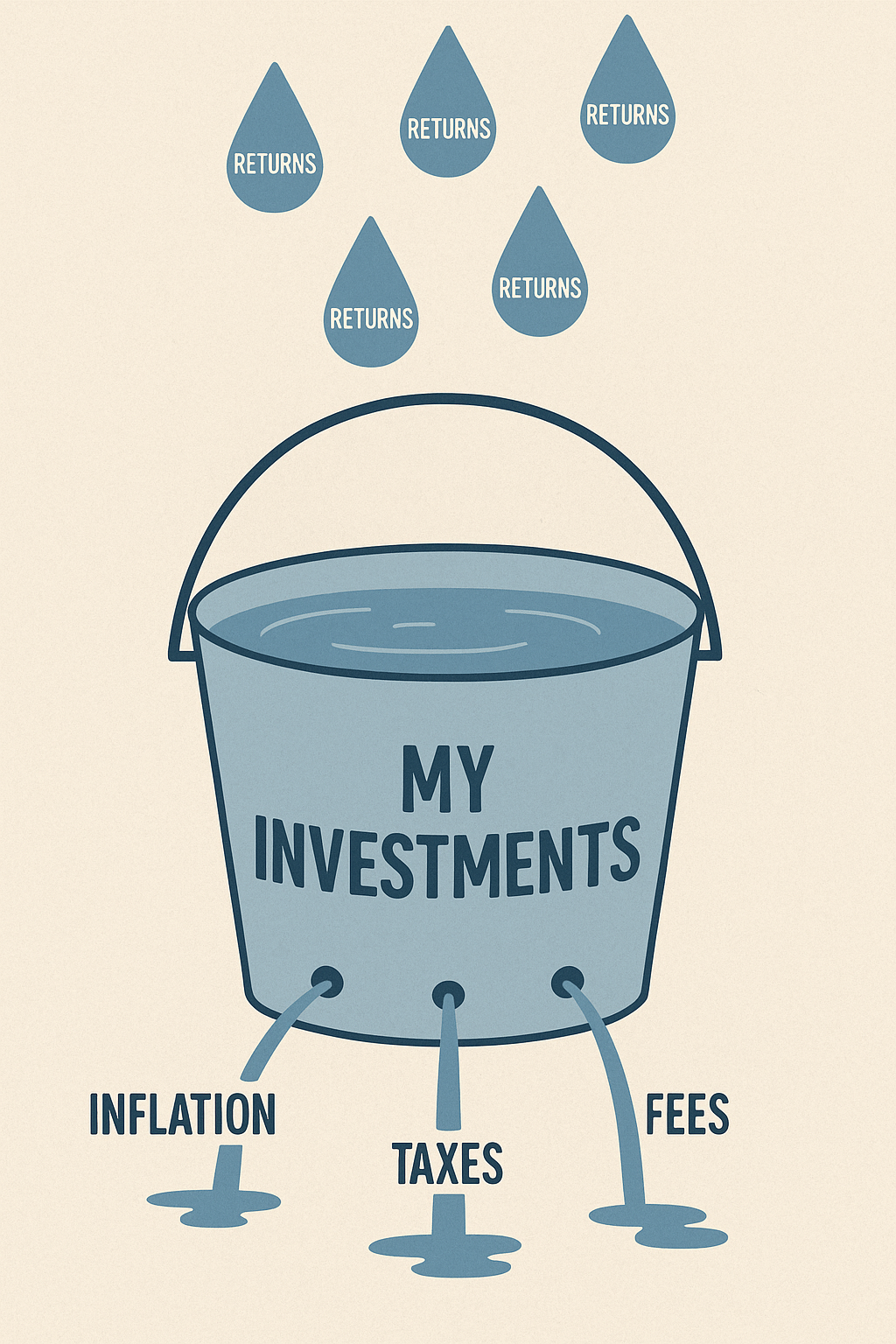

Who Are the Three Thieves Actively Stealing Your Gains?

If growing money is this simple, why isn’t everyone rich? I soon discovered three “villains” constantly working against us. Think of them as leaks in your investment bucket.

- 🔥 Villain #1: Inflation (The Silent Thief) As we learned in our first guide, inflation reduces the purchasing power of our money. If your portfolio grows by 8%, but inflation is 3%, your real return is only 5%.

- 🏛️ Villain #2: Taxes (The Unavoidable Partner) The government is entitled to a share of your profits. You can fight back by using “tax-shielded” accounts like a 401(k) or a Roth IRA. In a Roth IRA, for example, your money grows completely tax-free, and you pay no taxes on your qualified withdrawals in retirement. This means the tax villain can’t touch your snowball’s growth, allowing it to compound much more effectively.

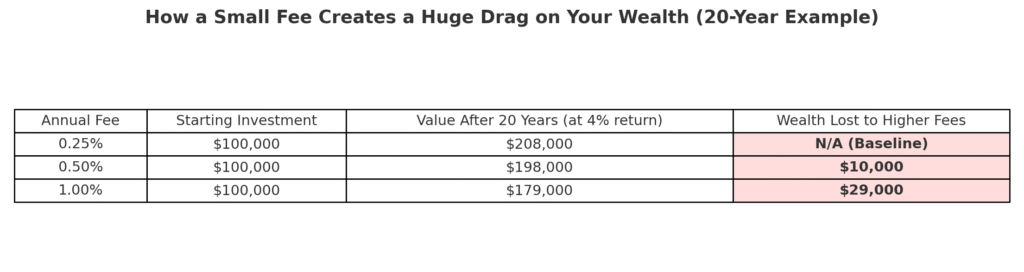

- 🏷️ Villain #3: Fees (The Sneaky Drain) This villain is the most dangerous because it’s so sneaky. Fees don’t just reduce your returns for one year; they reduce the amount of money you have left to compound for all future years. As a result, the impact of fees also compounds, but it works against us.

Three Compounding Traps Every Beginner Must Avoid

Understanding compounding is one thing; protecting it is another. Here are the three most common traps that can wreck your progress.

- The Trap of Impatience (Interrupting the Snowball). According to the famous investor Charlie Munger, “The first rule of compounding: Never interrupt it unnecessarily.” This means selling your investments during a market panic. Doing so is like picking up your snowball halfway down the hill and having to start over with a smaller one.

- The Trap of High Fees (A Constant Leak in Your Bucket). As we saw with the “Three Villains,” fees are a silent killer. A 1% fee doesn’t just cost you 1% this year; it costs you all the future growth that 1% would have generated for decades to come. Keeping your investment fees as low as possible is essential.

- The Trap of High-Interest Debt (The Evil Snowball). Compounding works against you with high-interest debt, like on a credit card. A 22% interest rate is a destructive snowball that will always roll faster than your investment one. Always pay down high-interest debt before you start investing seriously.

Your 4-Step Compound Interest Action Plan

- Defeat “Bad” Compounding: Aggressively pay down any high-interest debt (like credit cards) first.

- Build Your Foundation: Open a High-Yield Savings Account and build your 3-6 month emergency fund. (As we covered in our first guide on saving).

- Open Your “Growth Engine”: Open a tax-shielded brokerage account, like a Roth IRA.

- Put it on Autopilot: Set up a recurring investment into a low-cost S&P 500 index fund and make sure dividends are set to reinvest (DRIP).

Conclusion: Your Final Cheat Sheet on Compound Interest

After all this research, here is the final cheat sheet for us beginners on this powerful force.

- Compounding is an exponential growth cycle where your earnings start earning their own money.

- The two most important ingredients are time and consistency.

- Use the Rule of 72 as your go-to mental shortcut to estimate how fast your money can double.

- Put compounding on autopilot with low-cost index funds and dividend reinvestment plans (DRIPs).

- Always be on defense against the three villains: inflation, taxes, and fees.

- Finally, remember the two golden rules: never interrupt good compounding, and always pay off high-interest debt first.

Understanding this one concept is the single biggest step we can take toward building a better financial future.

REFERENCES

Consumer Financial Protection Bureau. (2020, November 18). How does compound interest work?.

Dimensional Fund Advisors. (2019, January 22). The uncommon average.

Empower. (2024, May 15). Understanding compound interest.

Fidelity. (n.d.). What is compound interest?. Retrieved July 26, 2025.

FINRA. (n.d.). Investing Basics. Retrieved July 26, 2025.

Investopedia. (Multiple Dates). Various articles on Investment Tax, DRIPs, Inflation, Rule of 72, and Simple/Compound Interest.

Koyfin. (n.d.). The Coca-Cola Company (KO) dividend data. Retrieved July 26, 2025.

MastersInvest. (n.d.). Compounding. Retrieved July 26, 2025.

Merrill Edge. (n.d.). Tax-aware investment strategies you should consider.

Nasdaq. (2024, March 16). This Is the 8th Wonder of the World, According to Albert Einstein.

Ramsey Solutions. (n.d.). 5 creative ways to teach compound interest.

Saxo. (n.d.). What is the true impact of hidden fees on investment returns?.

Schwab. (2023, September 27). The power of long-term compound interest investments.

Securian Financial. (n.d.). How compound interest works.

SmartAsset. (2025, April 30). S&P 500 average annual return.

TD. (n.d.). What is compound interest and how does it work?.

U.S. Bank. (n.d.). Effects of inflation on investments.

U.S. Securities and Exchange Commission. (Multiple Dates). Various resources on Compound Interest and Investment Fees.