Part 1: The Enemy in the Mirror

Hey everyone, welcome back to our investing journey! In our last post, we did a deep dive into Stocks vs. Real Estate. But the ‘what’ to invest in is only half the battle. This time, we’re tackling the single biggest factor in your success: investor psychology. (If you missed our last breakdown, you can check it out here!)

But while we were focused on the what to invest in, I realized I’d completely missed the single biggest factor that determines success in any investment: the how. It turns out that the biggest risk to our money isn’t a bad stock or a housing bubble; it’s our own psychology.

So, in this 3-part series, we’re going to tackle this head-on. In this first part, we’ll identify the enemy within by exploring the science behind why our brains seem wired to make bad financial decisions.

So, What’s This ‘Behavior Gap’ Costing You a Fortune?

I was doing some research when I stumbled upon something that honestly blew my mind.

There’s a company named DALBAR that, for over 30 years, has been tracking how actual, everyday investors perform compared to the stock market itself. The results are… not great.

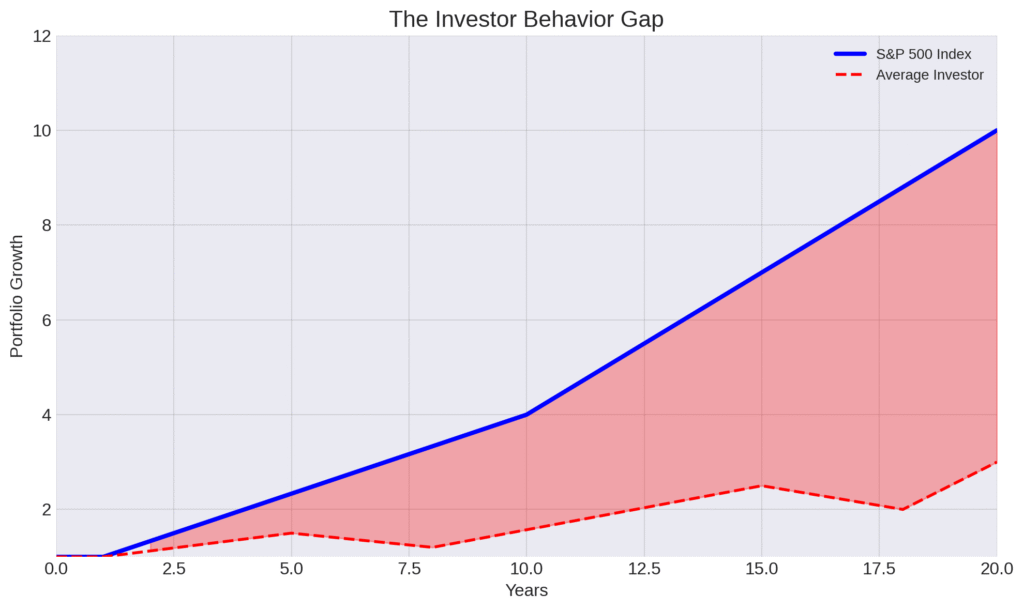

For instance, in a recent year when the S&P 500 was up over 25%, the average equity fund investor only made about 16.5%. That huge difference is called the “behavior gap.”

“It turns out the biggest risk to our portfolio isn’t a market crash or a bad economy. It’s us.”

This recurring pattern is the clearest proof of the powerful and costly effects of investor psychology.

Here’s the deal: over a 20-year period, this gap adds up to the average person underperforming the market by 2.72% every single year. It’s a recurring, wealth-destroying pattern caused by our own decisions.

The Science of Investor Psychology: Your Brain on Money

Ever wonder why we make these same mistakes over and over? I learned it all comes down to a fascinating field called behavioral finance. It basically throws the old idea of a perfectly “rational investor” right out the window.

The core idea that made it all click for me is a Nobel Prize-winning concept called Prospect Theory.

Let me ask you a quick question. Imagine I offered you a simple coin-flip bet.

Heads: You instantly win $150. Tails: You instantly lose $100.

Do you take the bet?

If you felt a strong hesitation, or decided to say ‘no,’ you’ve just experienced Prospect Theory firsthand. Even though the potential gain is much larger than the potential loss, most people refuse the bet. That’s because of a powerful quirk in our wiring called Loss Aversion.

Nobel Prize-winning research found that for most of us, the psychological pain of a loss is about twice as powerful as the pleasure of an equivalent gain. That simple fact is the source code for so many of our biggest investing mistakes.

Key Takeaway: The Science of Bad Decisions

Your brain isn’t a calculator. It’s a survival machine that feels the sting of a loss twice as much as the joy of a gain. This simple fact is the root cause of most emotional investing mistakes.

7 Key Traps in Investor Psychology: Know Your Enemy

Now that we know the “why,” let’s get into the “what.” I’ve been learning to spot the specific mental traps that cause that behavior gap. Here are the big ones.

🧠 Trap #1: Overconfidence Bias (The “I’m Smarter Than the Market” Delusion)

Okay, the first trap is a real sneaky one: Overconfidence Bias.

It’s that little voice in your head that pops up after a few lucky wins and starts whispering, ‘Hey, you’re actually a genius at this!’ It’s so easy to mistake a rising market for our own skill, but the moment we start believing our own hype, we’re in trouble.

I found that this single bias can lead to a whole bunch of terrible decisions, like trading way too often, not diversifying properly, or completely ignoring obvious risks. The story of “Johnny,” an engineer I read about, really brought this home for me. After some early success, he got so overconfident that he quit his job and borrowed against his house to trade more. As you can guess, when the market turned, it was a total disaster.

And what often happens when our Overconfidence leads us into a bad investment that starts to lose money? That’s when its painful cousin, Loss Aversion, shows up to make the situation even worse.

💔 Trap #2: Loss Aversion (The Paralyzing Pain of Seeing Red)

Next up is that powerful bias we just talked about, Loss Aversion, in action.

Because we hate the pain of losing so much, we do some really weird things. For instance, we tend to hold onto our losing stocks for way too long. We do this because clicking “sell” makes the loss feel real, and we avoid that pain by telling ourselves, ‘I’ll just wait for it to recover!’

What this feels like: ‘Everyone on social media is talking about this crypto coin… I don’t totally get it, but I feel like I have to get in RIGHT NOW or I’m going to be left behind!’

On the flip side, we often sell our winning stocks far too early. We get a little bit of profit and immediately want to “lock it in” out of fear that the good feeling might disappear.

“The bottom line is: we’re doing the exact opposite of the famous advice to ‘cut your losses and let your winners run.'”

This directly causes the behavior gap. A DALBAR study showed that in a tough market like 2022, countless investors sold in fear, causing their portfolios to underperform the market by a significant margin.

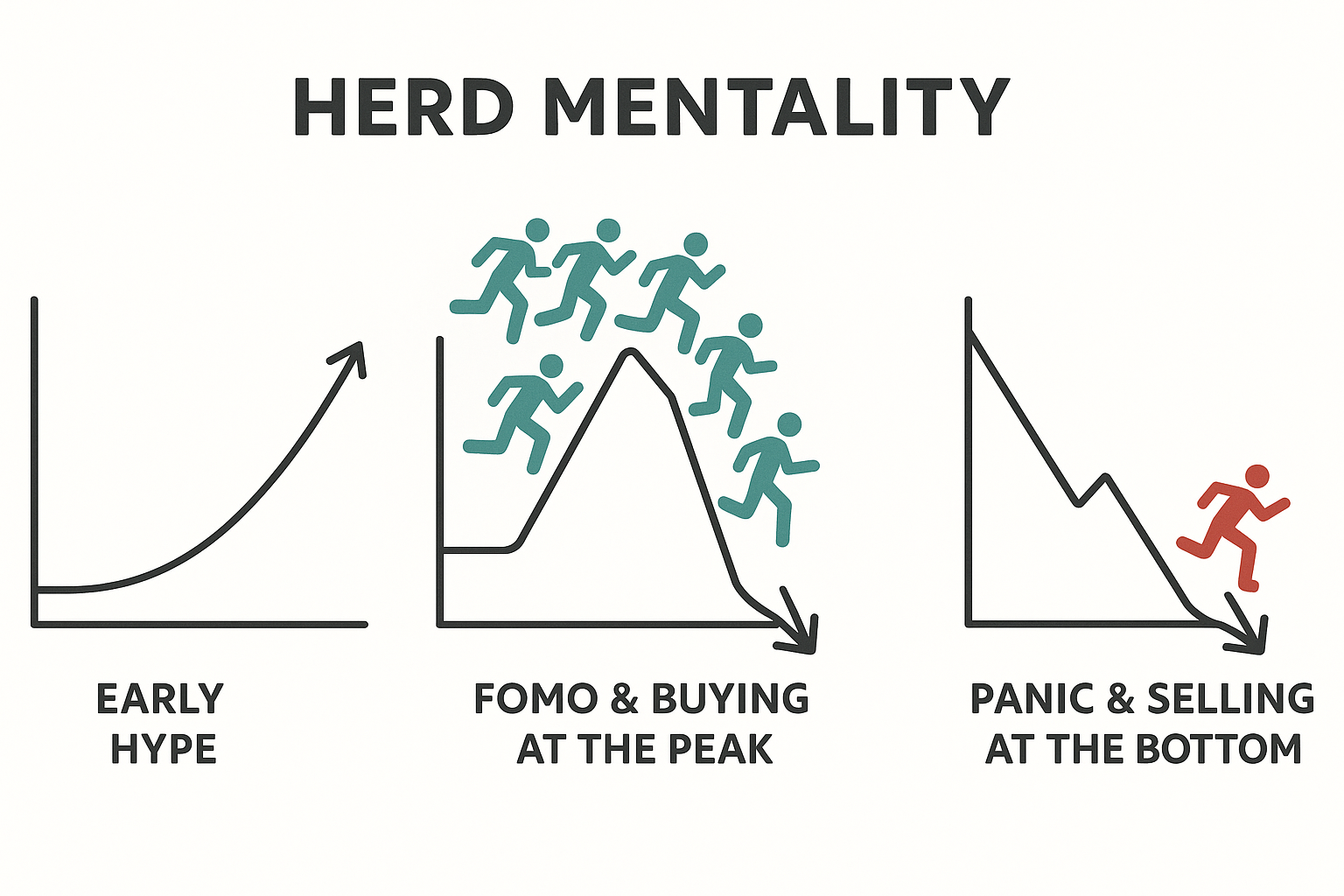

🐑 Trap #3: Herd Mentality (The Danger of Following the Crowd)

Ever felt that intense Fear Of Missing Out (FOMO)? That’s the engine behind Herd Mentality.

It’s our deep-seated instinct to copy what a large group is doing, often without stopping to think for ourselves. We just assume the crowd must know something we don’t.

This is what fuels speculative bubbles. Everyone sees an asset going up, and driven by greed and FOMO, they pile in, pushing the price even higher. But what happens when the herd panics? They all rush for the exit at once.

Think about it: this almost guarantees you will buy high and sell low. The GameStop frenzy in 2021 is a perfect modern example. Investors, fueled by social media hype, drove the price to insane levels, only for many to get crushed when the inevitable crash happened.

🎧 Trap #4: Confirmation Bias (The Echo Chamber of Expensive Opinions)

Have you ever decided you’re going to buy something, and then suddenly, all you seem to see are good reviews for it? That’s pretty much Confirmation Bias in a nutshell.

It’s our brain’s natural tendency to look for proof that we’re right, creating a personal echo chamber that feels comfortable but is incredibly dangerous for our portfolio. We’ll read the one positive news story and ignore the ten negative ones that challenge our belief.

Here’s the kicker: this directly contributes to the behavior gap. Why? Because it convinces us to hold onto a failing investment for way too long, whispering ‘just wait, it’ll turn around’ while we ignore all the evidence that it won’t.

Okay, let’s pause for a second. Halfway through this list, are you starting to feel a bit like I did? When I was first learning this, it felt like my brain was just a minefield of bad instincts waiting to go off.

It can be a little overwhelming. But stick with me, because recognizing these next few traps is what really separates a reactive investor from a strategic one. This is where we learn to spot the subtle mistakes.”

⚓ Trap #5: Anchoring Bias (Chained to an Irrelevant Number)

This next one is subtle but powerful: Anchoring Bias.

Our brain tends to latch onto the first piece of information it sees and use it as a reference point for everything that follows. In investing, that “anchor” is usually a price, like a stock’s 52-week high or the price you paid for it.

Imagine you buy a stock at $100, which feels like a fair price. A month later, it drops to $60. Your brain, now anchored to that initial $100 price, doesn’t see a company whose value has fallen; it sees a product that’s suddenly ‘40% off!’ This powerful illusion can make you buy more of a losing stock, not because of new research, but because you’re emotionally stuck on an old, irrelevant number.

But this ignores the most important question: has the company’s value actually fallen? You end up making decisions based on an old, irrelevant number instead of today’s reality.

💸 Trap #6: Sunk Cost Fallacy (Throwing Good Money After Bad)

The Sunk Cost Fallacy feels like it comes from a good place—we don’t want to be quitters! But in investing, it’s a disaster.

It’s the tendency to continue with something, even if it’s failing, just because we’ve already invested time, effort, or money into it. We’re trying to justify a past decision instead of making a good future one.

What does this mean for you? You might hold onto a terrible stock, or even worse, buy more of it as it falls, just because you’ve already lost so much. This is literally “throwing good money after bad”.

📈 Trap #7: Recency Bias (The “What Have You Done Lately?” Trap)

Finally, there’s Recency Bias. This is our brain’s tendency to give much more weight to recent events than to things that happened in the past.

If the market has been on a tear for the last six months, our brain assumes it will keep going up forever. If it just crashed, we become terrified and assume it will keep crashing.

This “what have you done for me lately?” thinking is a recipe for buying high (after a nice run-up) and selling low (after a scary drop), widening that behavior gap with every emotional decision.

Check Your Understanding:

You see a “hot” tech stock that all your friends are buying. It’s gone up 50% in the last two months, but you don’t really understand its business model. What’s the biggest psychological trap pushing you to buy?

A) Anchoring Bias B) Herd Mentality (FOMO) C) Sunk Cost Fallacy

(The answer is B! The fear of missing out and the desire to follow the crowd are powerful drivers of Herd Mentality.)

Coming up in Part 2…

Okay, let’s take a breath. We’ve just taken a hard look in the mirror and identified the enemy within. We’ve gone through the whirlwind tour of the psychological minefield in our own heads and put a name to each trap, from the sneaky pull of Overconfidence to the powerful current of Herd Mentality.

If you’ve made it this far, you now have the map of that minefield. But a map isn’t enough to get through it safely. You also need to see where the mines have exploded in the past.

In Part 2 of our series, we’ll leave the textbook behind and step into the real world. We’ll become financial detectives, examining the evidence from some of history’s most famous market bubbles and crashes to see exactly how these biases destroyed fortunes.

Our Archives

4-2: The Psychology of Panic: 3 Market Crashes Deconstructed

4-3: Rewire Your Brain: The Proven Playbook for Fearless Investing

References for Part 1

DALBAR, Inc. (2024). Quantitative analysis of investor behavior. Retrieved from https://www.dalbar.com/qaib/index

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263–291.

Medium. (2024, April 10). The overconfidence trap: How a math whiz lost it all.

U.S. Securities and Exchange Commission. (2021). Staff report on equity and options market structure conditions in early 2021. Retrieved from https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf