Part 1: The “Fair Fight” That Isn’t Fair at All

For months, I believed the “stocks vs. real estate” debate was a fair fight. It’s not. After dozens of hours of research, I realized the entire comparison is skewed by one incredible, and dangerous, real estate “superpower” that most beginners don’t understand.

Like you, I was stuck—paralyzed by the choice. One path seemed smart and modern, the other felt safe and traditional. The sheer volume of opinions on stocks vs. real estate can be overwhelming. In this article, I’m going to show you exactly what that superpower is, how it works, and reveal the secret ‘third option’ that might just be the best starting point for us all.

My Notes in a Nutshell on Stocks vs. Real Estate

If you just want the cheat sheet, here’s what I’ve figured out.

- Stocks seem best for: A hands-off approach, starting with less cash, and being able to get your money out fast.

- Real estate seems best for: Using loans to control a big asset (this is the ‘superpower’ we’ll talk about), but you need a lot of cash and patience.

- REITs (a weird stock/real estate hybrid): These are my surprise discovery. They seem to offer a bit of both worlds and are super easy to get into.

Stocks vs. Real Estate – What’s What?

First things first, I had to get my head around the absolute basics. What is a stock, really? And what does “investing in real estate” even mean in the context of stocks vs. real estate?

So, What Is a Stock?

Okay, so buying a “stock” just means you’re buying a tiny, tiny, tiny piece of a company. If you buy a share of Apple, you’re not just a customer anymore; you technically own a sliver of the whole operation. It’s a wild thought, but it’s true. Because you’re an owner, you get a piece of the pie. Here’s the analogy that finally made it click for me:

Analogy #1: The Neighborhood Pizza Place.

Think of your favorite local pizza spot. If you buy a “stock” in it, you’re not buying a pizza. You’re buying a piece of the business itself—the ovens, the brand, the secret sauce recipe. If the place becomes a huge hit, your little piece becomes way more valuable. If it fails, well, your piece is worthless.

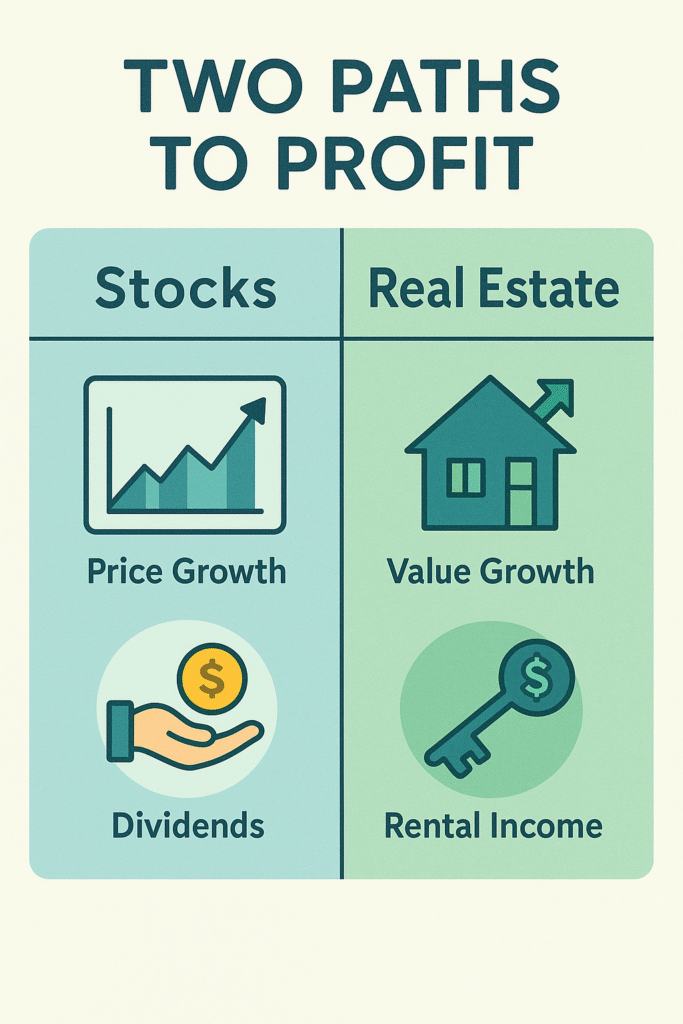

There are two ways you can get paid from this:

- The Price Goes Up (Capital Appreciation): This is the one everyone talks about. You buy a stock for $100. The company does awesome things, and suddenly, everyone wants a piece. That demand pushes the price up. You sell it for $150. Boom, you made $50.

- They Just Give You Cash (Dividends): This one’s cool. Some big, steady companies are like cash machines. They make so much profit that they just hand some of it back to their owners (that’s us!). It’s like the pizza place having a killer month and giving every owner a cash bonus. You get paid just for sticking around.

And What About Real Estate?

This one feels more obvious because you can literally touch it. You’re buying a physical property, hoping to make money off it. It works in almost the exact same ways.

- The Value Goes Up (Appreciation): You buy a house for $300,000. Years go by, the neighborhood gets better, and more people want to live there. You sell it for $450,000. You’ve made a $150,000 profit on the appreciation.

- Someone Pays You to Use It (Rental Income): This is the classic landlord plan. You buy a place, rent it out, and after you pay the mortgage, taxes, and fix the leaky faucet, the cash left over is your profit for the month. It’s the real estate version of a dividend.

So on the surface, they look similar. But what if I told you there’s a ‘legal cheat code’ in real estate that can let a 10% gain turn into a 50% profit on your own cash? In the next part, we’re breaking down the math on this incredible—and frankly, terrifying—superpower.

Our Archives

3-2: Stocks vs. Real Estate: Why This Surprising Strategy Is The Ultimate Advantage

3-3: Stocks vs. Real Estate: A Simple and Surprising Guide to The Ultimate Winner

Sources I Used

Factual Data, FRED. (2025). NASDAQ Composite Index [Data set]. Federal Reserve Bank of St. Louis. Retrieved from https://fred.stlouisfed.org/series/NASDAQCOM

HAR.com. (2025). Why 2025 might be the year to choose stocks over real estate. Retrieved from https://www.har.com/ri/3986/why-2025-might-be-the-year-to-choose-stocks-over-real-estate

Kiesnoski, K. (2025). Real estate vs. stocks: Which is the better investment? Investopedia. Retrieved from https://www.investopedia.com/investing/reasons-invest-real-estate-vs-stock-market/

Macrotrends. (2025). S&P 500 Historical Annual Returns [Data set]. Retrieved from https://www.macrotrends.net/2526/sp-500-historical-annual-returns

Nareit. (2025). Quarterly REIT Performance Data [Data set]. Retrieved from https://www.reit.com/data-research/data/quarterly-reit-performance-data

S&P Dow Jones Indices. (2025). S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index [Data set]. Retrieved from https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-us-national-home-price-nsa-index/